Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help me chegg professionals w/ req1-4, thank you so much in advance for your kind service Salsa Company is considering an investment in technology

pls help me chegg professionals w/ req1-4, thank you so much in advance for your kind service

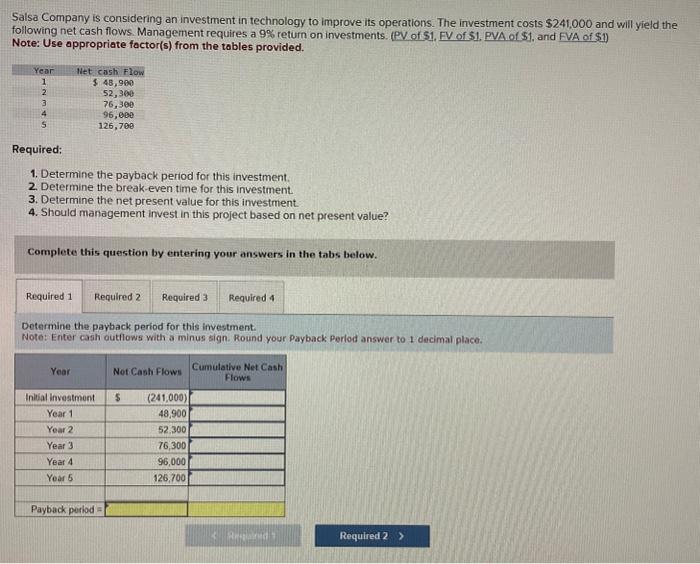

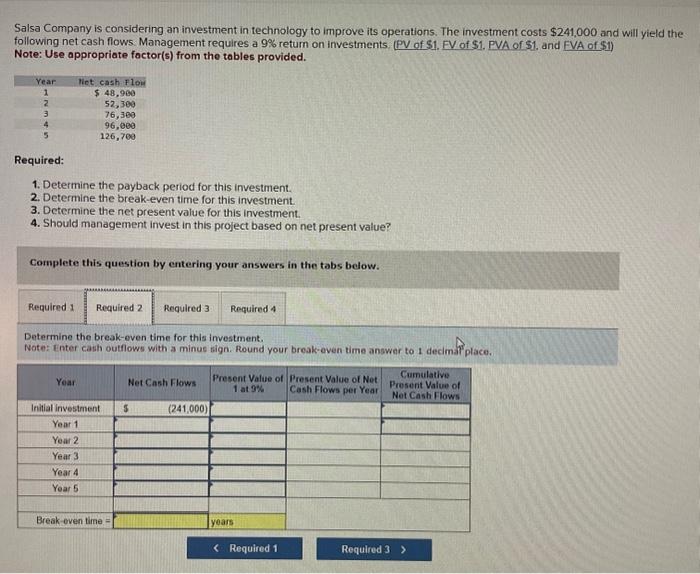

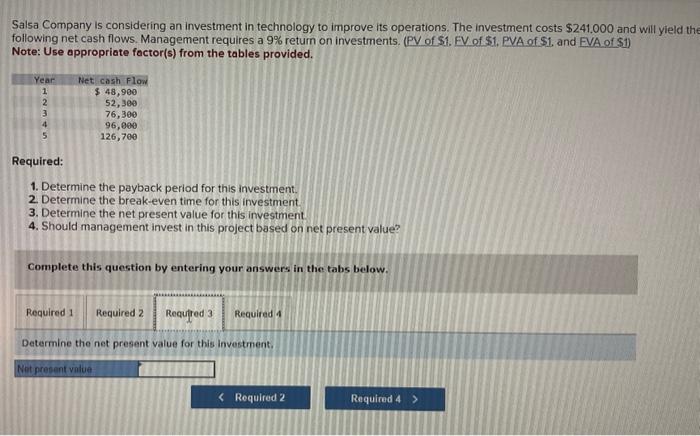

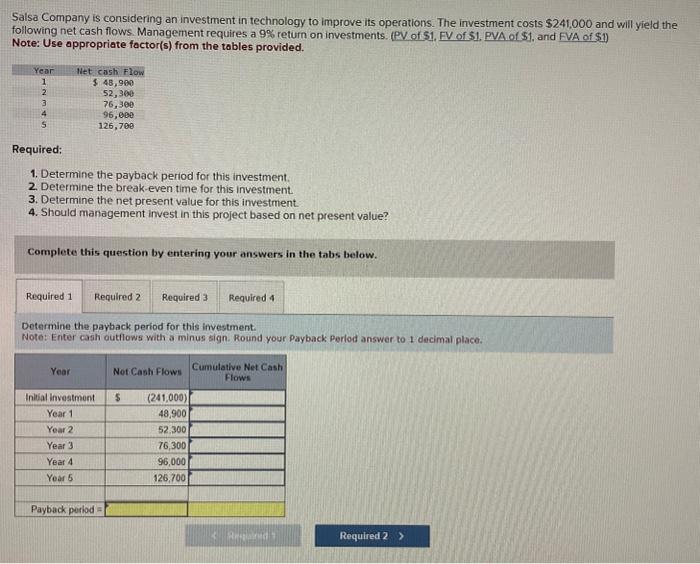

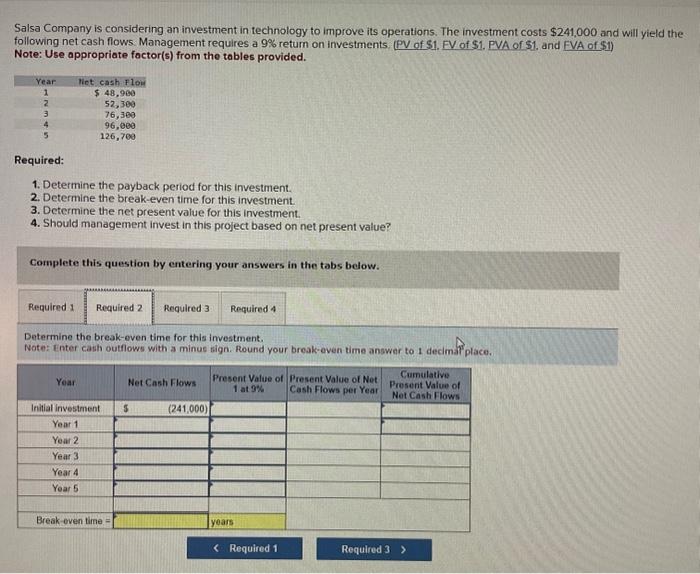

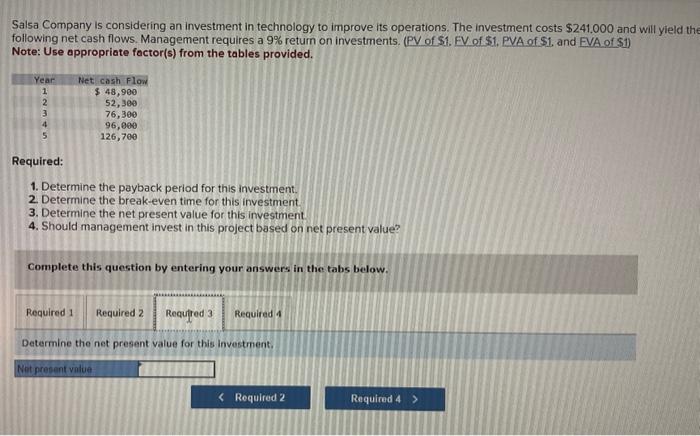

Salsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 9% return on investments. (PV of \$1. FV of \$1. PVA of S1, and FVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment. 3. Determine the net present value for this investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Dotermine the payback period for this imvestment. Note: Enter cash outfows with a minus sign. Round your Payback Perlod answer to 1 decimal place. Salsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 9% retum on investments. (PV of S1. FV of \$1. PVA of S1. and FVA of S1) Note: Use appropriate factor(s) from the tables provided. Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment. 3. Determine the net present value for this investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Determine the break-even time for this imvestment. Note: enter cash outflows with a minus tign. Round your break-even time answar to 1 decimat place. Salsa Company is considering an investment in technology to improve its operations. The investment costs $241.000 and will yield th following net cash flows. Management requires a 9% return on investments. (PV of \$1. FV of \$1. PVA of S1, and EVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment. 3. Determine the net present value for this investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Determine the net present value for this investment. Salsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 9% return on investments. (PV of S1, EV of \$1, PVA of \$1, and EVA of S1) Note: Use oppropriate factor(s) from the tables provided. Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment. 3. Determine the net present value for this investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Should managoment invert in this project based on net present value? Should management invest h this project based on net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started