Plz answer as fast as u can.

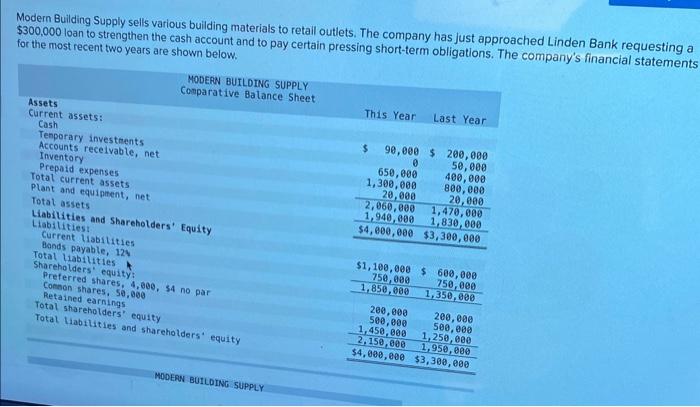

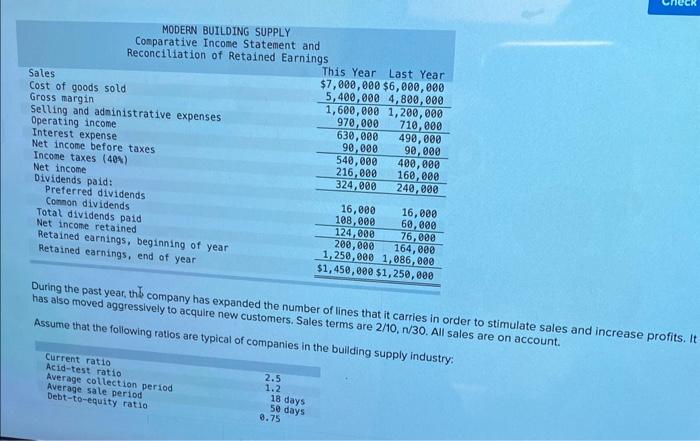

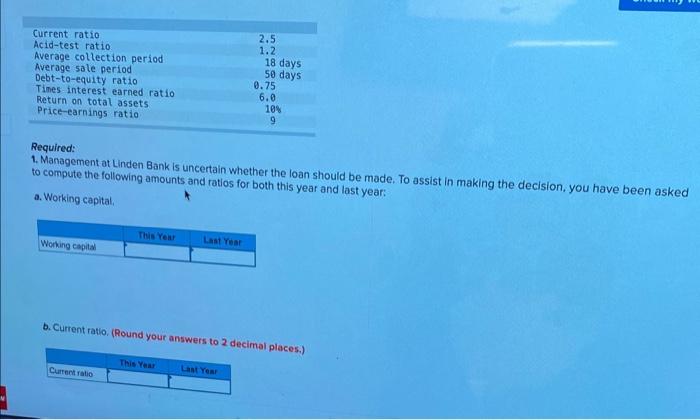

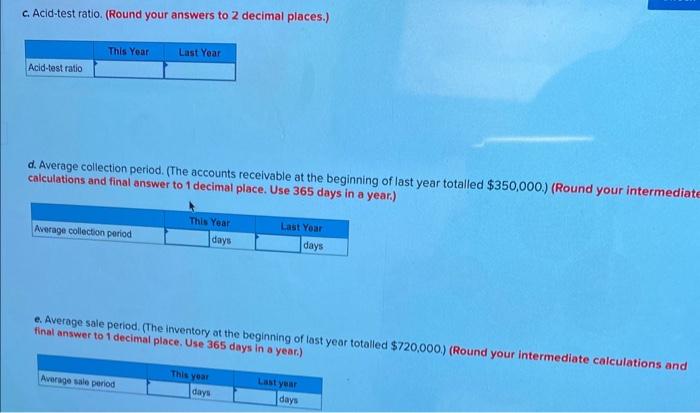

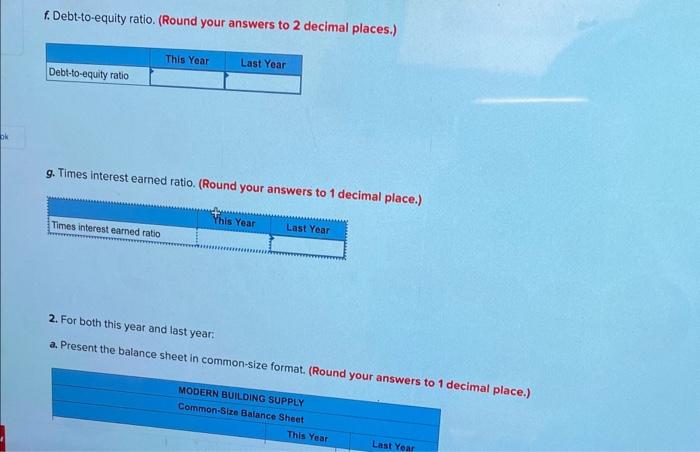

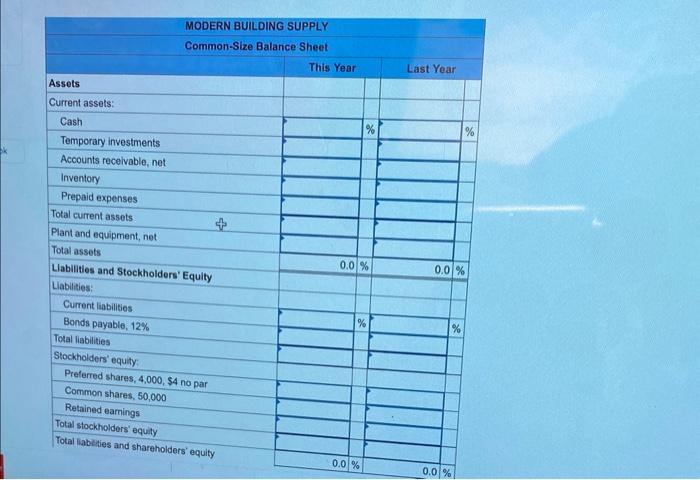

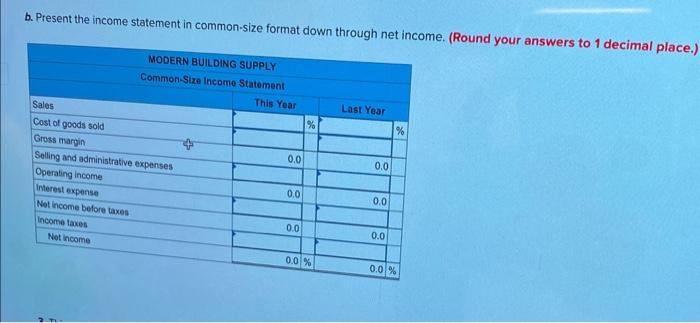

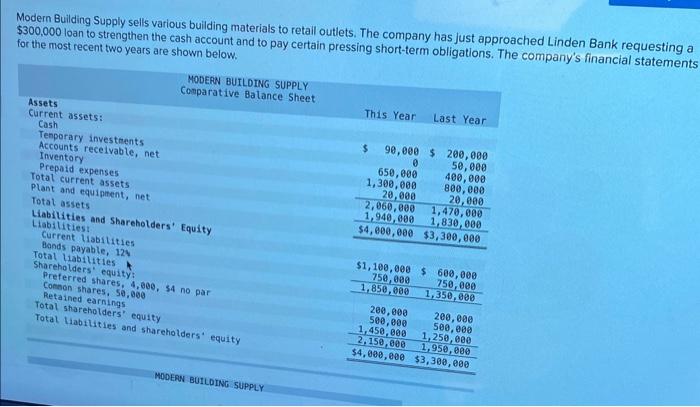

Modern Building Supply sells various building materials to retail outlets. The company has just approached Linden Bank requesting a $300,000 loan to strengthen the cash account and to pay certain pressing short-term obligations. The company's financial statements haring the past year, th company has expanded the number of lines that it carries in order to stimulate sales and increase profits. It Assume that the following ratios are tvnirat nsalomers. Sales terms are 2/10,n/30. All sales are on account. building supply industry: Required: 1. Management at Linden Bank is uncertain whether the loan should be made. To assist in making the decision, you have been asked to compute the following amounts and ratios for both this year and last year: a. Working capital, b. Current ratio, (Round your answers to 2 decimal places.) c. Acid-test ratio. (Round your answers to 2 decimal places.) d. Average collection period. (The accounts recelvable at the beginning of last year totalled $350,000.) (Round your intermediat calculations and final answer to 1 decimal place. Use 365 days in a year.) e. Average sale period. (The inventory at the beginning of last year totalled $720,000.) (Round your intermediate calculations and f. Debt-to-equity ratio. (Round your answers to 2 decimal places.) g. Times interest earned ratio. (Round your ancwav. \&. . . cimal place.) 2. For both this year and last year: a. Present the balance sheet in common-size fnom.....- decimal place.) b. Present the income statement in common-size format down through net income. (Round your answers to 1 decimal place.) Modern Building Supply sells various building materials to retail outlets. The company has just approached Linden Bank requesting a $300,000 loan to strengthen the cash account and to pay certain pressing short-term obligations. The company's financial statements haring the past year, th company has expanded the number of lines that it carries in order to stimulate sales and increase profits. It Assume that the following ratios are tvnirat nsalomers. Sales terms are 2/10,n/30. All sales are on account. building supply industry: Required: 1. Management at Linden Bank is uncertain whether the loan should be made. To assist in making the decision, you have been asked to compute the following amounts and ratios for both this year and last year: a. Working capital, b. Current ratio, (Round your answers to 2 decimal places.) c. Acid-test ratio. (Round your answers to 2 decimal places.) d. Average collection period. (The accounts recelvable at the beginning of last year totalled $350,000.) (Round your intermediat calculations and final answer to 1 decimal place. Use 365 days in a year.) e. Average sale period. (The inventory at the beginning of last year totalled $720,000.) (Round your intermediate calculations and f. Debt-to-equity ratio. (Round your answers to 2 decimal places.) g. Times interest earned ratio. (Round your ancwav. \&. . . cimal place.) 2. For both this year and last year: a. Present the balance sheet in common-size fnom.....- decimal place.) b. Present the income statement in common-size format down through net income. (Round your answers to 1 decimal place.)