Answered step by step

Verified Expert Solution

Question

1 Approved Answer

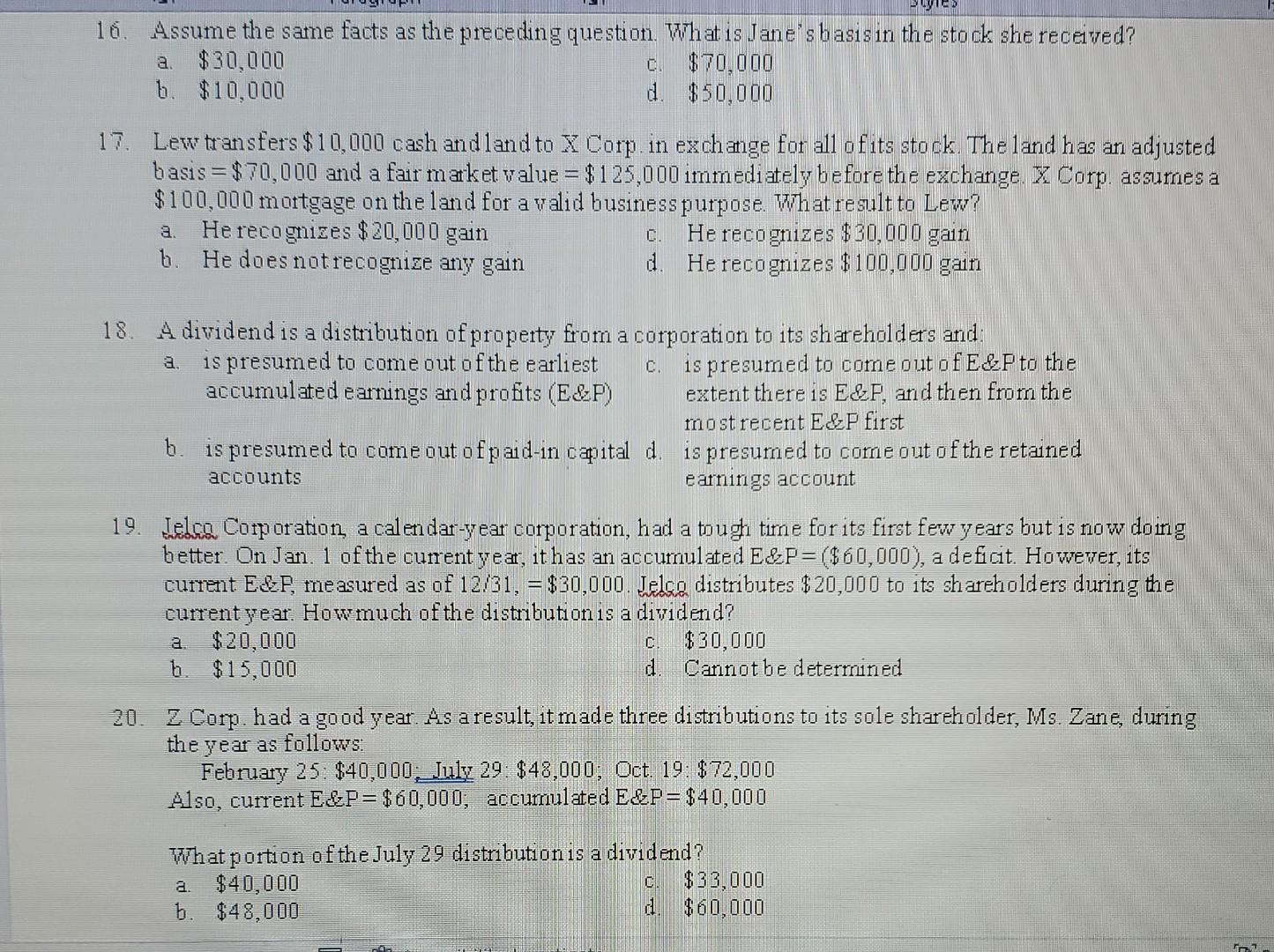

plz help 16. Assume the same facts as the prece ding question. What is Jane's basis in the stock she received? a. $30,000 c. $70,000

plz help

16. Assume the same facts as the prece ding question. What is Jane's basis in the stock she received? a. $30,000 c. $70,000 b. $10,000 d. $50,000 17. Lew transfers $10,000 cash and land to X Corp. in exchange for all of its stock. The land has an adjusted basis =$70,000 and a fair market value =$125,000 immediately before the exchange. X Corp. assumes a $100,000 mortgage on the land for a valid business purpose. What result to Lew? a. He recognizes $20,000 gain c. He recognizes $30,000 gain b. He does not recognize any gain d. Herecognizes $100,000 gain 18. A dividend is a distribution of property from a corporation to its shareholders and: a. is presumed to come out of the earliest c. is presumed to come out of E\&P to the accumulated earnings and profits (E\&P) extent there is E\&P, and then from the most recent E\& P first b. is presumed to come out of paid-in capital d. is presumed to come out of the retained accounts earnings account 19. Lelco Corp oration, a calendar-year corporation, had a tough time for its first few years but is now doing better. On Jan. 1 of the current year, it has an accumulated E&P=($60,000), a deficit. However, its current E\&P, measured as of 12/31,=$30,000. Jelso distributes $20,000 to its shareholders during the current year. How much of the distribution is a dividend? a. $20,000 c. $30,000 b. $15,000 d. Cannotbe determined 20. Z Corp. had a good year. As a result, it made three distributions to its sole shareholder, Ms. Zane, during the year as follows: February 25: $40,000; July 29:$48,000; Oct. 19:$72,000 Also, current E&P=$60,000; accumulated E&P=$40,000 16. Assume the same facts as the prece ding question. What is Jane's basis in the stock she received? a. $30,000 c. $70,000 b. $10,000 d. $50,000 17. Lew transfers $10,000 cash and land to X Corp. in exchange for all of its stock. The land has an adjusted basis =$70,000 and a fair market value =$125,000 immediately before the exchange. X Corp. assumes a $100,000 mortgage on the land for a valid business purpose. What result to Lew? a. He recognizes $20,000 gain c. He recognizes $30,000 gain b. He does not recognize any gain d. Herecognizes $100,000 gain 18. A dividend is a distribution of property from a corporation to its shareholders and: a. is presumed to come out of the earliest c. is presumed to come out of E\&P to the accumulated earnings and profits (E\&P) extent there is E\&P, and then from the most recent E\& P first b. is presumed to come out of paid-in capital d. is presumed to come out of the retained accounts earnings account 19. Lelco Corp oration, a calendar-year corporation, had a tough time for its first few years but is now doing better. On Jan. 1 of the current year, it has an accumulated E&P=($60,000), a deficit. However, its current E\&P, measured as of 12/31,=$30,000. Jelso distributes $20,000 to its shareholders during the current year. How much of the distribution is a dividend? a. $20,000 c. $30,000 b. $15,000 d. Cannotbe determined 20. Z Corp. had a good year. As a result, it made three distributions to its sole shareholder, Ms. Zane, during the year as follows: February 25: $40,000; July 29:$48,000; Oct. 19:$72,000 Also, current E&P=$60,000; accumulated E&P=$40,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started