Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Popcorn Industries is preparing pro forma financial statements for the upcoming year. Their executive team is tasked with determining how much in additional assets they

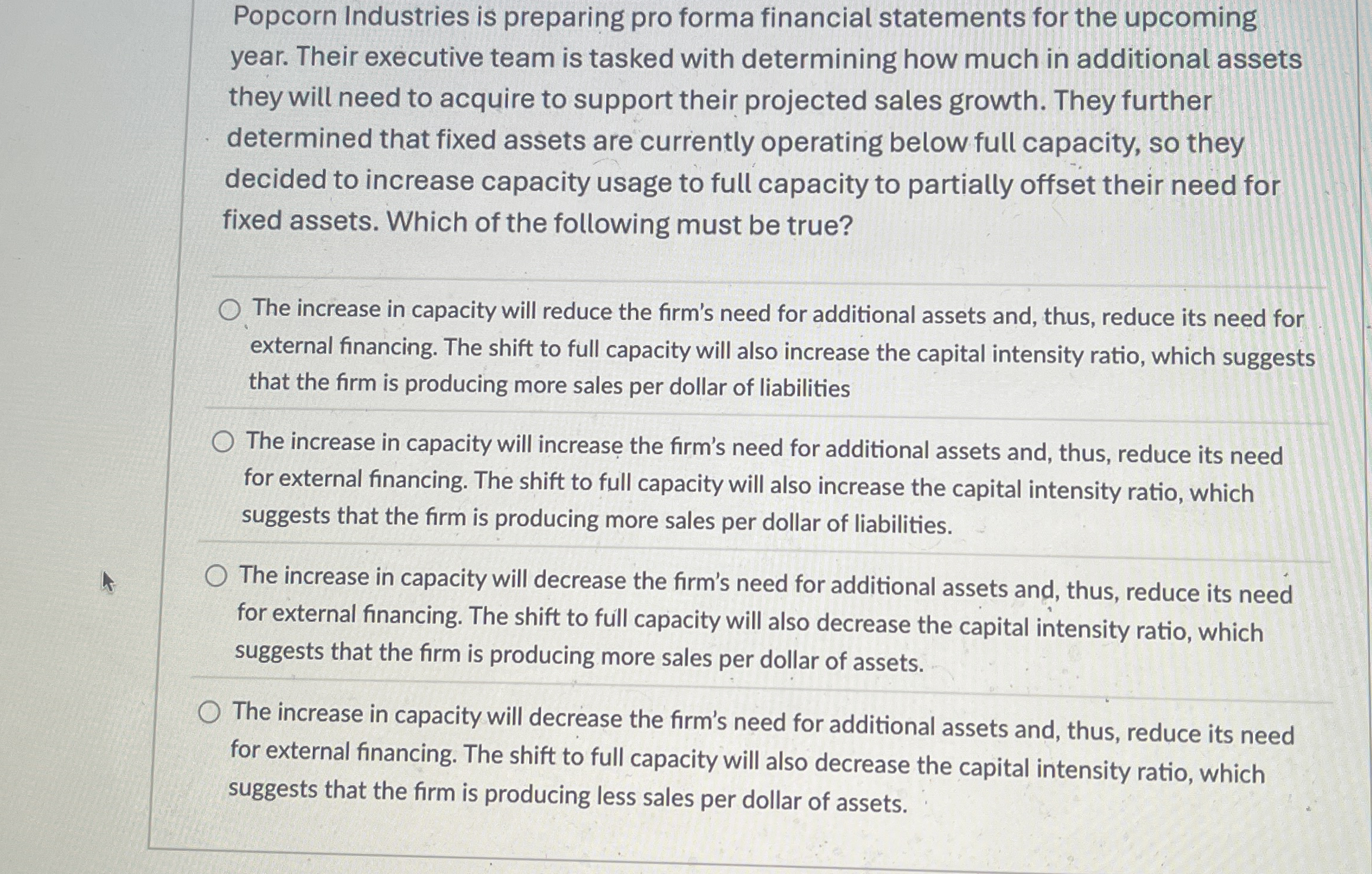

Popcorn Industries is preparing pro forma financial statements for the upcoming

year. Their executive team is tasked with determining how much in additional assets

they will need to acquire to support their projected sales growth. They further

determined that fixed assets are currently operating below full capacity, so they

decided to increase capacity usage to full capacity to partially offset their need for

fixed assets. Which of the following must be true?

The increase in capacity will reduce the firm's need for additional assets and, thus, reduce its need for

external financing. The shift to full capacity will also increase the capital intensity ratio, which suggests

that the firm is producing more sales per dollar of liabilities

The increase in capacity will increase the firm's need for additional assets and, thus, reduce its need

for external financing. The shift to full capacity will also increase the capital intensity ratio, which

suggests that the firm is producing more sales per dollar of liabilities.

The increase in capacity will decrease the firm's need for additional assets and, thus, reduce its need

for external financing. The shift to full capacity will also decrease the capital intensity ratio, which

suggests that the firm is producing more sales per dollar of assets.

The increase in capacity will decrease the firm's need for additional assets and, thus, reduce its need

for external financing. The shift to full capacity will also decrease the capital intensity ratio, which

suggests that the firm is producing less sales per dollar of assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started