Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks.

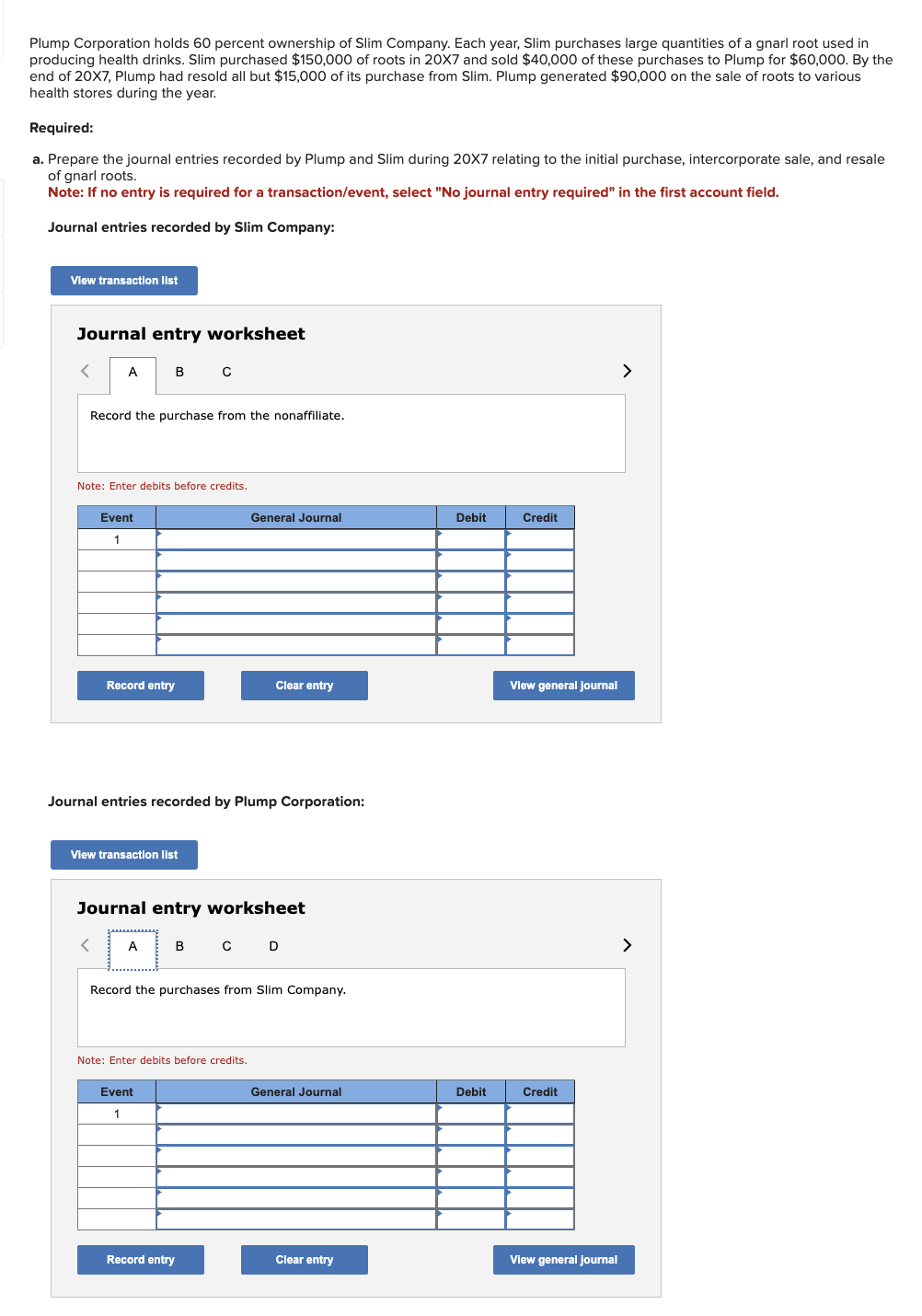

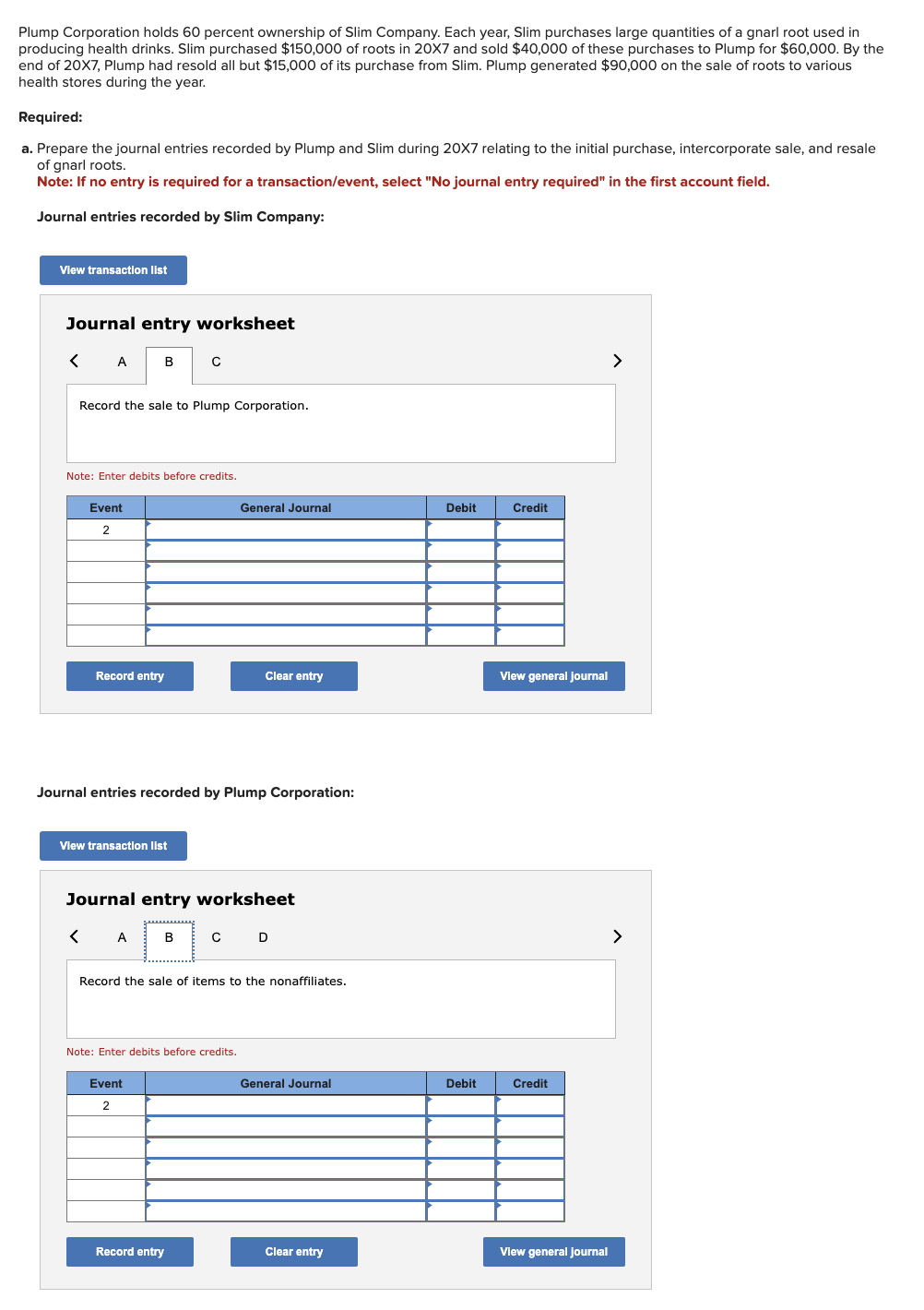

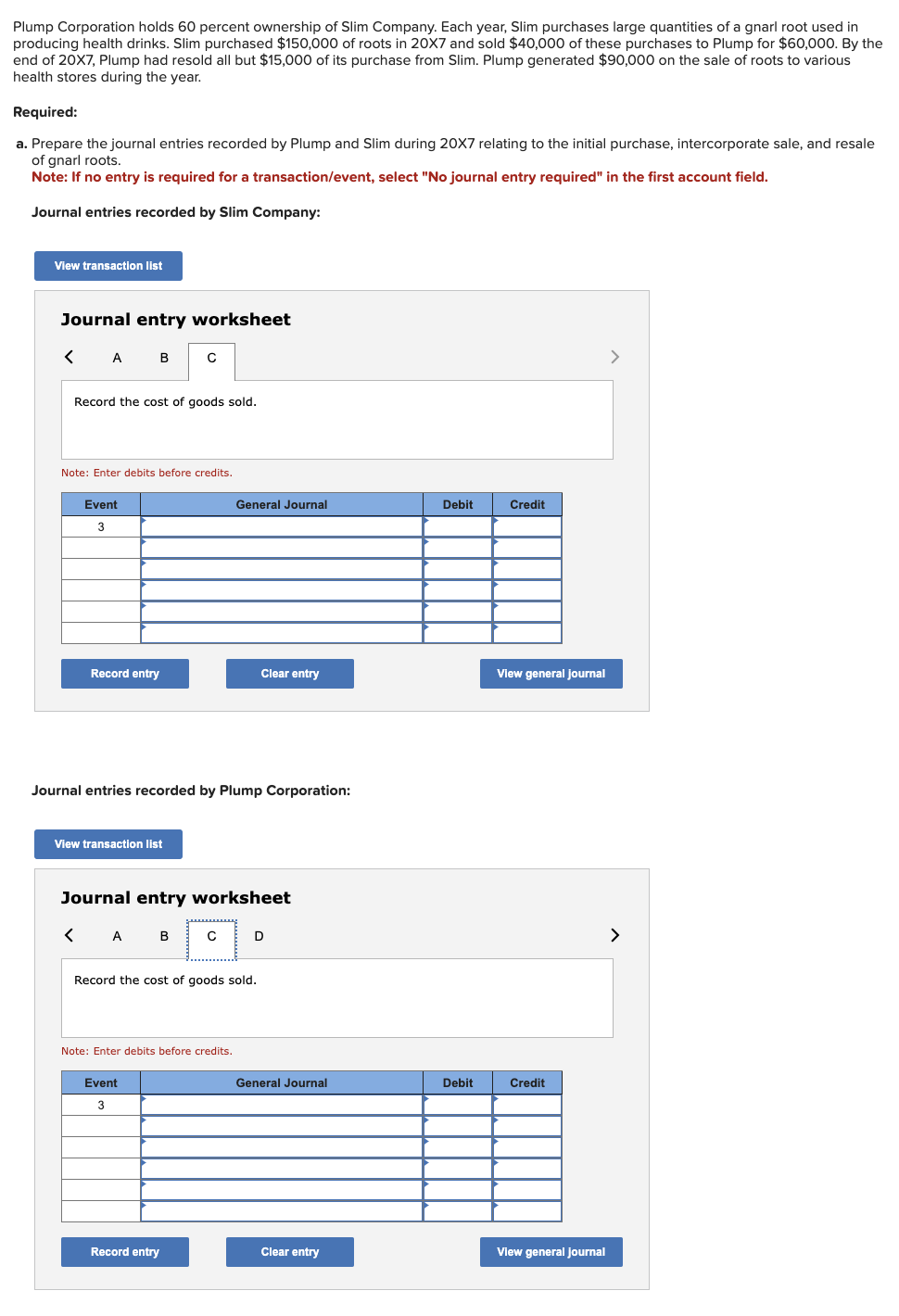

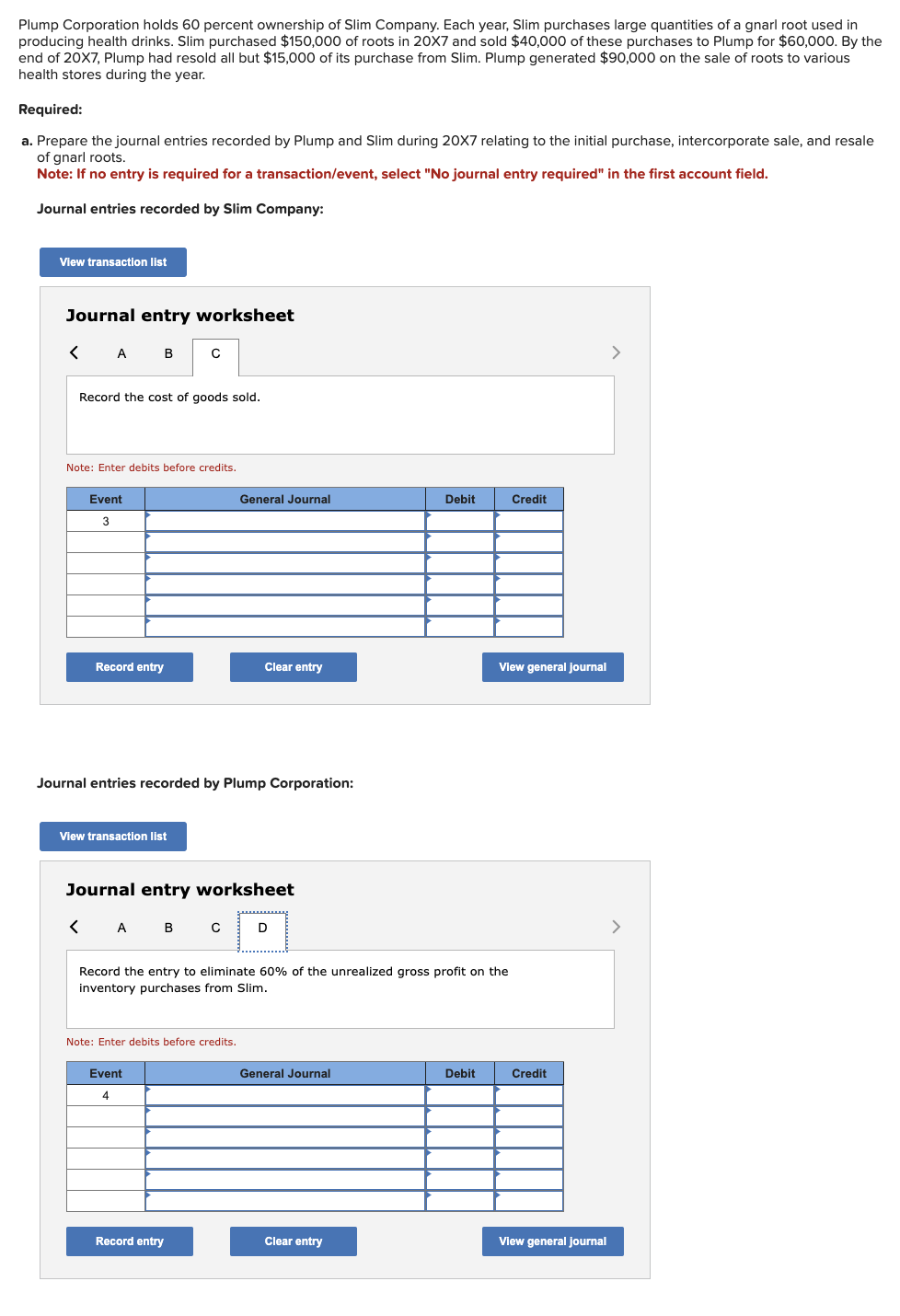

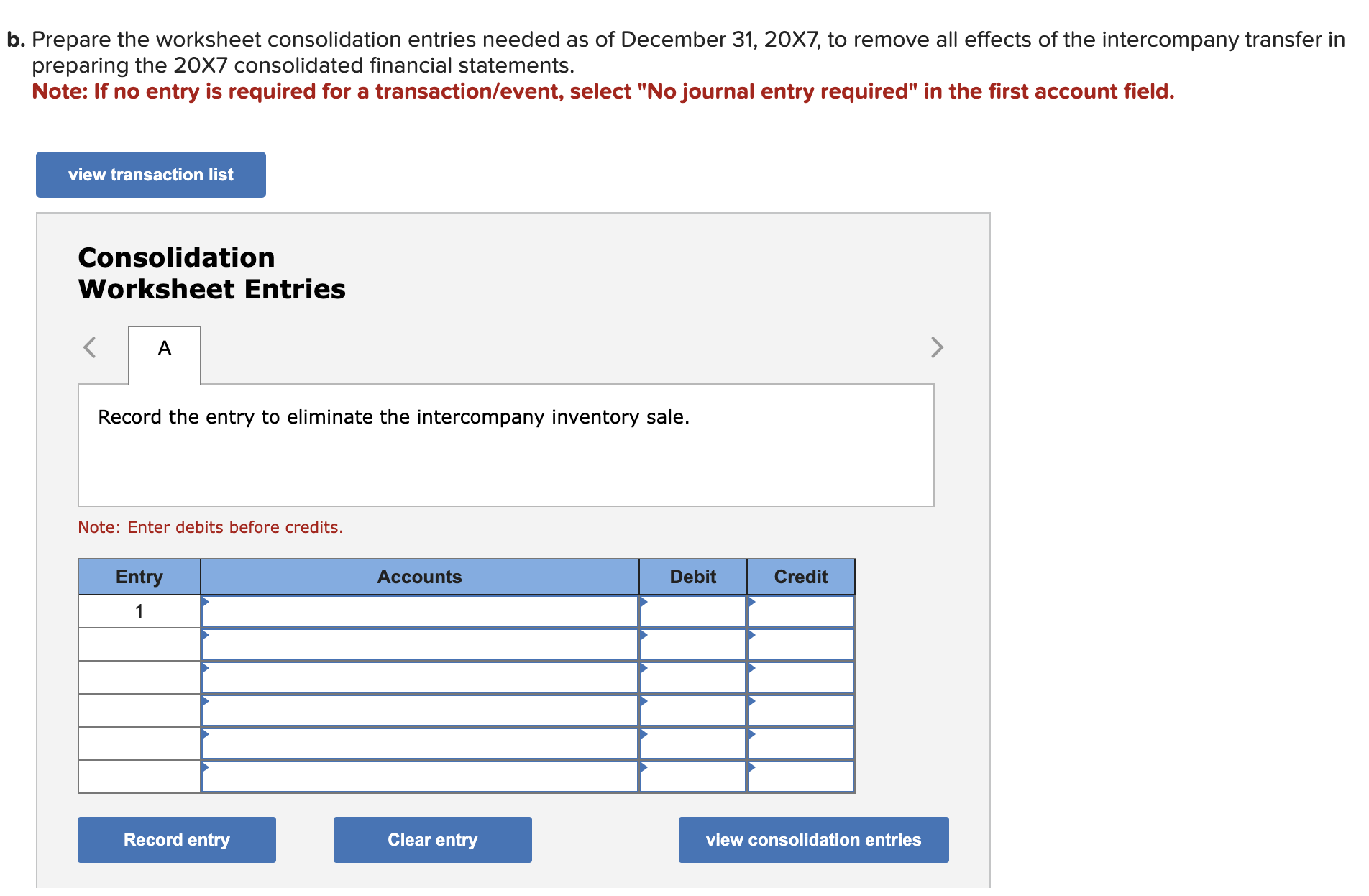

Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks. Slim purchased $150,000 of roots in 20X7 and sold $40,000 of these purchases to Plump for $60,000. By the end of 20X7, Plump had resold all but $15,000 of its purchase from Slim. Plump generated $90,000 on the sale of roots to various health stores during the year. Required: a. Prepare the journal entries recorded by Plump and Slim during 20X7 relating to the initial purchase, intercorporate sale, and resale of gnarl roots. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entries recorded by Slim Company: View transaction list Journal entry worksheet < A B C Record the purchase from the nonaffiliate. Note: Enter debits before credits. Event 1 General Journal Debit Credit Record entry Clear entry View general journal Journal entries recorded by Plump Corporation: View transaction list Journal entry worksheet < A B C D Record the purchases from Slim Company. Note: Enter debits before credits. Event 1 General Journal Debit Credit Record entry Clear entry View general journal > > Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks. Slim purchased $150,000 of roots in 20X7 and sold $40,000 of these purchases to Plump for $60,000. By the end of 20X7, Plump had resold all but $15,000 of its purchase from Slim. Plump generated $90,000 on the sale of roots to various health stores during the year. Required: a. Prepare the journal entries recorded by Plump and Slim during 20X7 relating to the initial purchase, intercorporate sale, and resale of gnarl roots. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entries recorded by Slim Company: View transaction list Journal entry worksheet A B C Record the sale to Plump Corporation. Note: Enter debits before credits. Event 2 General Journal Debit Credit Record entry Clear entry View general journal Journal entries recorded by Plump Corporation: View transaction list Journal entry worksheet A B D Record the sale of items to the nonaffiliates. Note: Enter debits before credits. Event 2 General Journal Debit Credit > Record entry Clear entry View general journal > Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks. Slim purchased $150,000 of roots in 20X7 and sold $40,000 of these purchases to Plump for $60,000. By the end of 20X7, Plump had resold all but $15,000 of its purchase from Slim. Plump generated $90,000 on the sale of roots to various health stores during the year. Required: a. Prepare the journal entries recorded by Plump and Slim during 20X7 relating to the initial purchase, intercorporate sale, and resale of gnarl roots. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entries recorded by Slim Company: View transaction list Journal entry worksheet Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks. Slim purchased $150,000 of roots in 20X7 and sold $40,000 of these purchases to Plump for $60,000. By the end of 20X7, Plump had resold all but $15,000 of its purchase from Slim. Plump generated $90,000 on the sale of roots to various health stores during the year. Required: a. Prepare the journal entries recorded by Plump and Slim during 20X7 relating to the initial purchase, intercorporate sale, and resale of gnarl roots. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entries recorded by Slim Company: View transaction list Journal entry worksheet A B Record the cost of goods sold. Note: Enter debits before credits. Event 3 General Journal Debit Credit Record entry Clear entry View general journal Journal entries recorded by Plump Corporation: View transaction list Journal entry worksheet A B C Record the entry to eliminate 60% of the unrealized gross profit on the inventory purchases from Slim. Note: Enter debits before credits. Event 4 General Journal Debit Credit Record entry Clear entry View general journal b. Prepare the worksheet consolidation entries needed as of December 31, 20X7, to remove all effects of the intercompany transfer in preparing the 20X7 consolidated financial statements. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. view transaction list Consolidation Worksheet Entries A Record the entry to eliminate the intercompany inventory sale. Note: Enter debits before credits. Entry 1 Accounts Debit Credit Record entry Clear entry view consolidation entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started