Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portfolio return and standard deviation Jamie Wong is thinking of building an investment portfolio containing two exchange traded funds ( ETFs ) . Jamie plans

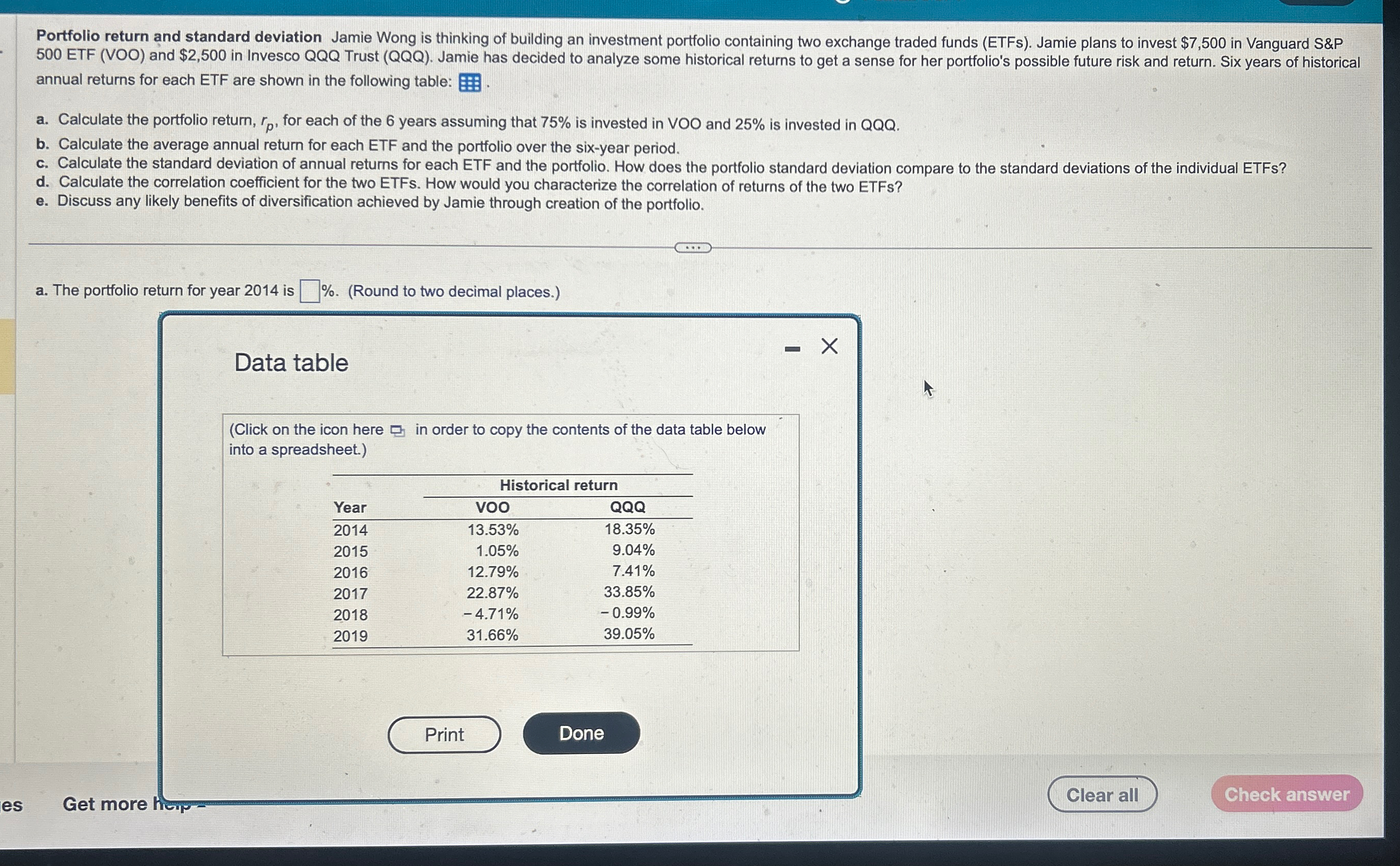

Portfolio return and standard deviation Jamie Wong is thinking of building an investment portfolio containing two exchange traded funds ETFs Jamie plans to invest $ in Vanguard S&P ETF VOO and $ in Invesco QQQ Trust QQQ Jamie has decided to analyze some historical returns to get a sense for her portfolio's possible future risk and return. Six years of historical annual returns for each ETF are shown in the following table:

a Calculate the portfolio return, for each of the years assuming that is invested in VOO and is invested in QQQ

b Calculate the average annual return for each ETF and the portfolio over the sixyear period.

c Calculate the standard deviation of annual returns for each ETF and the portfolio. How does the portfolio standard deviation compare to the standard deviations of the individual ETFs?

d Calculate the correlation coefficient for the two ETFs. How would you characterize the correlation of returns of the two ETFs?

e Discuss any likely benefits of diversification achieved by Jamie through creation of the portfolio.

a The portfolio return for year is Round to two decimal places.

Data table

Click on the icon here in order to copy the contents of the datable below into a spreadsheet.

tableHistorical returnYearVOO,QQQ

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started