Plz solve these two questions

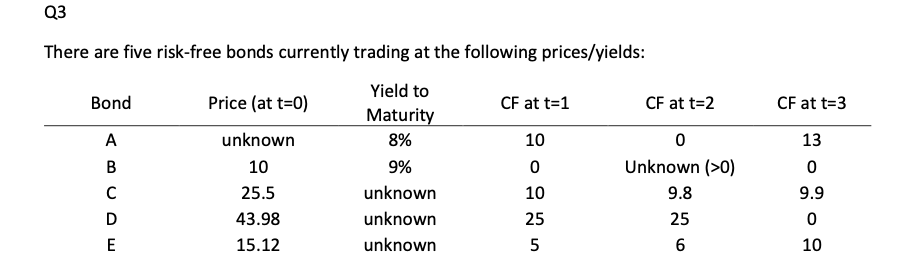

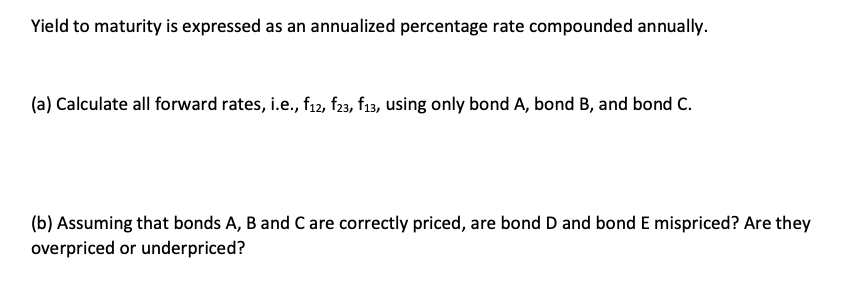

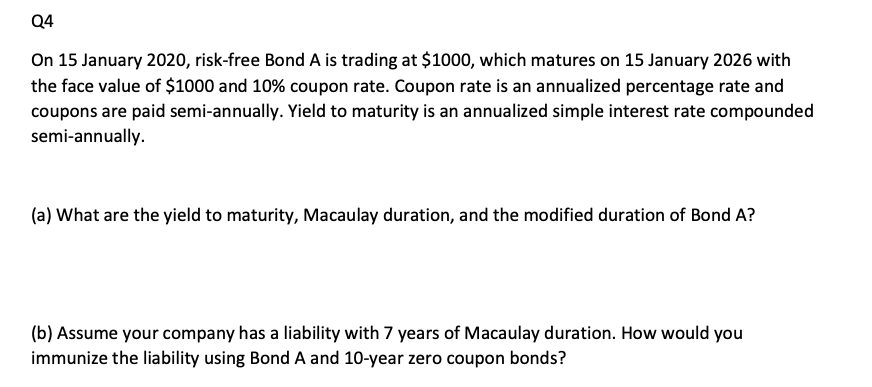

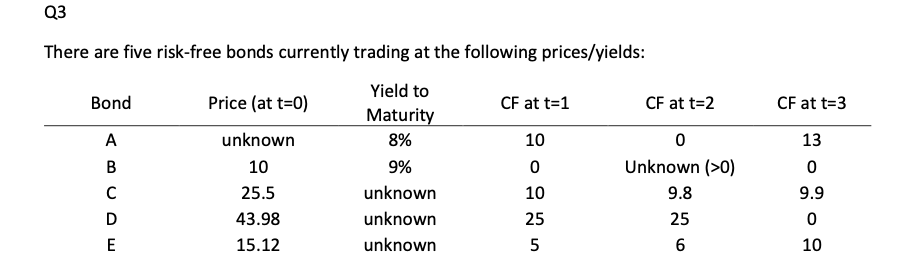

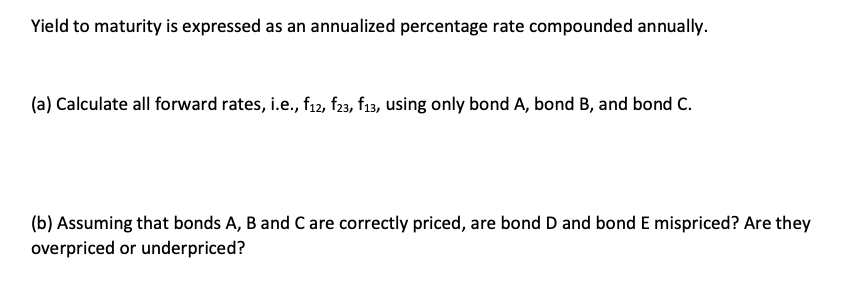

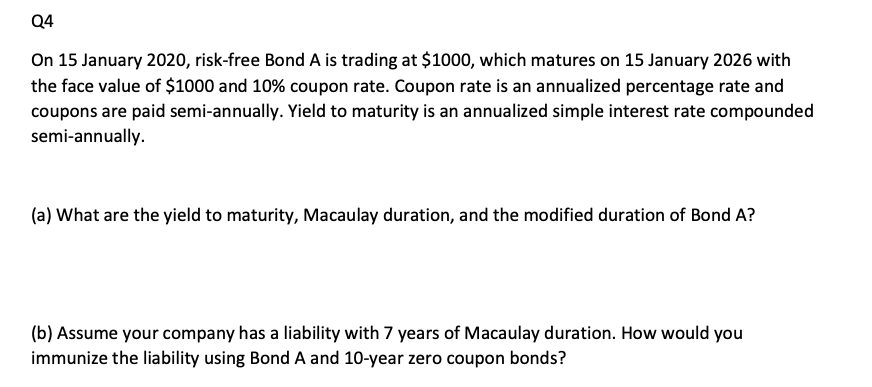

Q3 There are five risk-free bonds currently trading at the following prices/yields: Yield to Bond Price (at t=0) CF at t=1 CF at t=2 CF at t=3 Maturity 8% A unknown 10 0 13 B 10 9% 0 Unknown (>0) 0 25.5 unknown 10 9.8 9.9 D 43.98 unknown 25 25 0 E 15.12 unknown 5 6 10 Yield to maturity is expressed as an annualized percentage rate compounded annually. (a) Calculate all forward rates, i.e., f12, f23, f13, using only bond A, bond B, and bond C. (b) Assuming that bonds A, B and C are correctly priced, are bond D and bond E mispriced? Are they overpriced or underpriced? Q4 On 15 January 2020, risk-free Bond A is trading at $1000, which matures on 15 January 2026 with the face value of $1000 and 10% coupon rate. Coupon rate is an annualized percentage rate and coupons are paid semi-annually. Yield to maturity is an annualized simple interest rate compounded semi-annually. (a) What are the yield to maturity, Macaulay duration, and the modified duration of Bond A? (b) Assume your company has a liability with 7 years of Macaulay duration. How would you immunize the liability using Bond A and 10-year zero coupon bonds? Q3 There are five risk-free bonds currently trading at the following prices/yields: Yield to Bond Price (at t=0) CF at t=1 CF at t=2 CF at t=3 Maturity 8% A unknown 10 0 13 B 10 9% 0 Unknown (>0) 0 25.5 unknown 10 9.8 9.9 D 43.98 unknown 25 25 0 E 15.12 unknown 5 6 10 Yield to maturity is expressed as an annualized percentage rate compounded annually. (a) Calculate all forward rates, i.e., f12, f23, f13, using only bond A, bond B, and bond C. (b) Assuming that bonds A, B and C are correctly priced, are bond D and bond E mispriced? Are they overpriced or underpriced? Q4 On 15 January 2020, risk-free Bond A is trading at $1000, which matures on 15 January 2026 with the face value of $1000 and 10% coupon rate. Coupon rate is an annualized percentage rate and coupons are paid semi-annually. Yield to maturity is an annualized simple interest rate compounded semi-annually. (a) What are the yield to maturity, Macaulay duration, and the modified duration of Bond A? (b) Assume your company has a liability with 7 years of Macaulay duration. How would you immunize the liability using Bond A and 10-year zero coupon bonds