Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz solve this question fast The Lopez-Portilio Company has $10 million in assets, 80 percent financed by debt and 20 percent financed by common stock.

plz solve this question fast

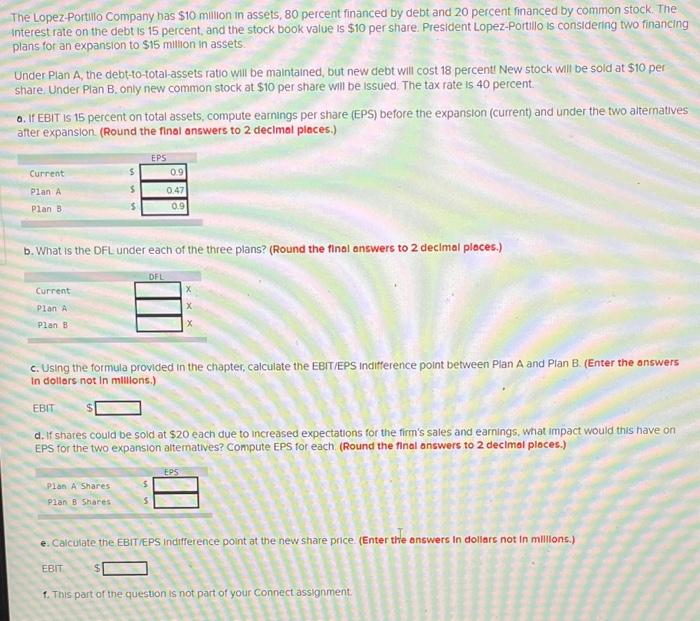

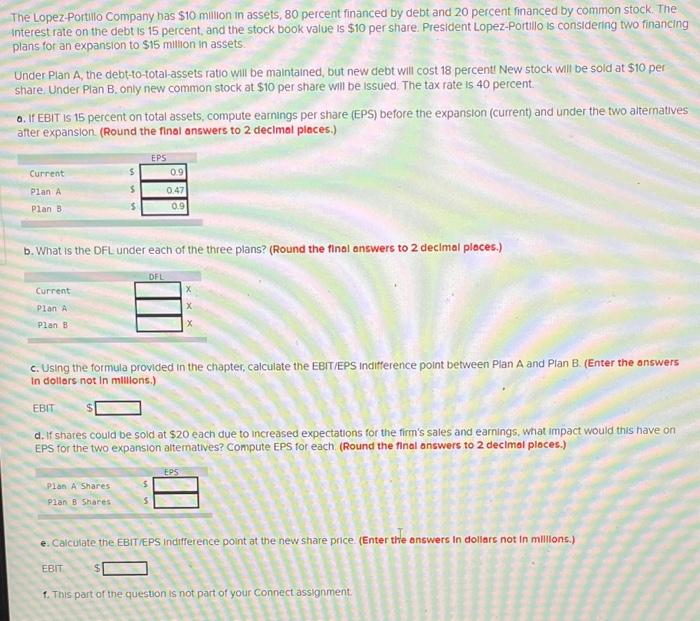

The Lopez-Portilio Company has $10 million in assets, 80 percent financed by debt and 20 percent financed by common stock. The interest rate on the debt is 15 percent, and the stock book value is $10 per share. President Lopez-Portlllo is considering two financing plans for an expansion to $15 milion in assets. Under Plan A, the debt-to-total-assets ratio will be maintained, but new debt will cost 18 percenti New stock will be sold at $10 per share. Under Plan B, only new common stock at $10 per share will be issued. The tax rate is 40 percent. Q. If EBIT is 15 percent on total assets, compute eamings per share (EPS) before the expansion (current) and under the two aiternattves after expansion. (Round the final answers to 2 decimal places.) b. What is the DFL under each of the three plans? (Round the final answers to 2 decimal pleces.) c. Using the formula provided in the chapter, calculate the EBIT/EPS indifference point between Plan A and Plan B. (Enter the onswers in dollars not in militons.) EBIT $ d. If shares could be sold at $20 each due to increased expectations for the firm's sales and earnings, what impact would this have on. EPS for the two expansion altematives? Compute EPS for each. (Round the fnnal answers to 2 decimal ploces.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started