Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plzz show all and any formulas and solutions . Bond A: 20-year bond with 3% coupon rate. Bond B: 5-year bond with 5% coupon rate.

plzz show all and any formulas and solutions

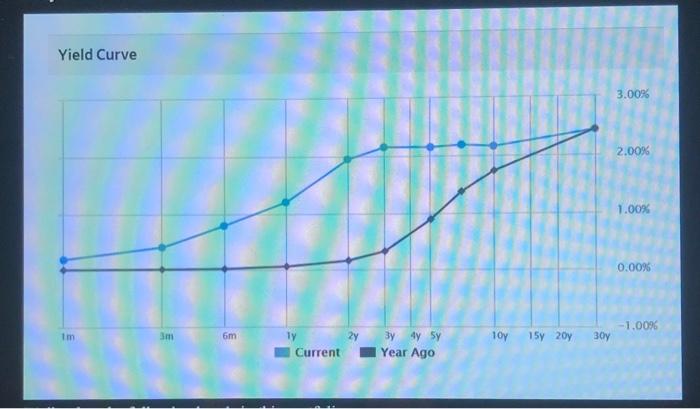

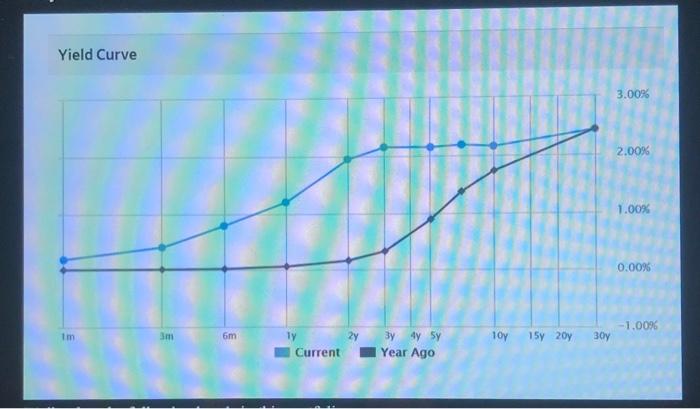

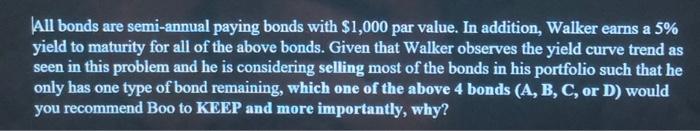

. Bond A: 20-year bond with 3% coupon rate. Bond B: 5-year bond with 5% coupon rate. Bond C: 2-year bond with 10% coupon rate. Bond D: 15-year bond with 2% coupon rate. Yield Curve 3.00% 2.00% 1.00% 0.00% -1.00% Im 3m 6m 2y 10y 15y 20 30y Ty Current 3y45y Year Ago All bonds are semi-annual paying bonds with $1,000 par value. In addition, Walker earns a 5% yield to maturity for all of the above bonds. Given that Walker observes the yield curve trend as seen in this problem and he is considering selling most of the bonds in his portfolio such that he only has one type of bond remaining, which one of the above 4 bonds (A, B, C, or D) would you recommend Boo to KEEP and more importantly, why? . Bond A: 20-year bond with 3% coupon rate. Bond B: 5-year bond with 5% coupon rate. Bond C: 2-year bond with 10% coupon rate. Bond D: 15-year bond with 2% coupon rate. Yield Curve 3.00% 2.00% 1.00% 0.00% -1.00% Im 3m 6m 2y 10y 15y 20 30y Ty Current 3y45y Year Ago All bonds are semi-annual paying bonds with $1,000 par value. In addition, Walker earns a 5% yield to maturity for all of the above bonds. Given that Walker observes the yield curve trend as seen in this problem and he is considering selling most of the bonds in his portfolio such that he only has one type of bond remaining, which one of the above 4 bonds (A, B, C, or D) would you recommend Boo to KEEP and more importantly, why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started