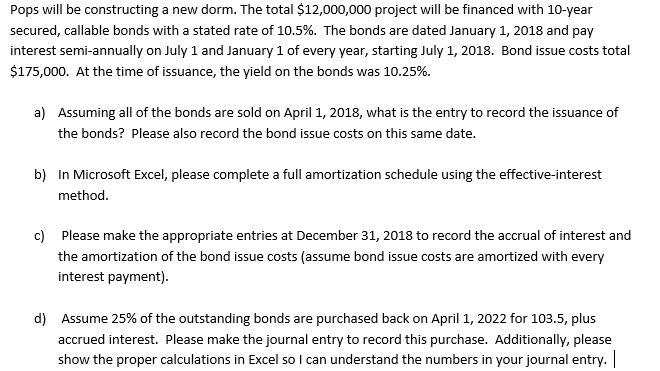

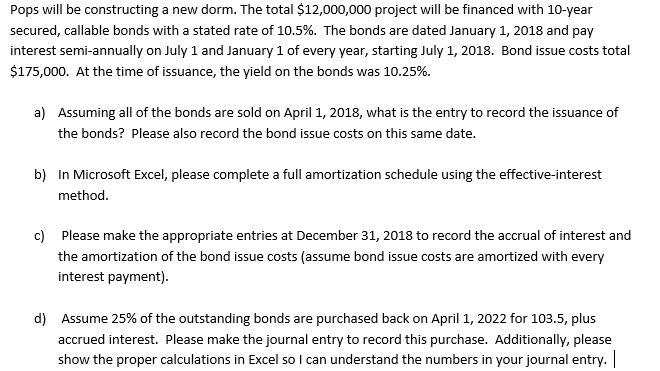

Pops will be constructing a new dorm. The total $12,000,000 project will be financed with 10-year secured, callable bonds with a stated rate of 10.5%. The bonds are dated January 1, 2018 and pay interest semi-annually on July 1 and January 1 of every year, starting July 1, 2018. Bond issue costs total $175,000. At the time of issuance, the yield on the bonds was 10.25%. a) Assuming all of the bonds are sold on April 1, 2018, what is the entry to record the issuance of the bonds? Please also record the bond issue costs on this same date. b) In Microsoft Excel, please complete a full amortization schedule using the effective-interest method. c) Please make the appropriate entries at December 31, 2018 to record the accrual of interest and the amortization of the bond issue costs (assume bond issue costs are amortized with every interest payment). d) Assume 25% of the outstanding bonds are purchased back on April 1, 2022 for 103.5, plus accrued interest. Please make the journal entry to record this purchase. Additionally, please show the proper calculations in Excel so I can understand the numbers in your journal entry. Pops will be constructing a new dorm. The total $12,000,000 project will be financed with 10-year secured, callable bonds with a stated rate of 10.5%. The bonds are dated January 1, 2018 and pay interest semi-annually on July 1 and January 1 of every year, starting July 1, 2018. Bond issue costs total $175,000. At the time of issuance, the yield on the bonds was 10.25%. a) Assuming all of the bonds are sold on April 1, 2018, what is the entry to record the issuance of the bonds? Please also record the bond issue costs on this same date. b) In Microsoft Excel, please complete a full amortization schedule using the effective-interest method. c) Please make the appropriate entries at December 31, 2018 to record the accrual of interest and the amortization of the bond issue costs (assume bond issue costs are amortized with every interest payment). d) Assume 25% of the outstanding bonds are purchased back on April 1, 2022 for 103.5, plus accrued interest. Please make the journal entry to record this purchase. Additionally, please show the proper calculations in Excel so I can understand the numbers in your journal entry