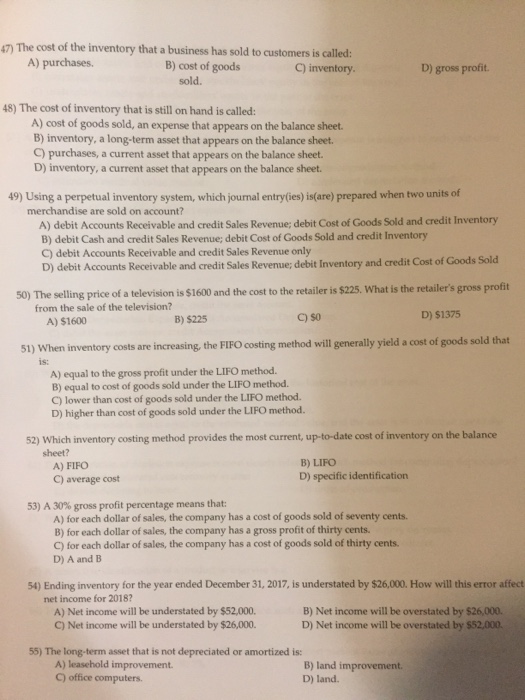

The cost of the inventory that a business has sold to customers is called: A) purchases. B) cost of goods sold. C) inventory. D) gross profit. The cost of inventory that is still on hand is called: A) cost of goods sold, an expense that appears on the balance sheet. B) inventory, a long - term asset that appears on the balance sheet. C) purchases, a current asset that appears on the balance sheet. D) inventory, a current asset that appears on the balance sheet. Using a perpetual inventory system, which journal entry(ies) is (are) prepared when two units of merchandise are sold on account? A) debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory B) debit Cash and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory C) debit Accounts Receivable and credit Sales Revenue only D) debit Accounts Receivable and credit Sales Revenue; debit Inventory and credit Cost of Goods Sold The selling price of a television is $1600 and the cost to the retailer is $225. What is the retailer's gross profit from the sale of the television? A) $1600 B) $225 C) $0 D) $1375 When inventory costs are increasing, the FIFO costing method will generally yield a cost of goods sold that is: A) equal to the gross profit under the LIFO method. B) equal to cost of goods sold under the LIFO method. C) lower than cost of goods sold under the LIFO method. D) higher than cost of goods sold under the LIFO method. Which inventory costing method provides the most current, up - to - date cost of inventory on the balance sheet? A) FIFO B) LIFO C) average cost D) specific identification A gross profit percentage means that: A) for each dollar of sales, the company has a cost of goods sold of seventy cents. B) for each dollar of sales, the company has a gross profit of thirty cents. C) for each dollar of sales, the company has a cost of goods sold of thirty cents. D) A and B Ending inventory for the year ended December 31, 2017, is understated by $26,000. How will this error affect net income for 2018? A) Net income will be understated by $52,000. B) Net income will be overstated by $26,000. C) Net income will be understated by $26,000. D) Net income will be overstated by $52400. The long - term asset that is not depreciated or amortized is: A) leasehold improvement. B) land improvement. C) office computers. D) land