pls help

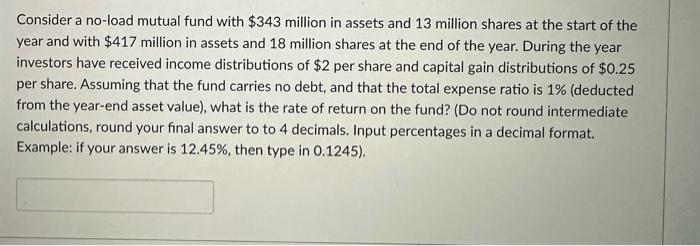

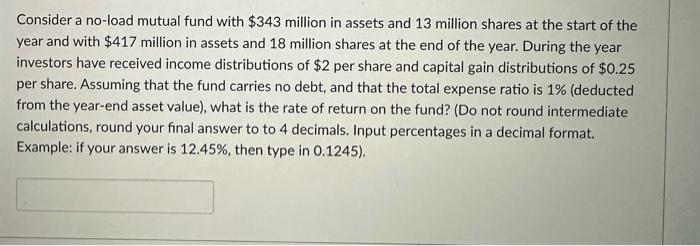

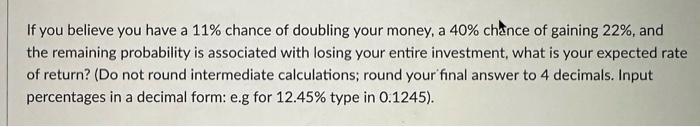

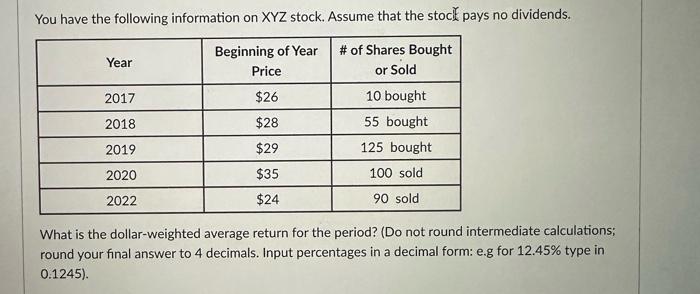

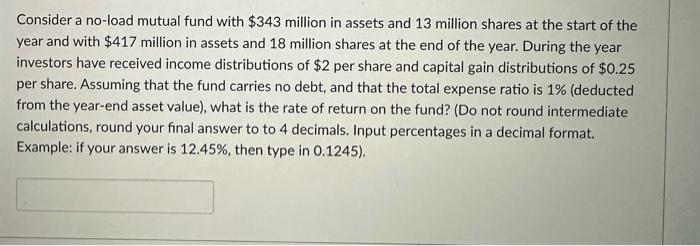

Consider a no-load mutual fund with $343 million in assets and 13 million shares at the start of the year and with $417 million in assets and 18 million shares at the end of the year. During the year investors have received income distributions of $2 per share and capital gain distributions of $0.25 per share. Assuming that the fund carries no debt, and that the total expense ratio is 1% (deducted from the year-end asset value), what is the rate of return on the fund? (Do not round intermediate calculations, round your final answer to to 4 decimals. Input percentages in a decimal format. Example: if your answer is 12.45%, then type in 0.1245 ). If you believe you have a 11% chance of doubling your money, a 40% chatce of gaining 22%, and the remaining probability is associated with losing your entire investment, what is your expected rate of return? (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). You have the following information on XYZ stock. Assume that the stocl pays no dividends. What is the dollar-weighted average return for the period? (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245) Consider a no-load mutual fund with $343 million in assets and 13 million shares at the start of the year and with $417 million in assets and 18 million shares at the end of the year. During the year investors have received income distributions of $2 per share and capital gain distributions of $0.25 per share. Assuming that the fund carries no debt, and that the total expense ratio is 1% (deducted from the year-end asset value), what is the rate of return on the fund? (Do not round intermediate calculations, round your final answer to to 4 decimals. Input percentages in a decimal format. Example: if your answer is 12.45%, then type in 0.1245 ). If you believe you have a 11% chance of doubling your money, a 40% chatce of gaining 22%, and the remaining probability is associated with losing your entire investment, what is your expected rate of return? (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). You have the following information on XYZ stock. Assume that the stocl pays no dividends. What is the dollar-weighted average return for the period? (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245)