Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help!!! The next 3 questions use the following data: On January 1,2015, Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon

plz help!!!

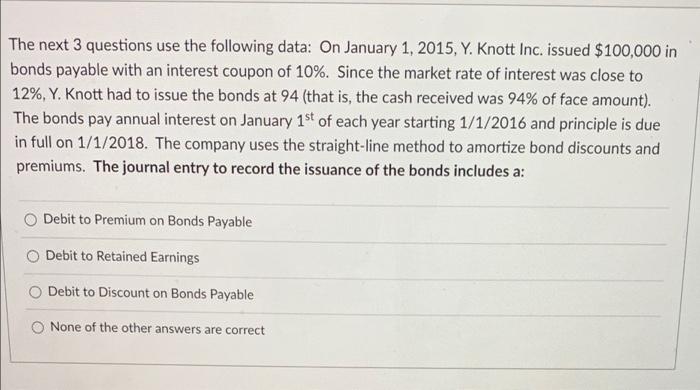

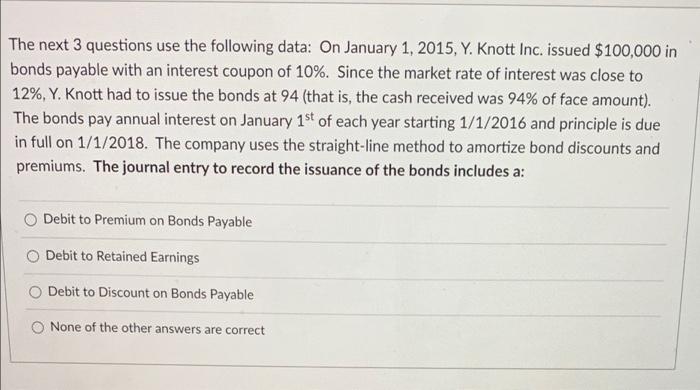

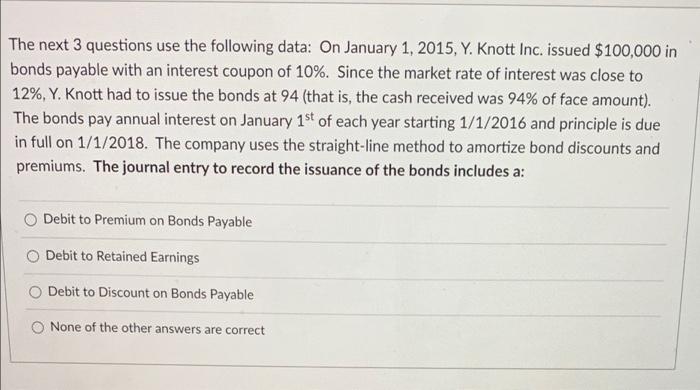

The next 3 questions use the following data: On January 1,2015, Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%,Y. Knott had to issue the bonds at 94 (that is, the cash received was 94% of face amount). The bonds pay annual interest on January 1st of each year starting 1/1/2016 and principle is due in full on 1/1/2018. The company uses the straight-line method to amortize bond discounts and premiums. The journal entry to record the issuance of the bonds includes a: Debit to Premium on Bonds Payable Debit to Retained Earnings Debit to Discount on Bonds Payable None of the other answers are correct On January 1,2015, Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%,Y. Knott had to issue the bonds at 94 (that is, the cash received was 94% of face amount). The bonds pay annual interest on January 1st of each year starting 1/1/2016 and principle is due in full on 1/1/2018. The company uses the straight-line method to amortize bond discounts and premiums. How much cash did Y. Knott Inc. receive when it issued the bonds? On January 1,2015,Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%, Y. Knott had to issue the bonds at 94 (that is, the cash received was 94% of face amount). The bonds pay annual interest on January 1st of each year starting 1/1/2016 and principle is due in full on 1/1/2018. The company uses the straight-line method to amortize bond discounts and premiums. What dollar mount of Interest Expense did Y. Knott Inc. show on the Income Statement in 2015 related to the bonds

The next 3 questions use the following data: On January 1,2015, Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%,Y. Knott had to issue the bonds at 94 (that is, the cash received was 94% of face amount). The bonds pay annual interest on January 1st of each year starting 1/1/2016 and principle is due in full on 1/1/2018. The company uses the straight-line method to amortize bond discounts and premiums. The journal entry to record the issuance of the bonds includes a: Debit to Premium on Bonds Payable Debit to Retained Earnings Debit to Discount on Bonds Payable None of the other answers are correct On January 1,2015, Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%,Y. Knott had to issue the bonds at 94 (that is, the cash received was 94% of face amount). The bonds pay annual interest on January 1st of each year starting 1/1/2016 and principle is due in full on 1/1/2018. The company uses the straight-line method to amortize bond discounts and premiums. How much cash did Y. Knott Inc. receive when it issued the bonds? On January 1,2015,Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%, Y. Knott had to issue the bonds at 94 (that is, the cash received was 94% of face amount). The bonds pay annual interest on January 1st of each year starting 1/1/2016 and principle is due in full on 1/1/2018. The company uses the straight-line method to amortize bond discounts and premiums. What dollar mount of Interest Expense did Y. Knott Inc. show on the Income Statement in 2015 related to the bonds

plz help!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started