Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls I need this done asap Note: This assignment can be done individually or in a group of up to five people in the same

pls I need this done asap

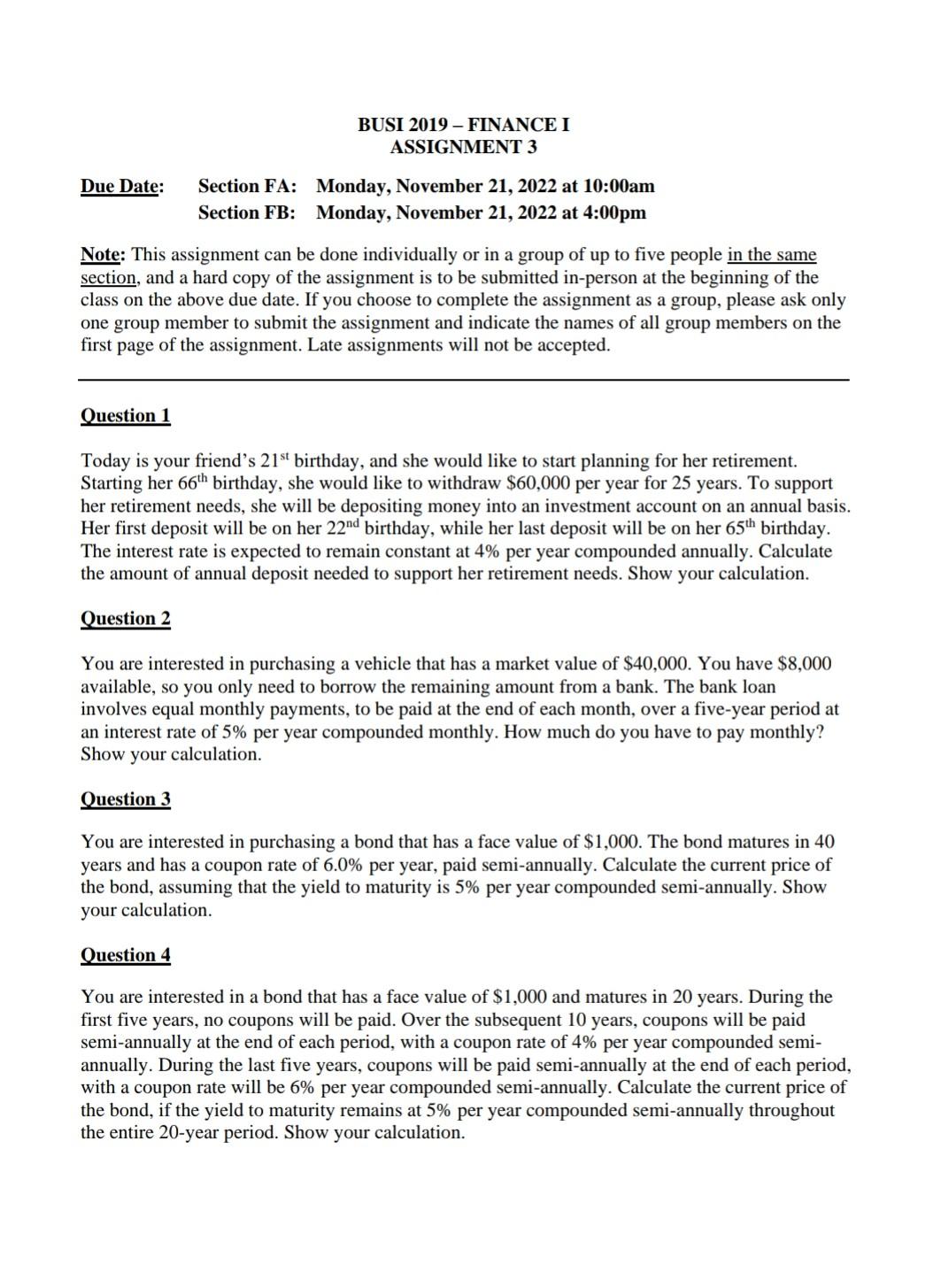

Note: This assignment can be done individually or in a group of up to five people in the same section, and a hard copy of the assignment is to be submitted in-person at the beginning of the class on the above due date. If you choose to complete the assignment as a group, please ask only one group member to submit the assignment and indicate the names of all group members on the first page of the assignment. Late assignments will not be accepted. Question 1 Today is your friend's 21st birthday, and she would like to start planning for her retirement. Starting her 66th birthday, she would like to withdraw $60,000 per year for 25 years. To support her retirement needs, she will be depositing money into an investment account on an annual basis. Her first deposit will be on her 22nd birthday, while her last deposit will be on her 65th birthday. The interest rate is expected to remain constant at 4% per year compounded annually. Calculate the amount of annual deposit needed to support her retirement needs. Show your calculation. Question 2 You are interested in purchasing a vehicle that has a market value of $40,000. You have $8,000 available, so you only need to borrow the remaining amount from a bank. The bank loan involves equal monthly payments, to be paid at the end of each month, over a five-year period at an interest rate of 5% per year compounded monthly. How much do you have to pay monthly? Show your calculation. Question 3 You are interested in purchasing a bond that has a face value of $1,000. The bond matures in 40 years and has a coupon rate of 6.0% per year, paid semi-annually. Calculate the current price of the bond, assuming that the yield to maturity is 5% per year compounded semi-annually. Show your calculation. Question 4 You are interested in a bond that has a face value of $1,000 and matures in 20 years. During the first five years, no coupons will be paid. Over the subsequent 10 years, coupons will be paid semi-annually at the end of each period, with a coupon rate of 4% per year compounded semiannually. During the last five years, coupons will be paid semi-annually at the end of each period, with a coupon rate will be 6% per year compounded semi-annually. Calculate the current price of the bond, if the yield to maturity remains at 5% per year compounded semi-annually throughout the entire 20-year period. Show your calculationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started