Question

Plz plz help Suppose Happiness Bank has the following balance sheet a. Calculate the equity multiplier for Happiness Bank. Suppose on average the assets of

Plz plz help

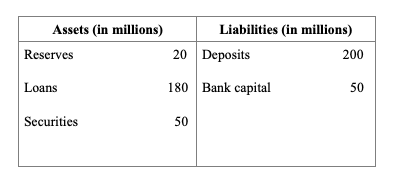

Suppose Happiness Bank has the following balance sheet

a. Calculate the equity multiplier for Happiness Bank. Suppose on average the assets of Happiness Bank have a return of 8%, what is the rate of return to the shareholders of the bank?

b. Suppose the reserve requirement is 10% and there is an outflow of 10 million in deposits. How can the bank eliminate the shortfall in the reserves? Please give one solution and update the balance sheet based on your solution.

c. Suppose 150 million of the bank loans have variable interest rate and 100 million of the deposits have variable interest rate, how would the profit of the bank be affected by a decrease in the interest rate? Is there any way to reduce the interest rate risk?

d. Explain the trade-off between liquidity and profitability for banks.

Assets (in millions) Reserves Liabilities in millions) 20 Deposits 200 Loans 180 Bank capital 50 Securities 50 Assets (in millions) Reserves Liabilities in millions) 20 Deposits 200 Loans 180 Bank capital 50 Securities 50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started