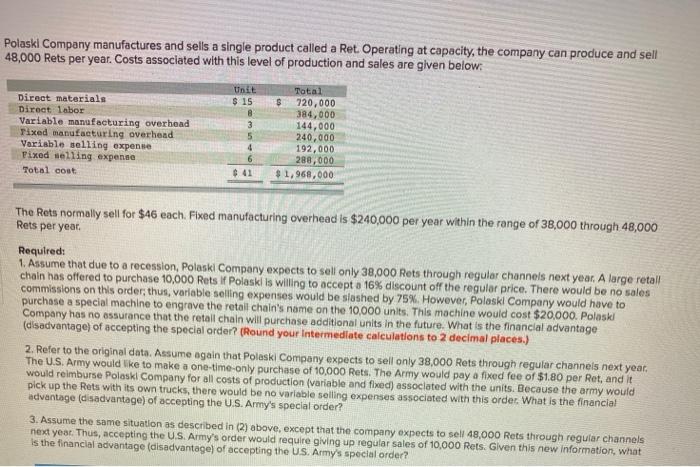

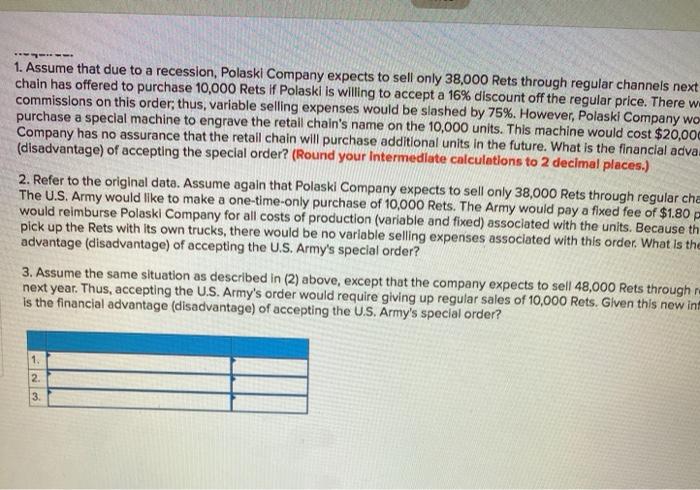

Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 48,000 Rets per year. Costs associated with this level of production and sales are given below: Unit $ 15 Direct materials Direct labor Variable manufacturing overhead Tixed manufacturing overhead Variable selling expense Fixed selling expense Total cost 3 5 4 Total $ 720,000 384,000 144,000 240,000 192,000 288,000 $1,968,000 $.41 The Rets normally sell for $46 each. Fixed manufacturing overhead is $240,000 per year within the range of 38,000 through 48,000 Rets per year. Required: 1. Assume that due to a recession, Polask Company expects to sell only 38,000 Rets through regular channels next year. A large retall chain has offered to purchase 10,000 Rets If Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrove the retail chain's name on the 10,000 units. This machine would cost $20,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage of accepting the special order? (Round your Intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 38,000 Rets through regular channels next year, The U.S. Army would like to make a one-time-only purchase of 10,000 Rets. The Army would pay a fixed fee of $1.80 per Ret, and it would reimburse Poloski Company for all costs of production (variable and fived) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 48,000 Rets through regular channels next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 10,000 Rets. Given this new information, what is the financial advantage (disadvantage of accepting the US Army's special order? 1. Assume that due to a recession, Polaskl Company expects to sell only 38,000 Rets through regular channels next chain has offered to purchase 10,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There w commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company wo purchase a special machine to engrave the retail chain's name on the 10,000 units. This machine would cost $20,000 Company has no assurance that the retail chain will purchase additional units in the future. What is the financial adva. (disadvantage) of accepting the special order? (Round your Intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 38,000 Rets through regular cha The U.S. Army would like to make a one-time-only purchase of 10,000 Rets. The Army would pay a fixed fee of $1.80p would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because th pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 48,000 Rets through next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 10,000 Rets. Glven this new in is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 1. 2. 3