Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help 14. Jean and Katherine form Newxcond They transfer appreciated property and get back 50 shares each of Wewcotn. stock. Shortly after this exchange,

plz help

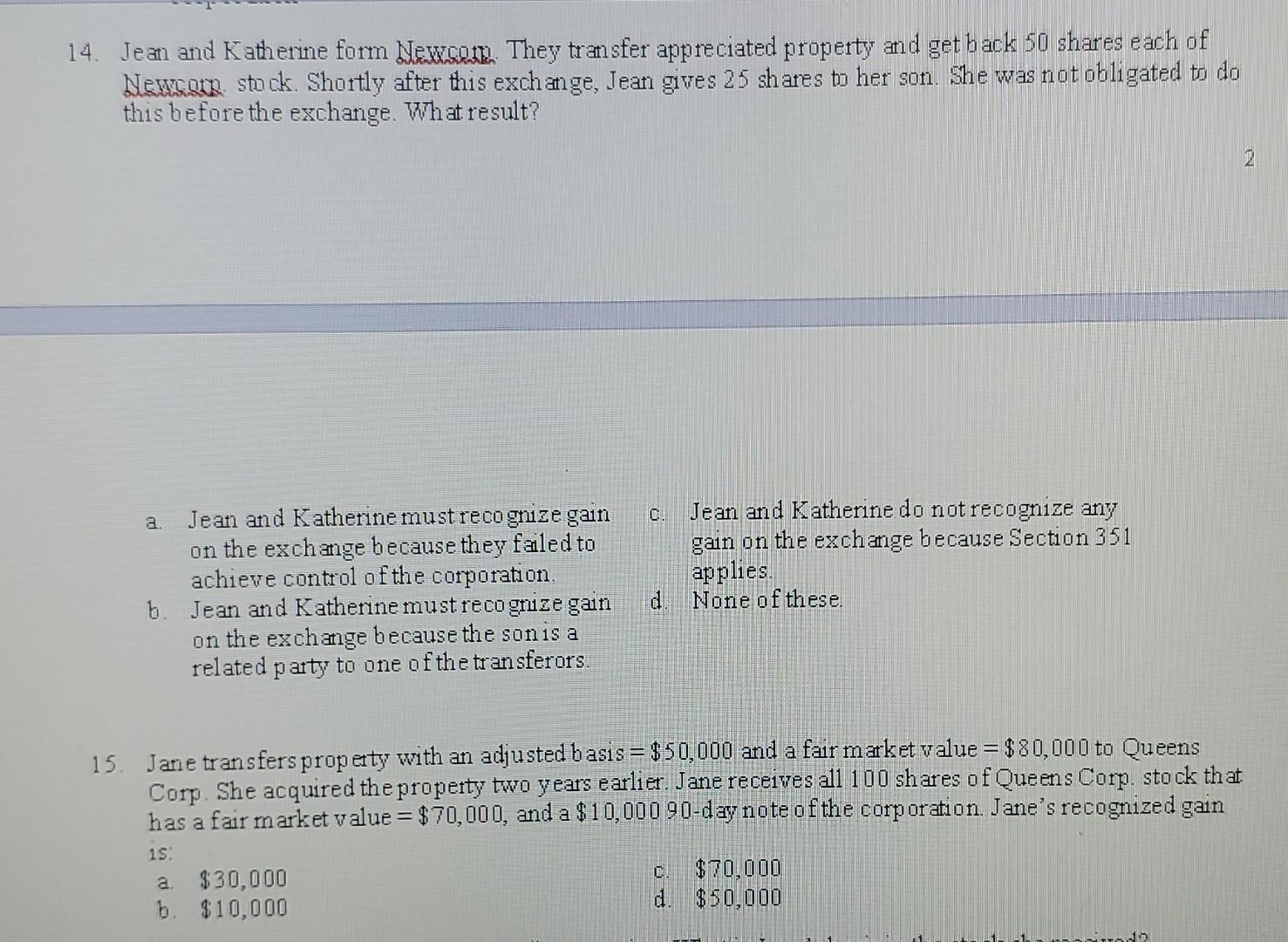

14. Jean and Katherine form Newxcond They transfer appreciated property and get back 50 shares each of Wewcotn. stock. Shortly after this exchange, Jean gives 25 shares to her son. She was not obligated to do this before the exchange. What result? a. Jean and Katherine must recognize gain c. Jean and Katherine do not recognize any on the exchange because they faled to gain on the exchange because Section 351 achieve control of the corporation. applies. b. Jean and Katherine must recognize gain d. None of these. on the exchange because the son is a related party to one of the transferors. 15. Jane transfers property with an adjusted basis =$50,000 and a fair market value =$80,000 to Queens Corp. She acquired the property two years earlier. Jane receives all 100 shares of Queens Corp. stock that has a fair market value =$70,000, and a $10,00090-day note of the corporation. Jane's recognized gain is: a. $30,000 c. $70,000 b. $10,000 d. $50,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started