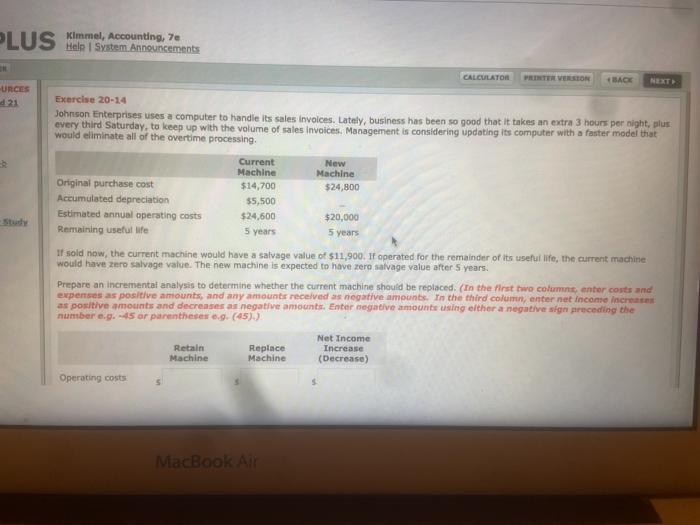

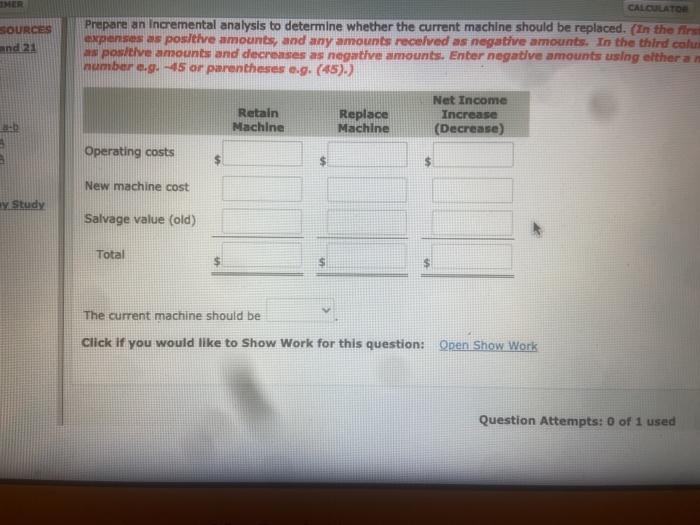

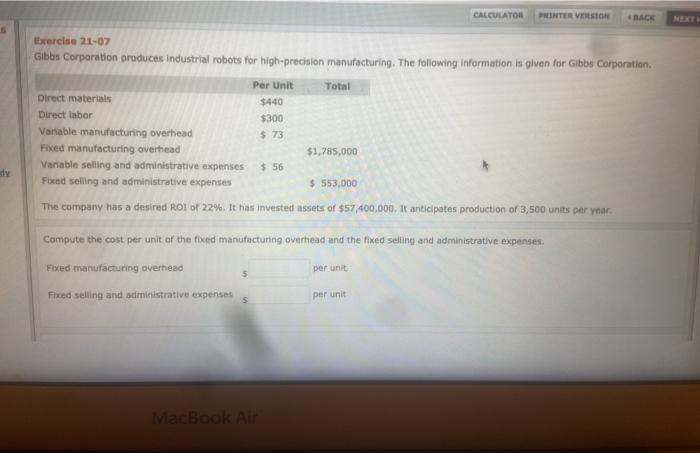

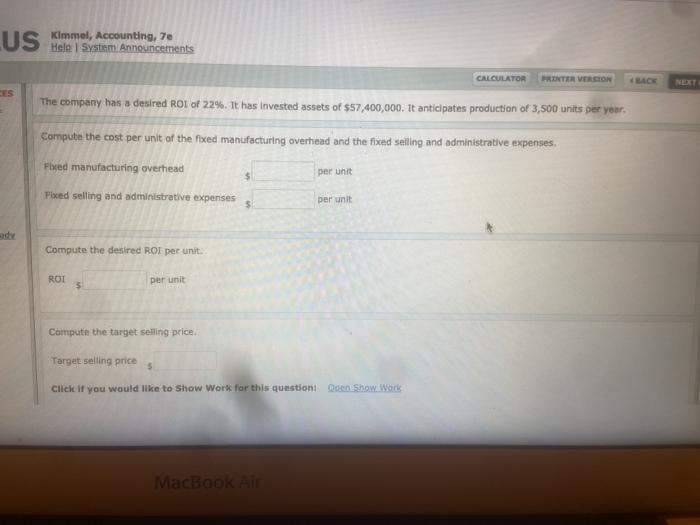

PLUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSION IBACE NEXT URCES Exercise 20-14 Johnson Enterprises uses a computer to handle its sales involces. Lately, business has been so good that it takes an extra 3 hours per night, plus every third Saturday, to keep up with the volume of sales invoices Management is considering updating its computer with a faster model that would eliminate all of the overtime processing, Current New Machine Machine Original purchase cost $14,700 $24,800 Accumulated depreciation $5,500 Estimated annual operating costs $24,600 $20,000 Remaining useful life 5 years 5 years If sold now, the current machine would have a salvage value of $11.900. It operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after 5 years. Prepare an incremental analysis to determine whether the current machine should be replaced. (In the first two columns anter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net income increase as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses g. (45).) Net Income Retain Replace Increase Machine Machine (Decrease) Operating costs MacBook Air SOURCES and 21 CALCULATOR Prepare an incremental analysis to determine whether the current machine should be replaced. (In the first expenses as positive amounts, and any amounts received as negative amounts. In the third colu as positive amounts and decreases as negative amounts. Enter negative amounts using either am number og. -5 or parentheses e.g. (45).) Retain Machine Replace Machine Net Income Increase (Decrease) - Operating costs $ New machine cost y Study Salvage value (old) Total The current machine should be Click If you would like to Show Work for this question: Open Show Work Question Attempts: 0 of 1 used CALCULATON PRINTER VERSION Exercise 21-07 Gibbs Corporation produces industrial robots for high-precision manufacturing. The following information is given for Gibbs Corporation Total $ 73 Per Unit Direct materials $440 Direct labor $300 Variable manufacturing overhead Fixed manufacturing overhead $1,785,000 Variable seling and administrative expenses $ 56 Fbend selling and administrative expenses The company has a desired ROI of 22%. It has invested assets of $57,400,000, it anticipates production of 3,500 units per ynar. $ 553,000 Compute the cost per unit of the fixed manufacturing overhead and the fixed selling and administrative expenses Fixed manufacturing overhead 5 per unit Fixed selling and administrative expenses per unit $ MacBook Air US Kimmel, Accounting, 7e Hele System Announcements CALCULATOR PROTER VERSION NEXT CES The company has a desired ROI of 22%. It has invested assets of $57,400,000. It anticipates production of 3,500 units per year. Compute the cost per unit of the fixed manufacturing overhead and the fixed selling and administrative expenses Fixed manufacturing overhead per unit Fixed selling and administrative expenses per unit ady Compute the desired ROI per unit. ROI per unit $ Compute the target selling price Target selling price 5 Click if you would like to show Work for this questioni Doen Show Work MacBook Air