Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls hurryy Considering there are no budget constraints. You are given information on the following two projects: Project A: It has an initial investment of

pls hurryy

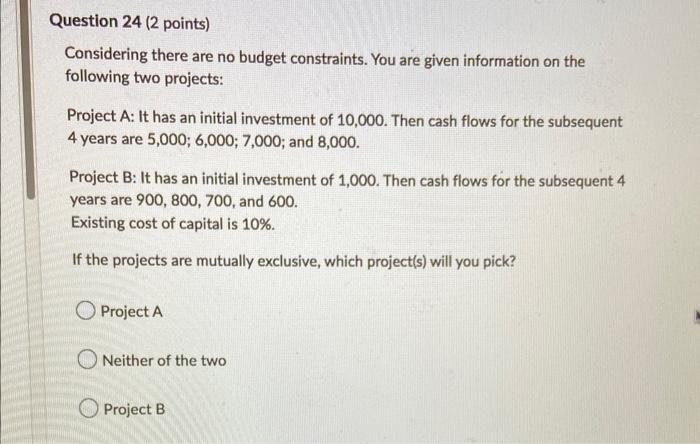

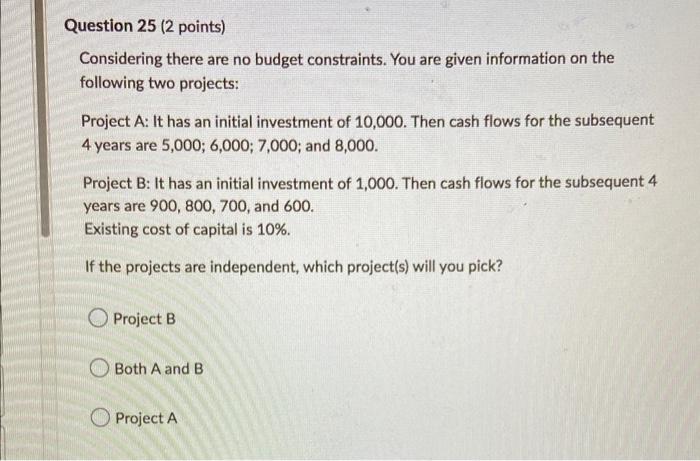

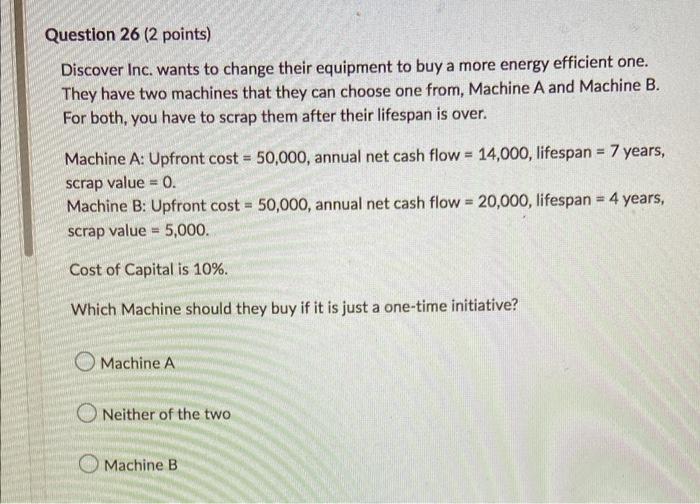

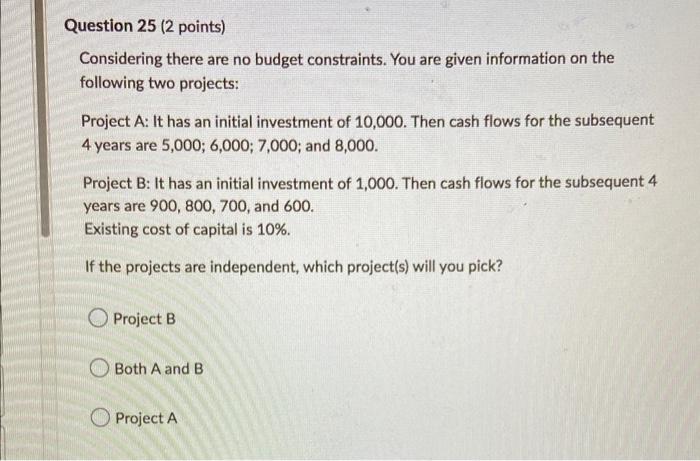

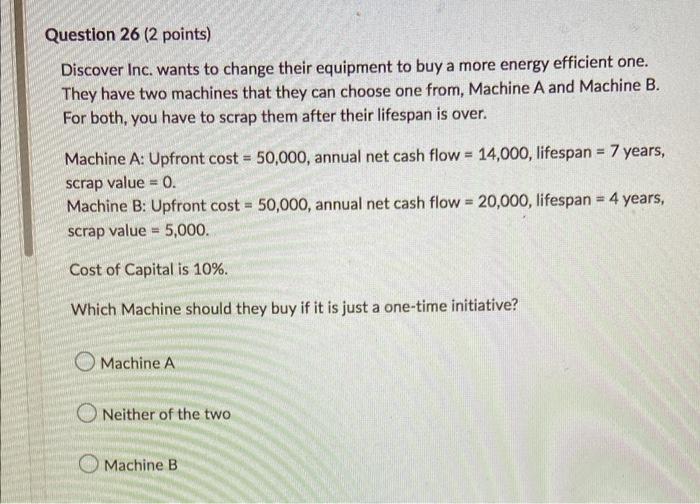

Considering there are no budget constraints. You are given information on the following two projects: Project A: It has an initial investment of 10,000 . Then cash flows for the subsequent 4 years are 5,000;6,000;7,000; and 8,000 . Project B: It has an initial investment of 1,000 . Then cash flows for the subsequent 4 years are 900,800,700, and 600 . Existing cost of capital is 10%. If the projects are mutually exclusive, which project(s) will you pick? Project A Neither of the two Project B Question 25 (2 points) Considering there are no budget constraints. You are given information on the following two projects: Project A: It has an initial investment of 10,000 . Then cash flows for the subsequent 4 years are 5,000;6,000;7,000; and 8,000. Project B: It has an initial investment of 1,000 . Then cash flows for the subsequent 4 years are 900,800,700, and 600. Existing cost of capital is 10%. If the projects are independent, which project(s) will you pick? Project B Both A and B Project A Discover Inc. wants to change their equipment to buy a more energy efficient one. They have two machines that they can choose one from, Machine A and Machine B. For both, you have to scrap them after their lifespan is over. Machine A: Upfront cost =50,000, annual net cash flow =14,000, lifespan =7 years, scrap value =0. Machine B: Upfront cost =50,000, annual net cash flow =20,000, lifespan =4 years, scrap value =5,000 Cost of Capital is 10%. Which Machine should they buy if it is just a one-time initiative? Machine A Neither of the two Machine B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started