Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help me with proper entries with calculation , the previous tutor had done it wrong so im uploading it again :'( Goods sold are

plz help me with proper entries with calculation , the previous tutor had done it wrong so im uploading it again :'(

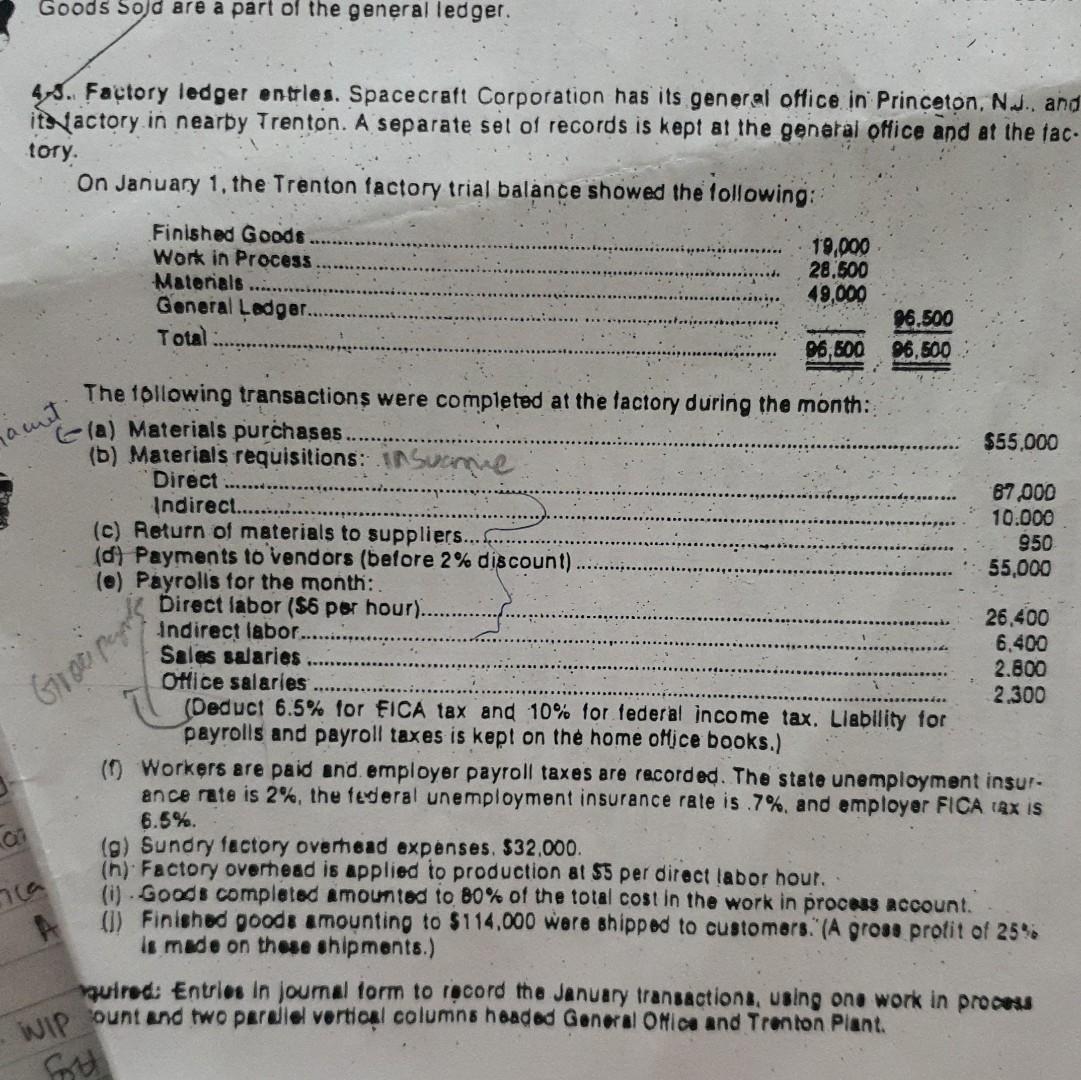

Goods sold are a part of the general ledger. 43. Factory ledger entries. Spacecraft Corporation has its general office in Princeton, NJ. and its actory in nearby Trenton. A separate set of records is kept at the general office and at the fac. tory. On January 1, the Trenton factory trial balance showed the following: Finished Goods Work in Process Materials General Ledger Total 19,000 28.500 49,000 96.500 96,500 96,500 racet Groopassing The following transactions were completed at the factory during the month: ela) Materials purchases. $55.000 (b) Materials requisitions: in Suome Direct 87,000 Indirect.... 10.000 (c) Return of materials to suppliers...s 950 (d) Payments to vendors (before 2% discount) 55,000 (c) Payrolls for the month: Direct labor ($6 per hour). 26.400 Indirect labor... 6.400 Sales salaries 2.800 Oflice salaries 2.300 (Deduct 6.5% for FICA tax and 10% for federal income tax. Liability for payrolls and payroll taxes is kept on the home office books.) (0 Workers are paid and employer payroll taxes are recorded. The state unemployment insur- ance rate is 2%, the federal unemployment insurance rate is 7%, and employer FICA tax is 6.5%. (9) Sundry factory overhead expenses. $32,000. (n) Factory overhead is applied to production at $5 per direct labor hour. (1) Goods completed amounted to B0% of the total cost in the work in proceus account. (1) Finished goods amounting to $114,000 wore shipped to customers."(A gross profit of 25% is made on these shipments.) uired: Entries in journal form to record the January transactions, using one work in proces WIP ount and two perdie vertical columns headed General ONice and Trenton Plant. an ica A SoulStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started