Question

Portfolio 1 consists of two risky assets A and B with the following characteristics E(rA) = 18%, E(rB) = 17%, A = 18% GB

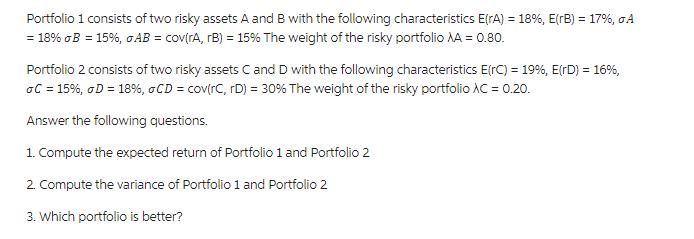

Portfolio 1 consists of two risky assets A and B with the following characteristics E(rA) = 18%, E(rB) = 17%, A = 18% GB = 15%, AB = cov(rA, rB) = 15% The weight of the risky portfolio A = 0.80. Portfolio 2 consists of two risky assets C and D with the following characteristics E(rC) = 19%, E(rD) = 16%, oC = 15%, D = 18%, o CD = cov(rC, rD) = 30% The weight of the risky portfolio XC = 0.20. Answer the following questions. 1. Compute the expected return of Portfolio 1 and Portfolio 2 2. Compute the variance of Portfolio 1 and Portfolio 2 3. Which portfolio is better?

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Expected return of Portfolio 1 Erp1 A ErA 1 A ErB Erp1 080 18 020 17 Erp1 178 Expected return of P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modeling the Dynamics of Life Calculus and Probability for Life Scientists

Authors: Frederick R. Adler

3rd edition

840064187, 978-1285225975, 128522597X, 978-0840064189

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App