Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz I need it as soon as possible cct & Reporting I 12036 on 30 et answered ed out of 0 Flag question Presented below

plz I need it as soon as possible

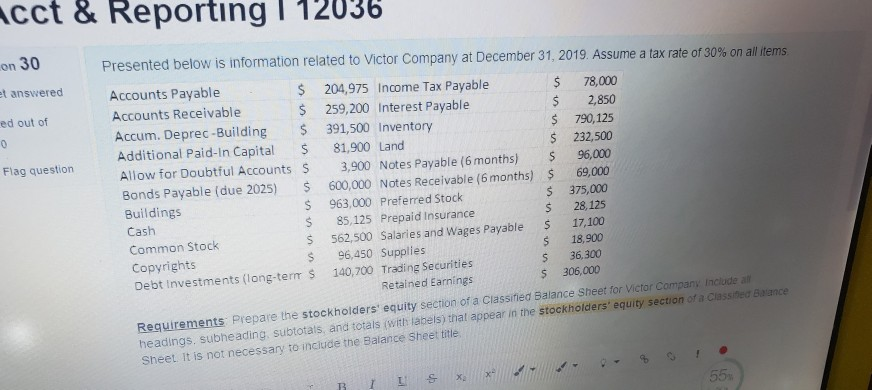

cct & Reporting I 12036 on 30 et answered ed out of 0 Flag question Presented below is information related to Victor Company at December 31, 2019. Assume a tax rate of 30% on all items Accounts Payable $ 204,975 Income Tax Payable $ 78,000 Accounts Receivable $ 259,200 Interest Payable $ 2,850 Accum. Deprec-Building $ 391,500 Inventory $ 790,125 Additional Paid-In Capital $ 81,900 Land $ 232,500 Allow for Doubtful Accounts S 3,900 Notes Payable (6 months) 96,000 Bonds Payable (due 2025) S 600,000 Notes Receivable (6 months) $ 69,000 Buildings $ 963,000 Preferred Stock s 375,000 Cash S 85,125 Prepaid Insurance S 28.125 s S 562.500 Salaries and Wages Payable Common Stock 17,100 5 S Copyrights 18.900 96,450 Supplies S 140,700 Trading Securities 36,300 Debt investments (long-term s Retained Earnings $ 306,000 Requirements Prepare the stockholders' equity section of a classified Balance Sheet for Victor Company include all headings. subheading, subtotals, and totals (with labels) that appear in the stockholders' equity section of a classited Balance Sheet. It is not necessary to include the Balance Sheet title x IS 55 B 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started