plz help me solve those make sure to show me ur working

so i know how to solve it alone

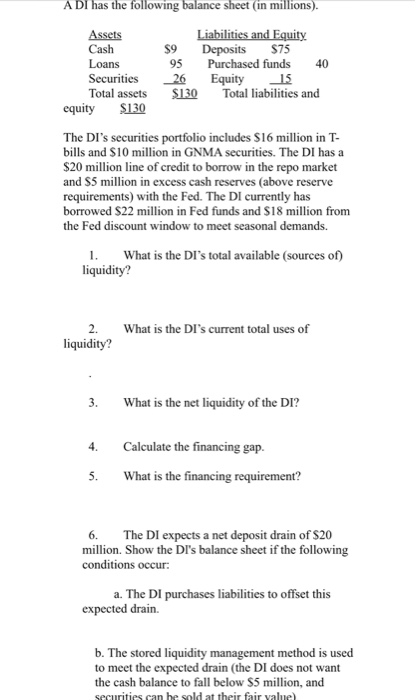

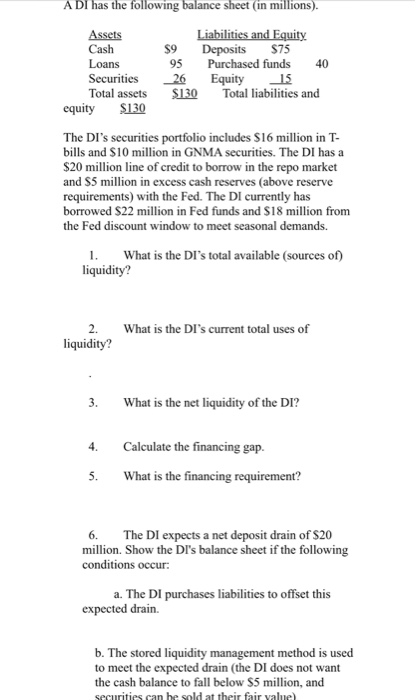

A DI has the following balance sheet (in millions) Assets Cash Loans Securities 26 Eqity 5 Total assets S130 Total liabilities and Liabilities and Equity S9 Deposits $75 95 Purchased funds 40 equity S130 The DI's securities portfolio includes S16 million in T bills and $10 million in GNMA securities. The DI has a $20 million line of credit to borrow in the repo market and S5 million in excess cash reserves (above reserve requirements) with the Fed. The DI currently has borrowed $22 million in Fed funds and $18 million from the Fed discount window to meet seasonal demands. What is the DI's total available (sources of) liquidity? 2. liquidity? What is the DI's current total uses of What is the net liquidity of the DI? Calculate the financing gap. 5. What is the financing requirement? 6 The DI expects a net deposit drain of $20 million. Show the DI's balance sheet if the following conditions occur a. The DI purchases liabilities to offset this expected drain. b. The stored liquidity management method is used to meet the expected drain (the DI does not want the cash balance to fall below $5 million, and A DI has the following balance sheet (in millions) Assets Cash Loans Securities 26 Eqity 5 Total assets S130 Total liabilities and Liabilities and Equity S9 Deposits $75 95 Purchased funds 40 equity S130 The DI's securities portfolio includes S16 million in T bills and $10 million in GNMA securities. The DI has a $20 million line of credit to borrow in the repo market and S5 million in excess cash reserves (above reserve requirements) with the Fed. The DI currently has borrowed $22 million in Fed funds and $18 million from the Fed discount window to meet seasonal demands. What is the DI's total available (sources of) liquidity? 2. liquidity? What is the DI's current total uses of What is the net liquidity of the DI? Calculate the financing gap. 5. What is the financing requirement? 6 The DI expects a net deposit drain of $20 million. Show the DI's balance sheet if the following conditions occur a. The DI purchases liabilities to offset this expected drain. b. The stored liquidity management method is used to meet the expected drain (the DI does not want the cash balance to fall below $5 million, and

plz help me solve those make sure to show me ur working

plz help me solve those make sure to show me ur working