Question

Plumber Corporation owns 60 percent of Socket Corporations voting common stock. On December 31, 20X4, Plumber paid Socket $276,000 for dump trucks Socket had purchased

Plumber Corporation owns 60 percent of Socket Corporations voting common stock. On December 31, 20X4, Plumber paid Socket $276,000 for dump trucks Socket had purchased on January 1, 20X2. Both companies use straight-line depreciation. The consolidation entry included in preparing consolidated financial statements at December 31, 20X4, was

| Consolidation Worksheet Entry | Debit | Credit |

|---|---|---|

| Trucks | 24,000 | |

| Gain on Sale of Trucks | 36,000 | |

| Accumulated Depreciation | 60,000 |

1) What amount did Socket pay to purchase the trucks on January 1, 20X2?

Answer - $300,000

2) What was the economic life of the trucks on January 1, 20X2?

Answer - 15 years.

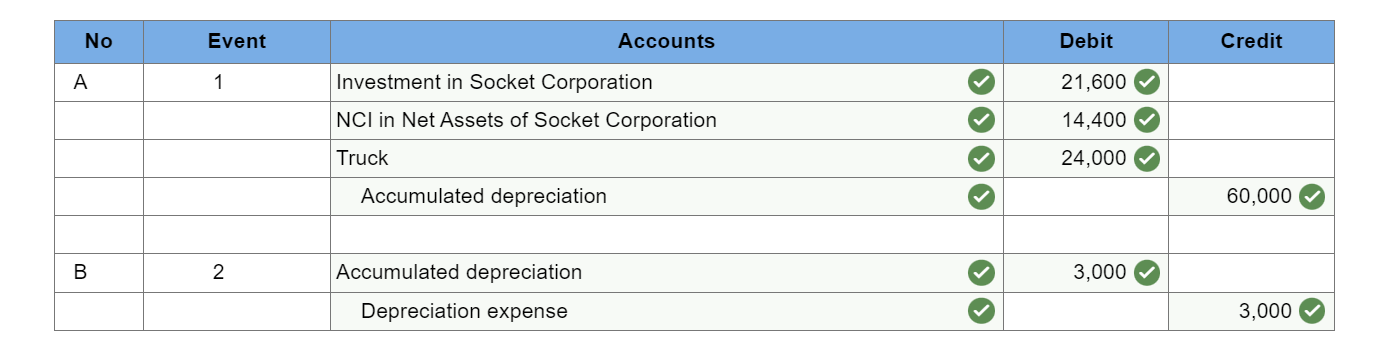

Prepare the worksheet consolidation entry needed in preparing the consolidated financial statements at December 31, 20X5.

Can you please show the calculation for Journal Entry (B). Please show a clear calculation for how the Accumulated Depreciation is $3000? I just need that part answered. Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started