Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz giveconclusion A time series is a sequence of data points, measured typically at successive points in time spaced at uniform time intervals. It can

plz giveconclusion

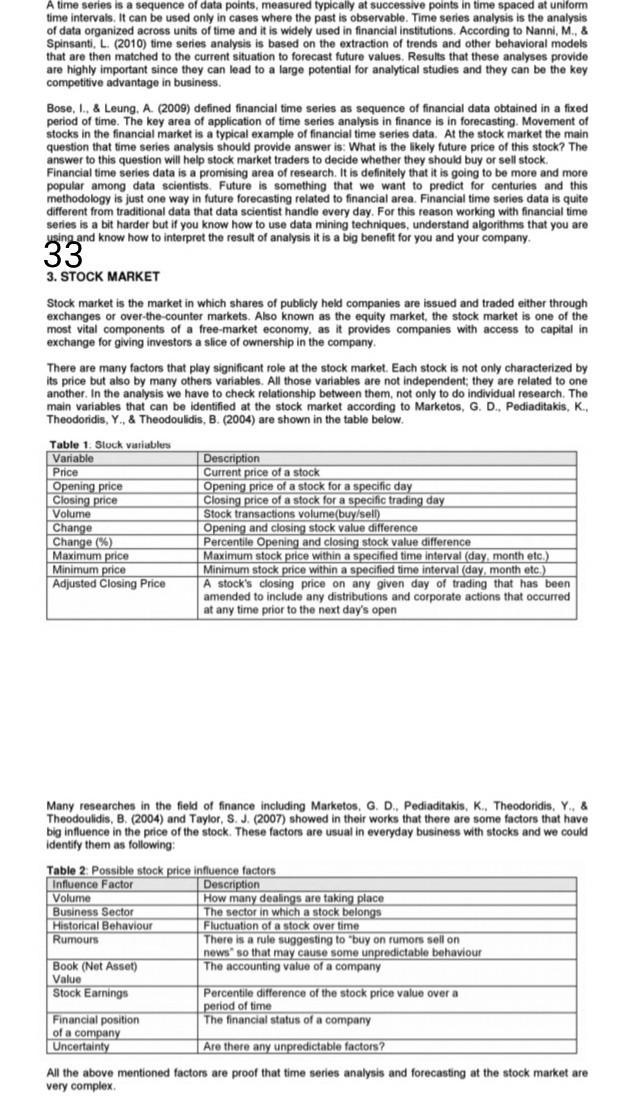

A time series is a sequence of data points, measured typically at successive points in time spaced at uniform time intervals. It can be used only in cases where the past is observable. Time series analysis is the analysis of data organized across units of time and it is widely used in financial institutions. According to Nanni, M., & Spinsanti, L. (2010) time series analysis is based on the extraction of trends and other behavioral models that are then matched to the current situation to forecast future values. Results that these analyses provide are highly important since they can lead to a large potential for analytical studies and they can be the key competitive advantage in business. Bose, L. & Leung, A. (2009) defined financial time series as sequence of financial data obtained in a fixed period of time. The key area of application of time series analysis in finance is in forecasting, Movement of stocks in the financial market is a typical example of financial time series data. At the stock market the main question that time series analysis should provide answer is: What is the likely future price of this stock? The answer to this question will help stock market traders to decide whether they should buy or sell stock Financial time series data is a promising area of research. It is definitely that it is going to be more and more popular among data scientists. Future is something that we want to predict for centuries and this methodology is just one way in future forecasting related to financial area. Financial time series data is quite different from traditional data that data scientist handle every day. For this reason working with financial time series is a bit harder but if you know how to use data mining techniques, understand algorithms that you are using and know how to interpret the result of analysis it is a big benefit for you and your company. 33 3. STOCK MARKET Stock market is the market in which shares of publicly held companies are issued and traded either through exchanges or over-the-counter markets. Also known as the equity market, the stock market is one of the most vital components of a free-market economy, as it provides companies with access to capital in exchange for giving investors a slice of ownership in the company There are many factors that play significant role at the stock market. Each stock is not only characterized by its price but also by many others variables. All those variables are not independent; they are related to one another. In the analysis we have to check relationship between them, not only to do individual research. The main variables that can be identified at the stock market according to Marketos, G. D., Pediaditakis, K., Theodoridis, Y., & Theodoulidis, B. (2004) are shown in the table below. Table 1. Slock variables Variable Price Opening price Closing price Volume Change Change (%) Maximum price Minimum price Adjusted Closing Price Description Current price of a stock Opening price of a stock for a specific day Closing price of a stock for a specific trading day Stock transactions volume(buy/sell) Opening and closing stock value difference Percentile Opening and closing stock value difference Maximum stock price within a specified time interval (day, month etc.) Minimum stock price within a specified time interval (day, month etc.) A stock's closing price on any given day of trading that has been amended to include any distributions and corporate actions that occurred at any time prior to the next day's open Many researches in the field of finance including Marketos, G. D. Pediaditakis, K., Theodoridis, Y., & Theodoulidis, B. (2004) and Taylor, S. J. (2007) showed in their works that there are some factors that have big influence in the price of the stock. These factors are usual in everyday business with stocks and we could identify them as following: Table 2 Possible stock price influence factors Influence Factor Description Volume How many dealings are taking place Business Sector The sector in which a stock belongs Historical Behaviour Fluctuation of a stock over time Rumours There is a rule suggesting to buy on rumors sell on news so that may cause some unpredictable behaviour Book (Not Asset) The accounting value of a company Value Stock Earnings Percentile difference of the stock price value over a period of time Financial position The financial status of a company of a company Uncertainty Are there any unpredictable factors? All the above mentioned factors are proof that time series analysis and forecasting at the stock market are very complex A time series is a sequence of data points, measured typically at successive points in time spaced at uniform time intervals. It can be used only in cases where the past is observable. Time series analysis is the analysis of data organized across units of time and it is widely used in financial institutions. According to Nanni, M., & Spinsanti, L. (2010) time series analysis is based on the extraction of trends and other behavioral models that are then matched to the current situation to forecast future values. Results that these analyses provide are highly important since they can lead to a large potential for analytical studies and they can be the key competitive advantage in business. Bose, L. & Leung, A. (2009) defined financial time series as sequence of financial data obtained in a fixed period of time. The key area of application of time series analysis in finance is in forecasting, Movement of stocks in the financial market is a typical example of financial time series data. At the stock market the main question that time series analysis should provide answer is: What is the likely future price of this stock? The answer to this question will help stock market traders to decide whether they should buy or sell stock Financial time series data is a promising area of research. It is definitely that it is going to be more and more popular among data scientists. Future is something that we want to predict for centuries and this methodology is just one way in future forecasting related to financial area. Financial time series data is quite different from traditional data that data scientist handle every day. For this reason working with financial time series is a bit harder but if you know how to use data mining techniques, understand algorithms that you are using and know how to interpret the result of analysis it is a big benefit for you and your company. 33 3. STOCK MARKET Stock market is the market in which shares of publicly held companies are issued and traded either through exchanges or over-the-counter markets. Also known as the equity market, the stock market is one of the most vital components of a free-market economy, as it provides companies with access to capital in exchange for giving investors a slice of ownership in the company There are many factors that play significant role at the stock market. Each stock is not only characterized by its price but also by many others variables. All those variables are not independent; they are related to one another. In the analysis we have to check relationship between them, not only to do individual research. The main variables that can be identified at the stock market according to Marketos, G. D., Pediaditakis, K., Theodoridis, Y., & Theodoulidis, B. (2004) are shown in the table below. Table 1. Slock variables Variable Price Opening price Closing price Volume Change Change (%) Maximum price Minimum price Adjusted Closing Price Description Current price of a stock Opening price of a stock for a specific day Closing price of a stock for a specific trading day Stock transactions volume(buy/sell) Opening and closing stock value difference Percentile Opening and closing stock value difference Maximum stock price within a specified time interval (day, month etc.) Minimum stock price within a specified time interval (day, month etc.) A stock's closing price on any given day of trading that has been amended to include any distributions and corporate actions that occurred at any time prior to the next day's open Many researches in the field of finance including Marketos, G. D. Pediaditakis, K., Theodoridis, Y., & Theodoulidis, B. (2004) and Taylor, S. J. (2007) showed in their works that there are some factors that have big influence in the price of the stock. These factors are usual in everyday business with stocks and we could identify them as following: Table 2 Possible stock price influence factors Influence Factor Description Volume How many dealings are taking place Business Sector The sector in which a stock belongs Historical Behaviour Fluctuation of a stock over time Rumours There is a rule suggesting to buy on rumors sell on news so that may cause some unpredictable behaviour Book (Not Asset) The accounting value of a company Value Stock Earnings Percentile difference of the stock price value over a period of time Financial position The financial status of a company of a company Uncertainty Are there any unpredictable factors? All the above mentioned factors are proof that time series analysis and forecasting at the stock market are very complexStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started