Question

PLZ PLA HELP HERE QUESTION 1 You have $21,000 in cash. You can deposit it today in the Charter Hall Direct Industrial Fund earning 5.6%

PLZ PLA HELP HERE

QUESTION 1

You have $21,000 in cash. You can deposit it today in the Charter Hall Direct Industrial Fund earning 5.6% semiannually; or you can wait, put in a CBA term deposit for 24 months earning 0.25% annually, and then invest in your friends caf in 2 years. Your friend is promising you a return of 7.0% on your investment. Whichever alternative you choose, you will need to cash in at the end of 10 years for a house deposit. Assume your friend is trustworthy and that both investments carry the same risk. Show your workings in support of the investment that you choose?

QUESTION 2

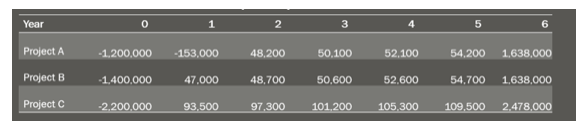

You are analysing 3 proposed capital investments with the following cash flows.

The discount rate for the projects is 4.5%. Calculate the Net Present Value for each project. Which project, or projects, should be accepted if you have unlimited funds to invest? Show your workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started