Question

Portsmouth Corporation, an Irish corporation, is a wholly owned subsidiary of Salem Corporation, a U.S. corporation. Portsmouth Corporation was incorporated on January 2, 2021 and

Portsmouth Corporation, an Irish corporation, is a wholly owned subsidiary of Salem Corporation, a U.S. corporation. Portsmouth Corporation was incorporated on January 2, 2021 and adopted the Euro as its functional currency.

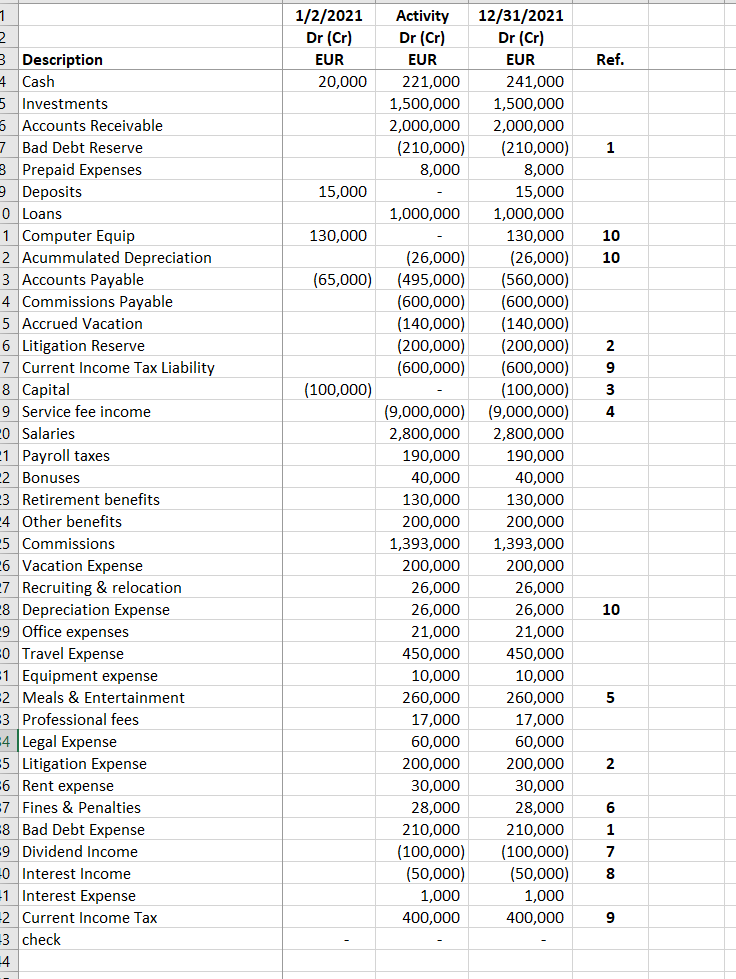

Refer to the trial balance of Portsmouth Corporation for the annual period ending on December 31, 2021, which was prepared according to US GAAP standards.

Exchange rates (EUR/USD): 1/2/2021 1.22121 12/31/2021 1.1324 2021average 1.18032

Required:

Calculate the earnings & profits of Portsmouth Corporation for 2021. Refer to Treasury Regulations 1.964-1.

Calculate the amount of subpart F income that Portsmouth should recognize in 2021.

Calculate the Global Intangible Low- Taxed Income (GILTI) and any applicable foreign tax credit.

Complete the following forms: o Form 5471 pages 1-6 o Form 5471 schedule E Current Earnings and Profits o Form 5471 schedule I-1 Information for Global Intangible Low- Taxed Income Refer to irs.gov for the forms and instructions.

Notes:

1. Bad debt reserve The company managements estimated that EUR210,000 of the company accounts receivable will not be collected and as such recorded the applicable bad debt reserve

2. Litigation reserve -Management recorded litigation reserve in the amount of EUR200,000. Assume that under the Irish tax laws this reserve does not meet the all events test for deducting expenses

3. Capital 100,000 shares of common stock in the amount of EUR1 each

4. Service fee income received from an unrelated Irish corporation for services performed within Ireland

5. Meals & Entertainment Only 50% deductible for income tax purposes

6. Fines & Penalties Entirely non deductible for income tax purposes

7. Dividend income received from a 5% owned unrelated Dutch corporation. Withholding taxes did not apply as the tax rate is reduced to 0% under Dutch domestic tax law

8. Interest income received from a loan to an unrelated French corporation. No withholding tax was levied on the interest

9. Accrued corporate taxes calculated at 12.5% of the Irish taxable income

10. Fixed assets Computer equipment with cost of EUR130,000 placed in service on January 2, 2021. Depreciation in Euros was calculated as follows:

| Life | 5 year | 5 year | 5 year |

| System | US GAAP | GDS | ADS |

| Method | Straight line | 200%DB | Straight Line |

| 2021 Depreciation expense | 26,000 | 52,000 | 26,000 |

1 1/2/2021 Dr (Cr) EUR 20,000 Ref. Activity Dr (Cr) EUR 221,000 1,500,000 2,000,000 (210,000) 8,000 1 15,000 1,000,000 130,000 10 10 (65,000) (26,000) (495,000) (600,000) (140,000) (200,000) (600,000) 2 9 (100,000) 3 4 3 Description 4. Cash 5 Investments 5 Accounts Receivable 7 Bad Debt Reserve 3 Prepaid Expenses Deposits 0 Loans 1 Computer Equip 2 Acummulated Depreciation 3 Accounts Payable 4 Commissions Payable 5 Accrued Vacation 6 Litigation Reserve 7 Current Income Tax Liability 8 Capital 9 Service fee income 0 Salaries -1 Payroll taxes 2 Bonuses 3 Retirement benefits -4 Other benefits 5 Commissions -6 Vacation Expense -7 Recruiting & relocation 8 Depreciation Expense -9 Office expenses 0 Travel Expense 1 Equipment expense 2 Meals & Entertainment 3 Professional fees -4 Legal Expense 5 Litigation Expense -6 Rent expense 7 Fines & Penalties E8 Bad Debt Expense 9 Dividend Income 0 Interest Income =1 Interest Expense 2 Current Income Tax -3 check -4 12/31/2021 Dr (Cr) EUR 241,000 1,500,000 2,000,000 (210,000) 8,000 15,000 1,000,000 130,000 (26,000) (560,000) (600,000) (140,000) (200,000) (600,000) (100,000) (9,000,000) 2,800,000 190,000 40,000 130,000 200,000 1,393,000 200,000 26,000 26,000 21,000 450,000 10,000 260,000 17,000 60,000 200,000 30,000 28,000 210,000 (100,000) (50,000) 1,000 400,000 (9,000,000) 2,800,000 190,000 40,000 130,000 200,000 1,393,000 200,000 26,000 26,000 21,000 450,000 10,000 260,000 17,000 60,000 200,000 30,000 28,000 210,000 (100,000) (50,000) 1,000 400,000 10 5 2 6 0 00 7 8 9 1 1/2/2021 Dr (Cr) EUR 20,000 Ref. Activity Dr (Cr) EUR 221,000 1,500,000 2,000,000 (210,000) 8,000 1 15,000 1,000,000 130,000 10 10 (65,000) (26,000) (495,000) (600,000) (140,000) (200,000) (600,000) 2 9 (100,000) 3 4 3 Description 4. Cash 5 Investments 5 Accounts Receivable 7 Bad Debt Reserve 3 Prepaid Expenses Deposits 0 Loans 1 Computer Equip 2 Acummulated Depreciation 3 Accounts Payable 4 Commissions Payable 5 Accrued Vacation 6 Litigation Reserve 7 Current Income Tax Liability 8 Capital 9 Service fee income 0 Salaries -1 Payroll taxes 2 Bonuses 3 Retirement benefits -4 Other benefits 5 Commissions -6 Vacation Expense -7 Recruiting & relocation 8 Depreciation Expense -9 Office expenses 0 Travel Expense 1 Equipment expense 2 Meals & Entertainment 3 Professional fees -4 Legal Expense 5 Litigation Expense -6 Rent expense 7 Fines & Penalties E8 Bad Debt Expense 9 Dividend Income 0 Interest Income =1 Interest Expense 2 Current Income Tax -3 check -4 12/31/2021 Dr (Cr) EUR 241,000 1,500,000 2,000,000 (210,000) 8,000 15,000 1,000,000 130,000 (26,000) (560,000) (600,000) (140,000) (200,000) (600,000) (100,000) (9,000,000) 2,800,000 190,000 40,000 130,000 200,000 1,393,000 200,000 26,000 26,000 21,000 450,000 10,000 260,000 17,000 60,000 200,000 30,000 28,000 210,000 (100,000) (50,000) 1,000 400,000 (9,000,000) 2,800,000 190,000 40,000 130,000 200,000 1,393,000 200,000 26,000 26,000 21,000 450,000 10,000 260,000 17,000 60,000 200,000 30,000 28,000 210,000 (100,000) (50,000) 1,000 400,000 10 5 2 6 0 00 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started