Plz show the specific calculation, thanks!

Plz show the specific calculation, thanks!

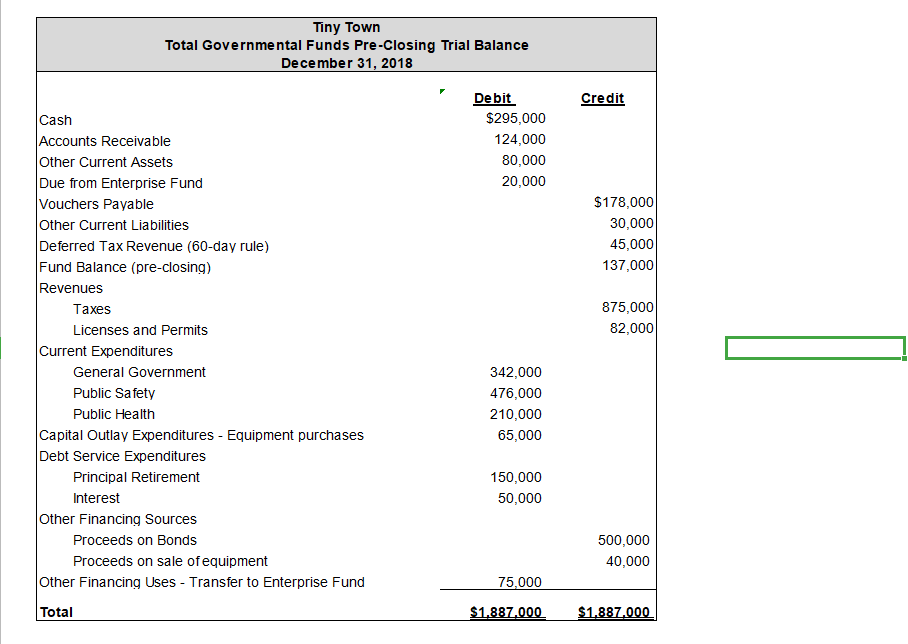

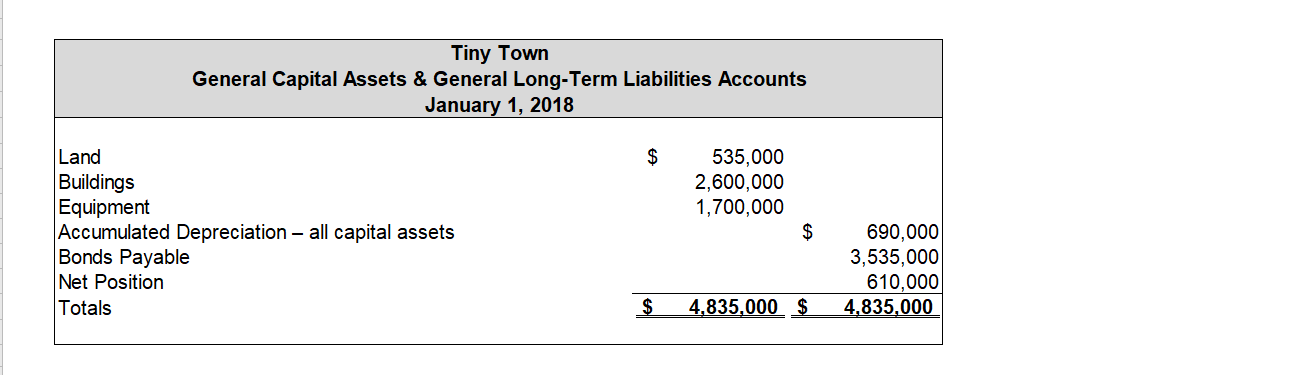

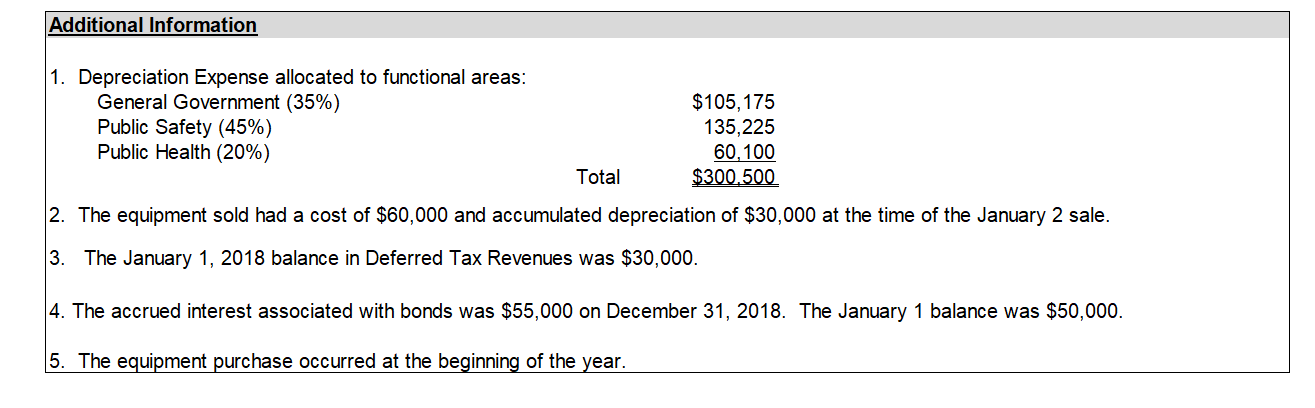

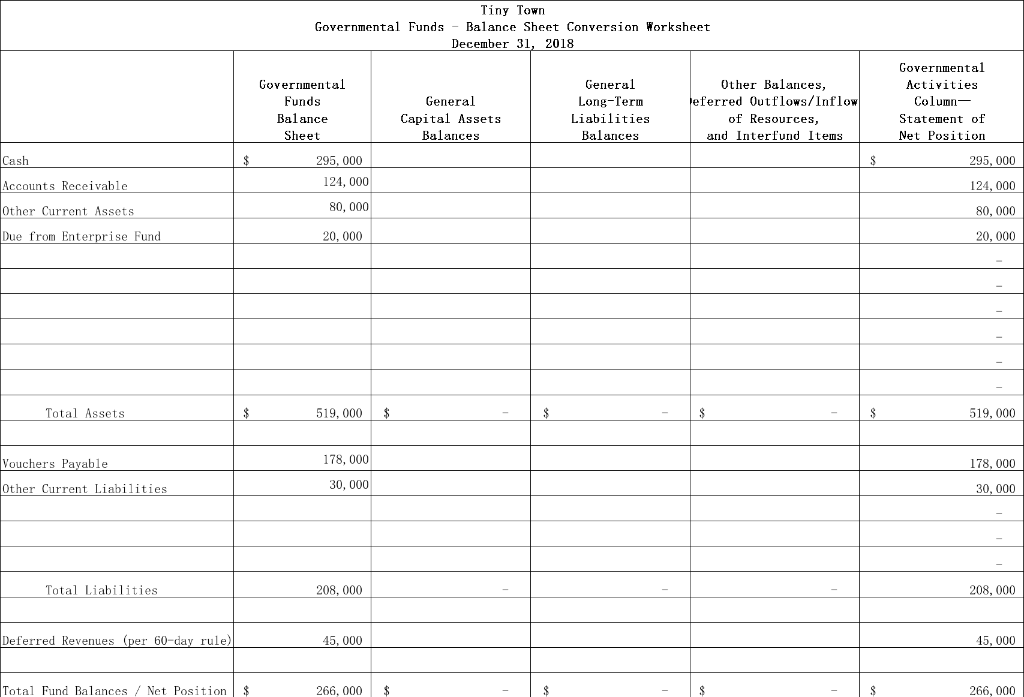

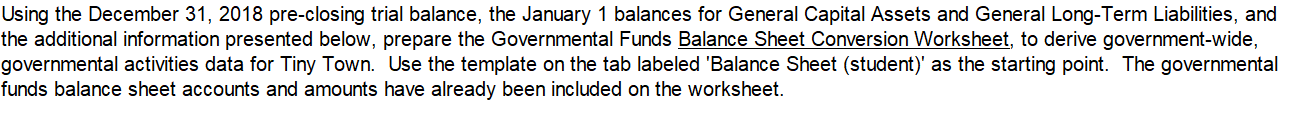

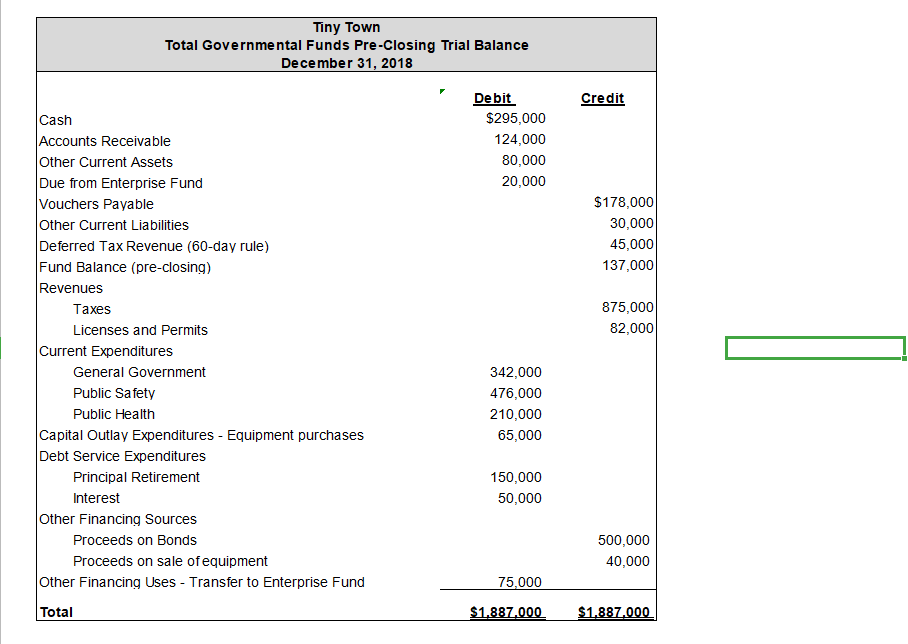

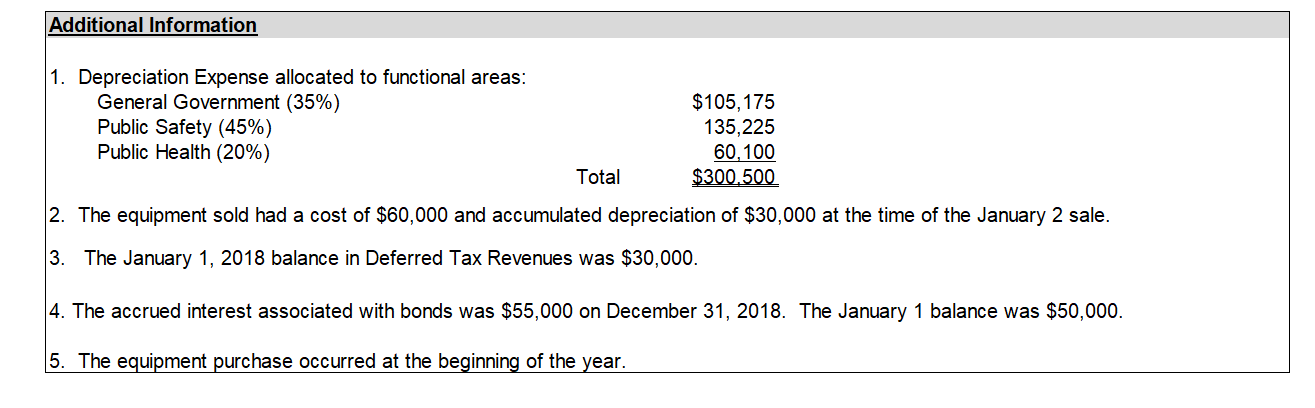

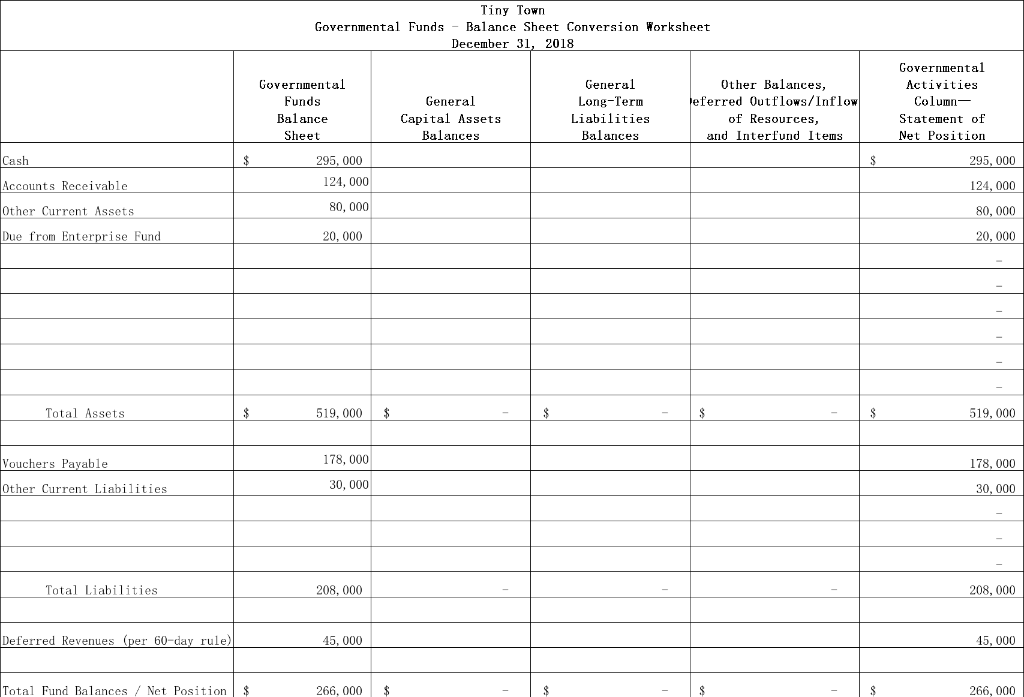

Using the December 31, 2018 pre-closing trial balance, the January 1 balances for General Capital Assets and General Long-Term Liabilities, and the additional information presented below, prepare the Governmental Funds Balance Sheet Conversion Worksheet, to derive government-wide, governmental activities data for Tiny Town. Use the template on the tab labeled 'Balance Sheet (student)' as the starting point. The governmental funds balance sheet accounts and amounts have already been included on the worksheet. Tiny Town Total Governmental Funds Pre-Closing Trial Balance December 31, 2018 Credit Debit $295,000 124,000 80,000 20,000 $178,000 30,000 45,000 137,000 875,000 82,000 Cash Accounts Receivable Other Current Assets Due from Enterprise Fund Vouchers Payable Other Current Liabilities Deferred Tax Revenue (60-day rule) Fund Balance (pre-closing) Revenues Taxes Licenses and Permits Current Expenditures General Government Public Safety Public Health Capital Outlay Expenditures - Equipment purchases Debt Service Expenditures Principal Retirement Interest Other Financing Sources Proceeds on Bonds Proceeds on sale of equipment Other Financing Uses - Transfer to Enterprise Fund 342,000 476,000 210,000 65,000 150,000 50,000 500,000 40,000 75,000 Total $1.887.000 $1.887.000 Tiny Town General Capital Assets & General Long-Term Liabilities Accounts January 1, 2018 Land 535,000 2,600,000 1,700,000 Buildings Equipment Accumulated Depreciation - all capital assets Bonds Payable Net Position Totals 690,000 3,535,000 610,000 4,835,000 $ 4,835,000 $ Additional Information 1. Depreciation Expense allocated to functional areas: General Government (35%) $105, 175 Public Safety (45%) 135,225 Public Health (20%) 60,100 Total $300.500 2. The equipment sold had a cost of $60,000 and accumulated depreciation of $30,000 at the time of the January 2 sale. 3. The January 1, 2018 balance in Deferred Tax Revenues was $30,000. 4. The accrued interest associated with bonds was $55,000 on December 31, 2018. The January 1 balance was $50,000. 5. The equipment purchase occurred at the beginning of the year. Tiny Town Governmental Funds - Balance Sheet Conversion Worksheet December 31, 2018 General Capital Assets Balances General Long-Term Liabilities Balances Other Balances, Jeferred Outflows/Inflow of Resources, and Interfund Items Governmental Activities Column- Statement of Net Position Governmental Funds Balance Sheet 295, 000 124, 000 80,000 Cash Accounts Receivable 295, 000 124, 000 80,000 20,000 Other Current Assets Due from Enterprise Fund 20,000 Total Assets Total Assets $ 519,000 $ - $ $ $ 519,000 Vouchers Payable 178,000 178,000 Other Current Liabilities 30,000 30,000 Total Liabilities 208.000 - - 208,000 Deferred Revenues (per 60-day rule) 45,000 45,000 Total Fund Balances / Net Position $ 266, 000 $ 266,000 Using the December 31, 2018 pre-closing trial balance, the January 1 balances for General Capital Assets and General Long-Term Liabilities, and the additional information presented below, prepare the Governmental Funds Balance Sheet Conversion Worksheet, to derive government-wide, governmental activities data for Tiny Town. Use the template on the tab labeled 'Balance Sheet (student)' as the starting point. The governmental funds balance sheet accounts and amounts have already been included on the worksheet. Tiny Town Total Governmental Funds Pre-Closing Trial Balance December 31, 2018 Credit Debit $295,000 124,000 80,000 20,000 $178,000 30,000 45,000 137,000 875,000 82,000 Cash Accounts Receivable Other Current Assets Due from Enterprise Fund Vouchers Payable Other Current Liabilities Deferred Tax Revenue (60-day rule) Fund Balance (pre-closing) Revenues Taxes Licenses and Permits Current Expenditures General Government Public Safety Public Health Capital Outlay Expenditures - Equipment purchases Debt Service Expenditures Principal Retirement Interest Other Financing Sources Proceeds on Bonds Proceeds on sale of equipment Other Financing Uses - Transfer to Enterprise Fund 342,000 476,000 210,000 65,000 150,000 50,000 500,000 40,000 75,000 Total $1.887.000 $1.887.000 Tiny Town General Capital Assets & General Long-Term Liabilities Accounts January 1, 2018 Land 535,000 2,600,000 1,700,000 Buildings Equipment Accumulated Depreciation - all capital assets Bonds Payable Net Position Totals 690,000 3,535,000 610,000 4,835,000 $ 4,835,000 $ Additional Information 1. Depreciation Expense allocated to functional areas: General Government (35%) $105, 175 Public Safety (45%) 135,225 Public Health (20%) 60,100 Total $300.500 2. The equipment sold had a cost of $60,000 and accumulated depreciation of $30,000 at the time of the January 2 sale. 3. The January 1, 2018 balance in Deferred Tax Revenues was $30,000. 4. The accrued interest associated with bonds was $55,000 on December 31, 2018. The January 1 balance was $50,000. 5. The equipment purchase occurred at the beginning of the year. Tiny Town Governmental Funds - Balance Sheet Conversion Worksheet December 31, 2018 General Capital Assets Balances General Long-Term Liabilities Balances Other Balances, Jeferred Outflows/Inflow of Resources, and Interfund Items Governmental Activities Column- Statement of Net Position Governmental Funds Balance Sheet 295, 000 124, 000 80,000 Cash Accounts Receivable 295, 000 124, 000 80,000 20,000 Other Current Assets Due from Enterprise Fund 20,000 Total Assets Total Assets $ 519,000 $ - $ $ $ 519,000 Vouchers Payable 178,000 178,000 Other Current Liabilities 30,000 30,000 Total Liabilities 208.000 - - 208,000 Deferred Revenues (per 60-day rule) 45,000 45,000 Total Fund Balances / Net Position $ 266, 000 $ 266,000

Plz show the specific calculation, thanks!

Plz show the specific calculation, thanks!