Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLS SOLVE Yellow Elm Education Technology currently has bonds outstanding with a total face value of $4.637 billion on which the firm pays coupons in

PLS SOLVE

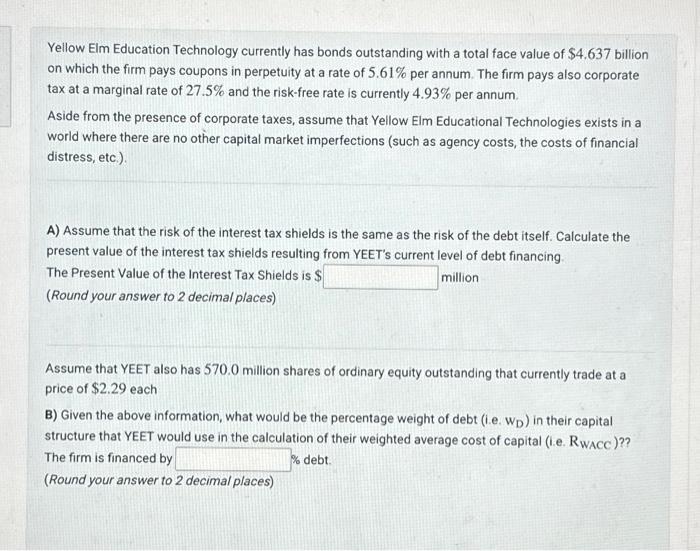

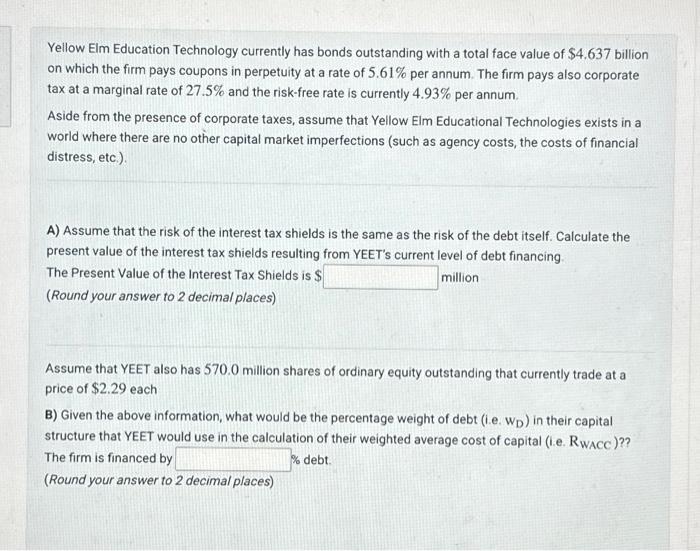

Yellow Elm Education Technology currently has bonds outstanding with a total face value of $4.637 billion on which the firm pays coupons in perpetuity at a rate of 5.61% per annum. The firm pays also corporate tax at a marginal rate of 27.5% and the risk-free rate is currently 4.93% per annum. Aside from the presence of corporate taxes, assume that Yellow Elm Educational Technologies exists in a world where there are no other capital market imperfections (such as agency costs, the costs of financial distress, etc.). A) Assume that the risk of the interest tax shields is the same as the risk of the debt itself. Calculate the present value of the interest tax shields resulting from YEET's current level of debt financing The Present Value of the Interest Tax Shields is \$ million (Round your answer to 2 decimal places) Assume that YEET also has 570.0 million shares of ordinary equity outstanding that currently trade at a price of $2.29 each B) Given the above information, what would be the percentage weight of debt (i.e. wD ) in their capital structure that YEET would use in the calculation of their weighted average cost of capital (i.e. R WACC)?? The firm is financed by % debt. (Round your answer to 2 decimal places) Yellow Elm Education Technology currently has bonds outstanding with a total face value of $4.637 billion on which the firm pays coupons in perpetuity at a rate of 5.61% per annum. The firm pays also corporate tax at a marginal rate of 27.5% and the risk-free rate is currently 4.93% per annum. Aside from the presence of corporate taxes, assume that Yellow Elm Educational Technologies exists in a world where there are no other capital market imperfections (such as agency costs, the costs of financial distress, etc.). A) Assume that the risk of the interest tax shields is the same as the risk of the debt itself. Calculate the present value of the interest tax shields resulting from YEET's current level of debt financing The Present Value of the Interest Tax Shields is \$ million (Round your answer to 2 decimal places) Assume that YEET also has 570.0 million shares of ordinary equity outstanding that currently trade at a price of $2.29 each B) Given the above information, what would be the percentage weight of debt (i.e. wD ) in their capital structure that YEET would use in the calculation of their weighted average cost of capital (i.e. R WACC)?? The firm is financed by % debt. (Round your answer to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started