Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz explain as much as you can 4. Tarantula Publishing prints advertising flyers, booklets and magazines for customers. The company has 12 employees who work

plz explain as much as you can

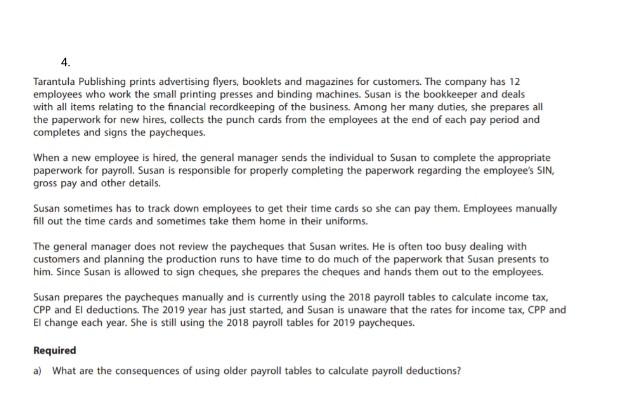

4. Tarantula Publishing prints advertising flyers, booklets and magazines for customers. The company has 12 employees who work the small printing presses and binding machines. Susan is the bookkeeper and deals with all items relating to the financial recordkeeping of the business. Among her many duties, she prepares all the paperwork for new hires, collects the punch cards from the employees at the end of each pay period and completes and signs the paycheques. When a new employee is hired, the general manager sends the individual to Susan to complete the appropriate paperwork for payroll . Susan is responsible for properly completing the paperwork regarding the employee's SIN, gross pay and other details Susan sometimes has to track down employees to get their time cards so she can pay them. Employees manually fill out the time cards and sometimes take them home in their uniforms. The general manager does not review the paycheques that Susan writes. He is often too busy dealing with customers and planning the production runs to have time to do much of the paperwork that Susan presents to him. Since Susan is allowed to sign cheques, she prepares the cheques and hands them out to the employees. Susan prepares the paycheques manually and is currently using the 2018 payroll tables to calculate income tax. CPP and El deductions. The 2019 year has just started, and Susan is unaware that the rates for income tax, CPP and El change each year. She is still using the 2018 payroll tables for 2019 paycheques. Required a) What are the consequences of using older payroll tables to calculate payroll deductionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started