Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls provide solutions 3. 31. XX, Y, and ZZ formed a partnership on January 1, 2012. Each contributed P120,000 Page 12 Metro.Dupan Colleges Senior Set

pls provide solutions

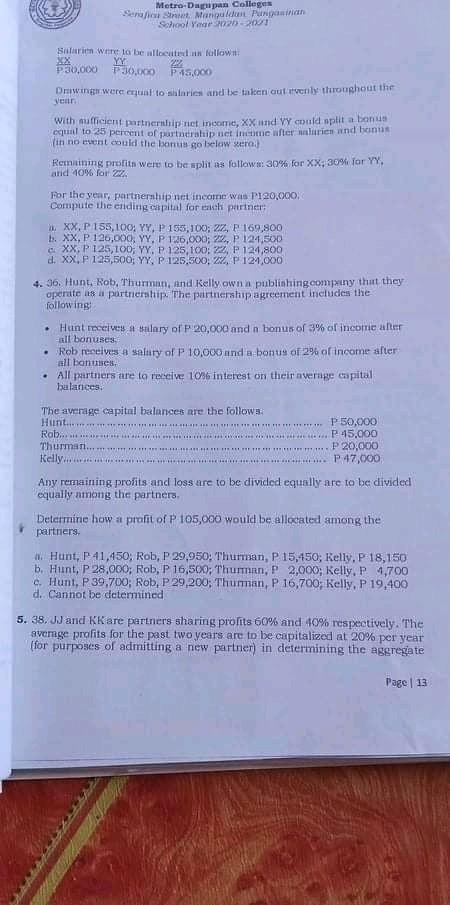

3. 31. XX, Y, and ZZ formed a partnership on January 1, 2012. Each contributed P120,000 Page 12 Metro.Dupan Colleges Senior Set Mangud Pungan School Year 2001 Salarin we to be moeten follow XX YY 22 P. 30.000 P45,000 Dmwing were cut to stories and be taken out venle throughout the 30.000 with cufficient partnership rict income, XX und Vy could split a bonus counto 25 percent of partnership net inimester in and bonus in no event could the bonus golelow sera Retaining profit were to be split as follows: 30% for XX, 30% for YY. and 40% for For the year partnershipinet income was 120.000 Compute the ending capital for ench partner XX, P 155, 100: YY, P 155,100; ZZ, P 169,800 1. XX, P 126,000, YY, P 1.26.000; 22, P 124.500 ci XX, P 125, 100, YY, P 125,100: 22 P124,800 d. XX. 125,500, YY, P 125,500; 2, P.124.000 4. 36. Hunt Rob, Thurman, and Kelly own a publishing company that they operate as a partnership the partnership agreement includes the following Hunt coelven a lary of P 20,000 and n bonus of 3% of income after all bonuses, Rob receives a salary of P 10,000 and a bonus of 29 of income after all bonuses All partners are to receive 10% interest on their nvernge capital halarices 11111 F The average capital balances are the follows. Hint P 50,000 Rob....... ............. 45,000 Thurman P 20,000 Kelly... ............. P. 47,000 Any remaining profits and loss are to be divided equally are to be divided equally nmong the partners Determine how a profit of P 105,000 would be allocated among the partners, Hunt, P 41,450, Rob, P 29,950: Thurman, P15,450, Kelly, P 18,150 b. Hunt, P 28,000; Rob, P 16,500; Thurman, P 2,000; Kelly, P 1.700 c. Hunt, P 39,700, Rob, P 29,200; Thurman, P 16,700, Kelly, P 19,400 d. Cannot be determined 5. 38. JJ and KK are partners sharing profits 60% and 40% respectively. The average profits for the past two years are to be capitalized at 20% per year (for purposes of admitting a new partner) in determining the aggregate Page 13Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started