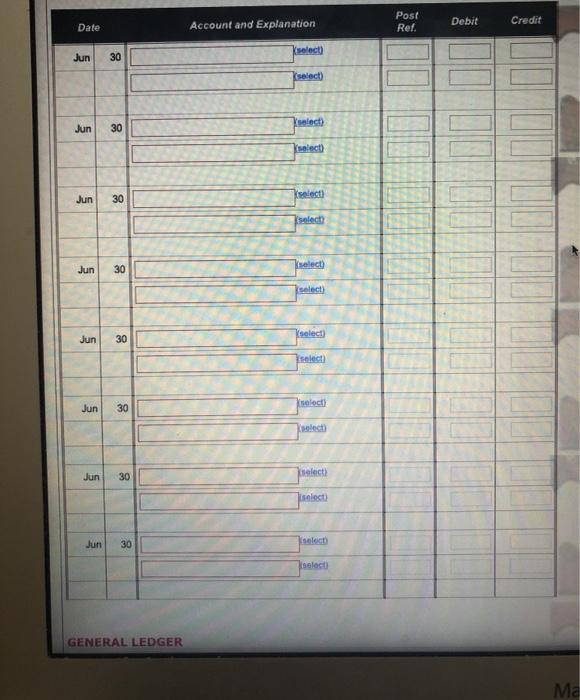

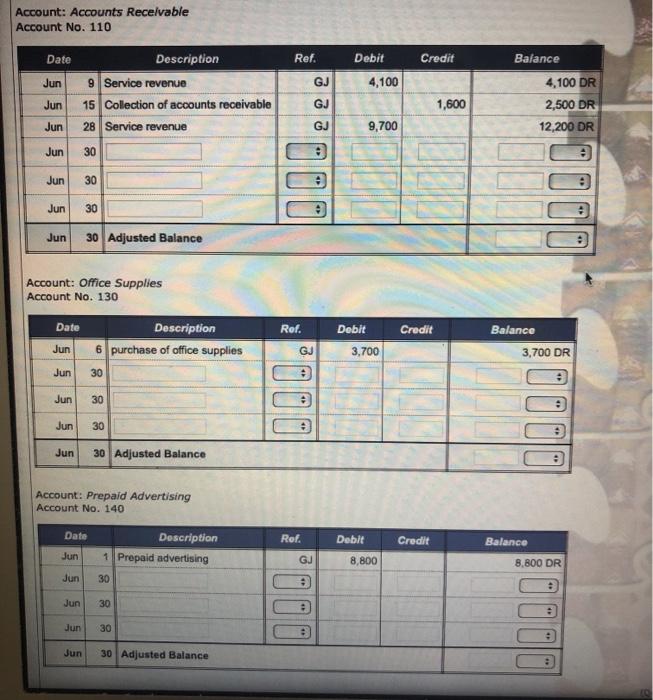

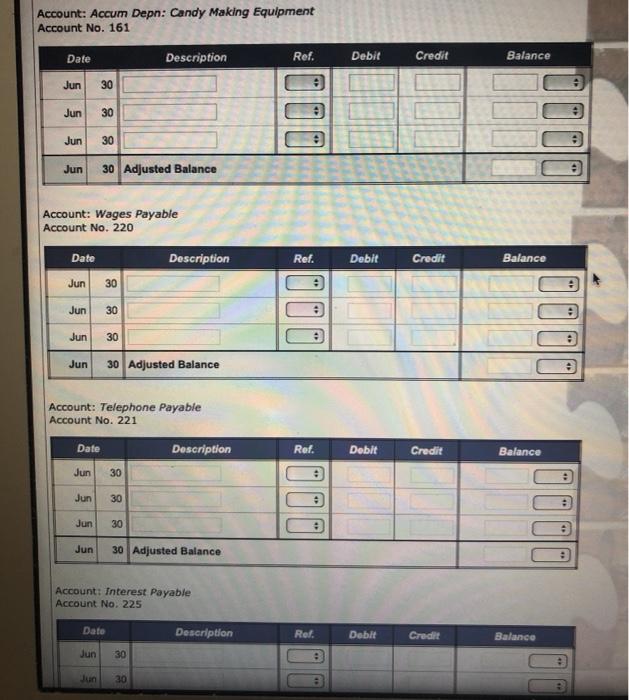

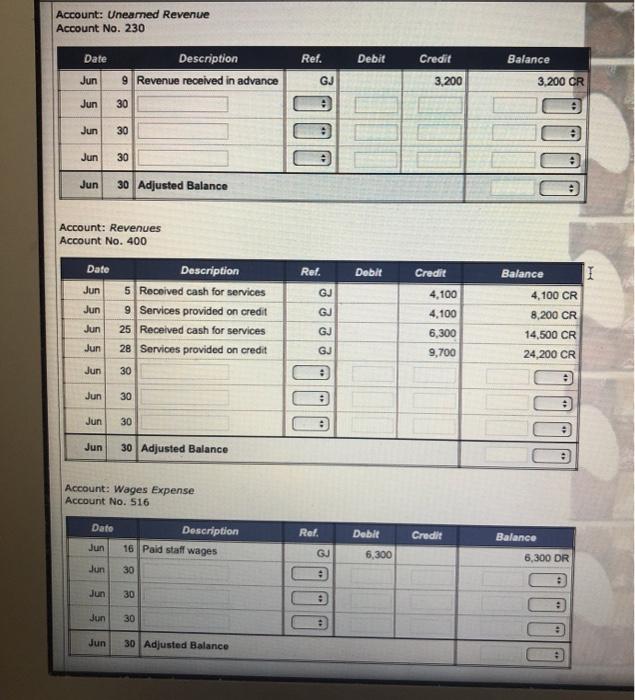

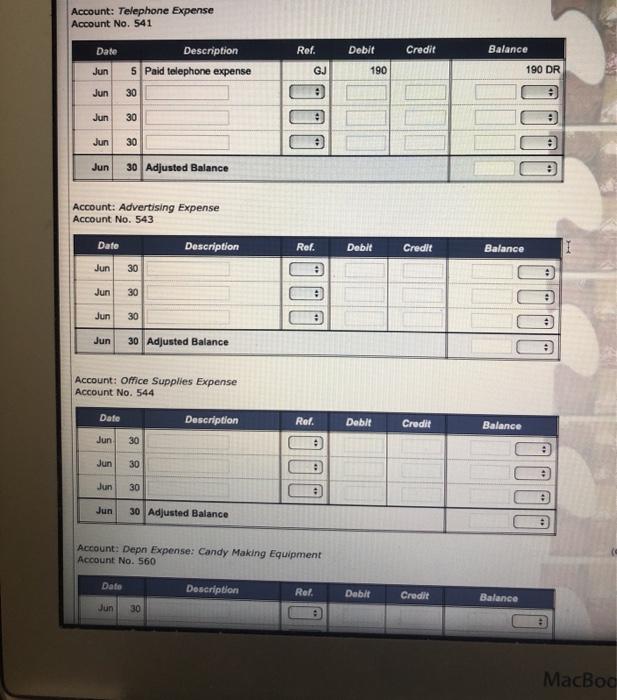

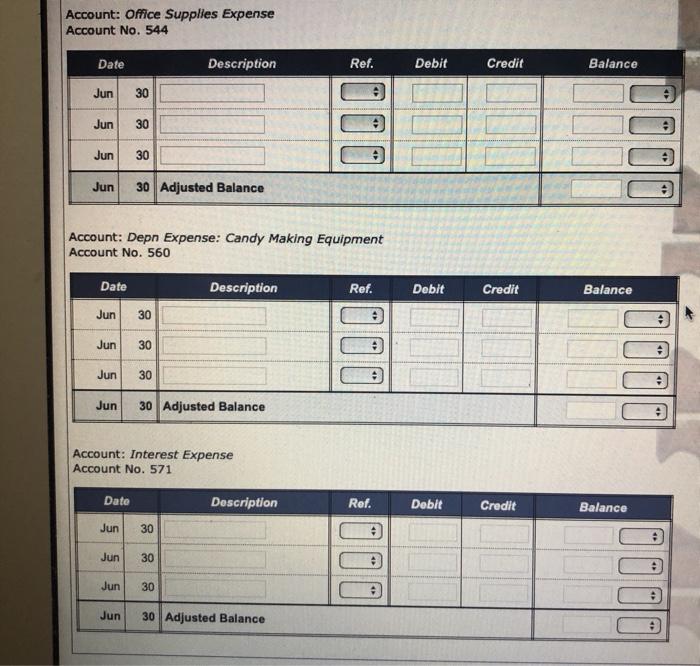

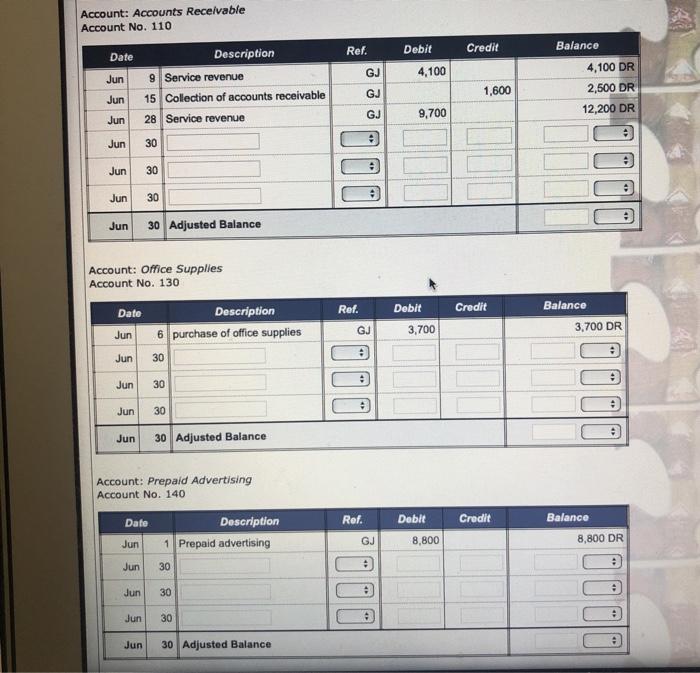

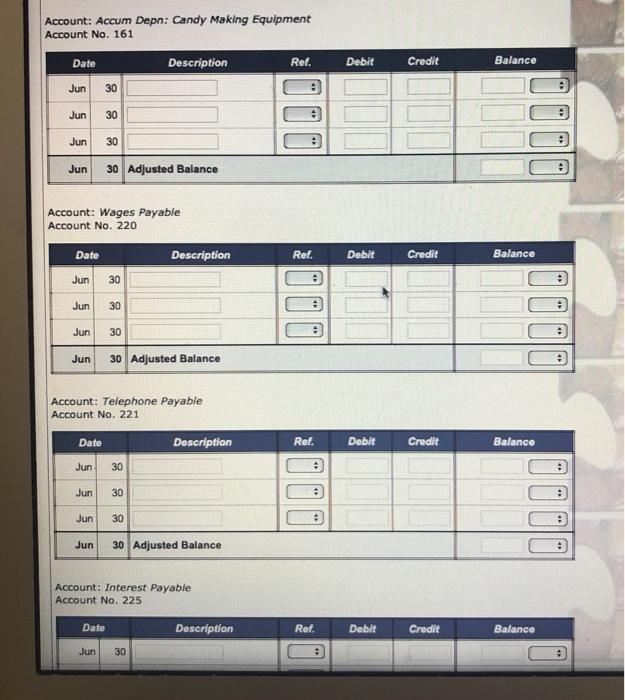

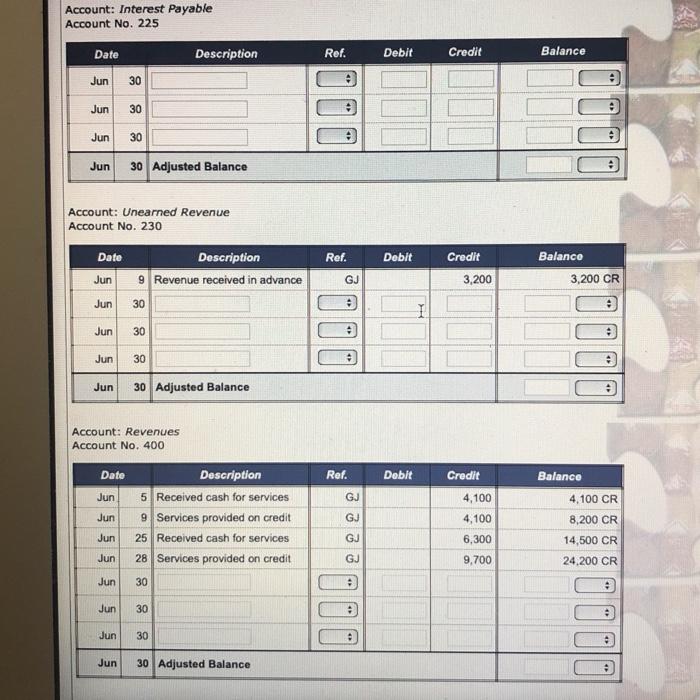

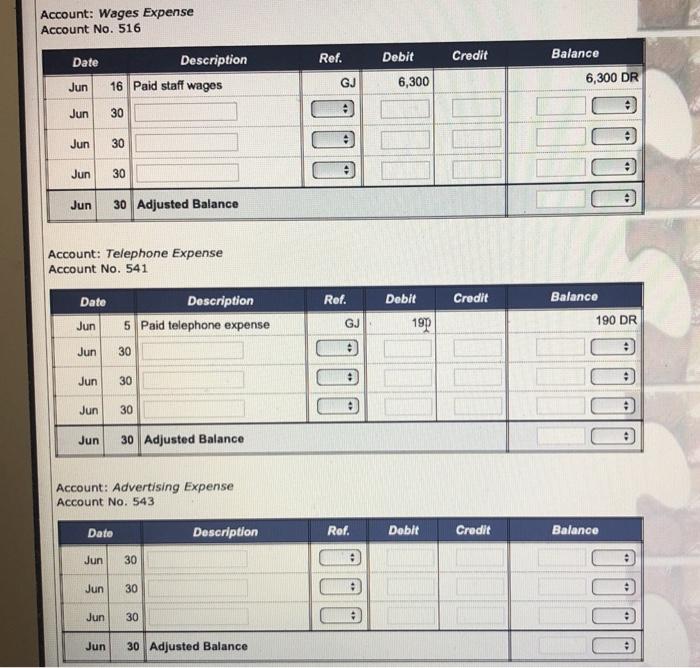

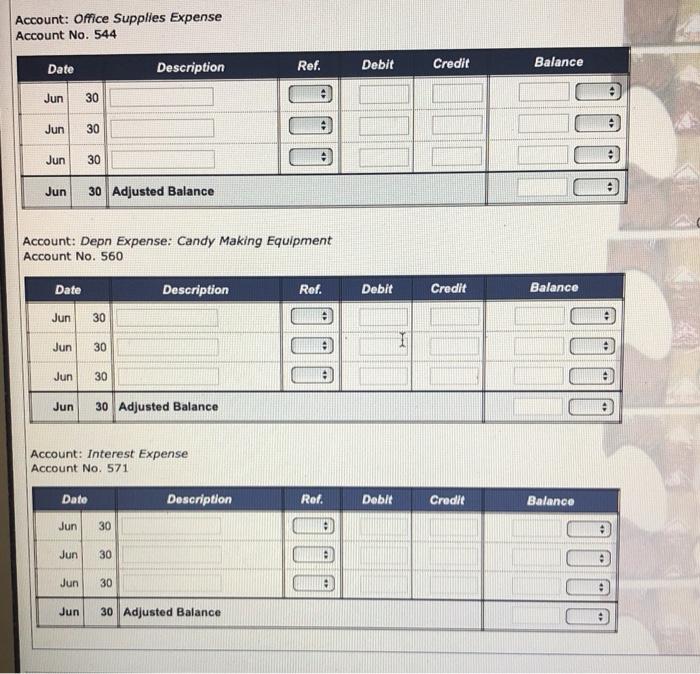

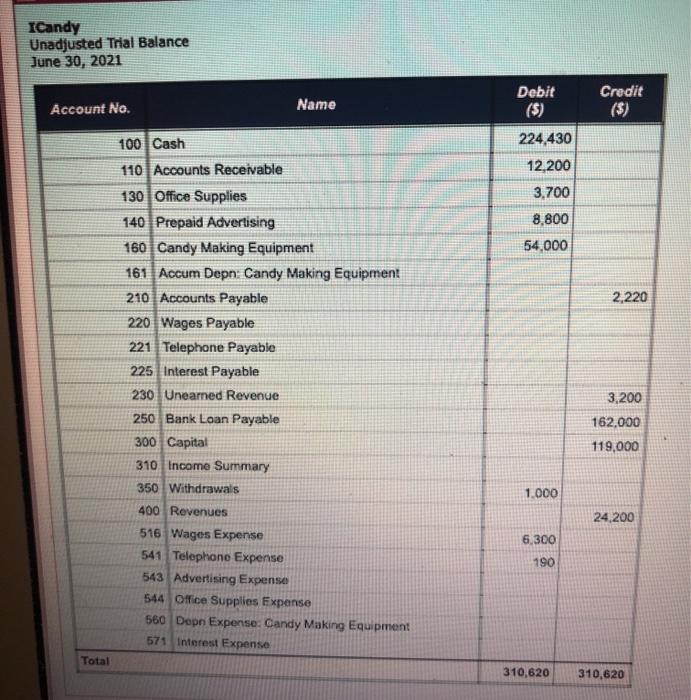

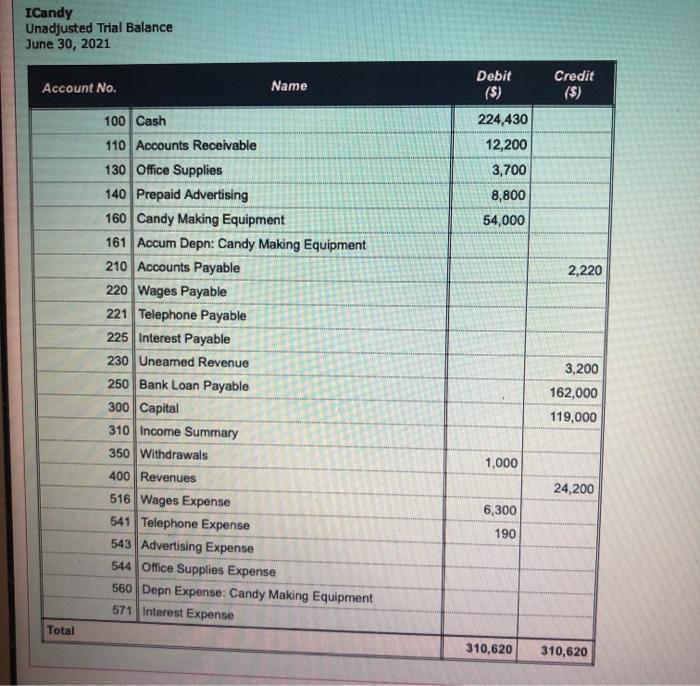

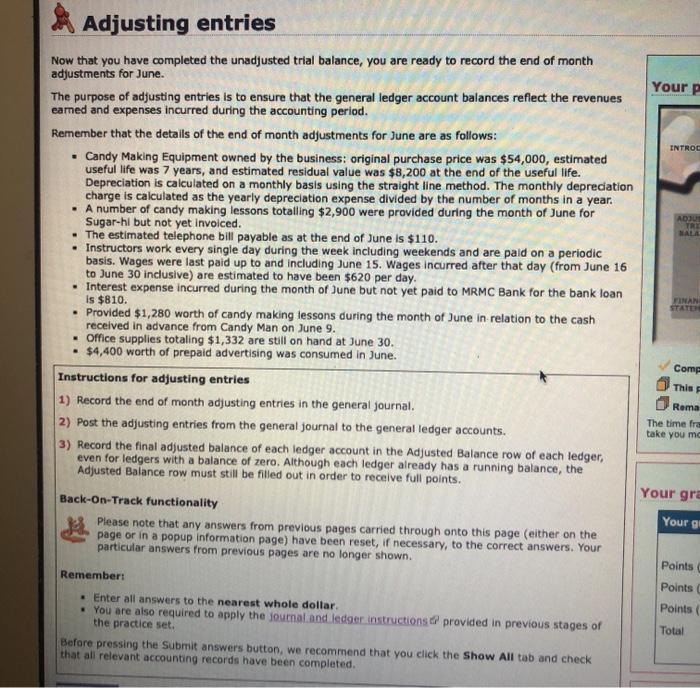

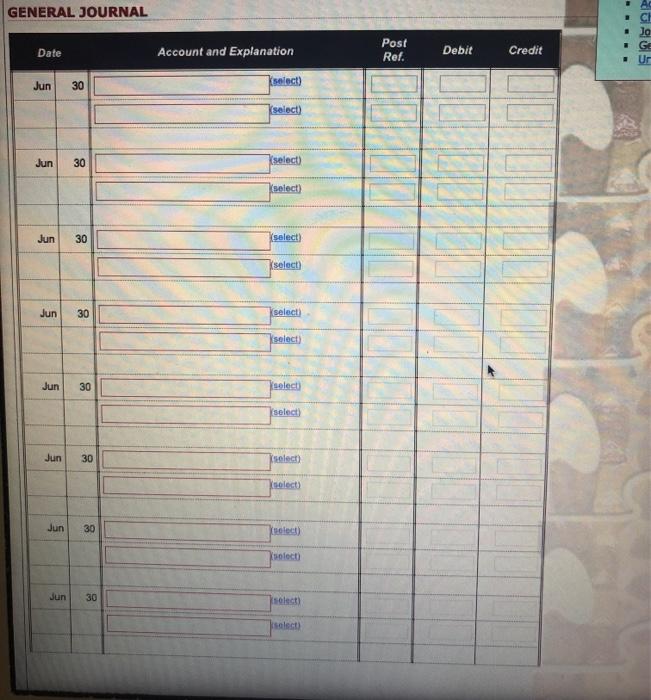

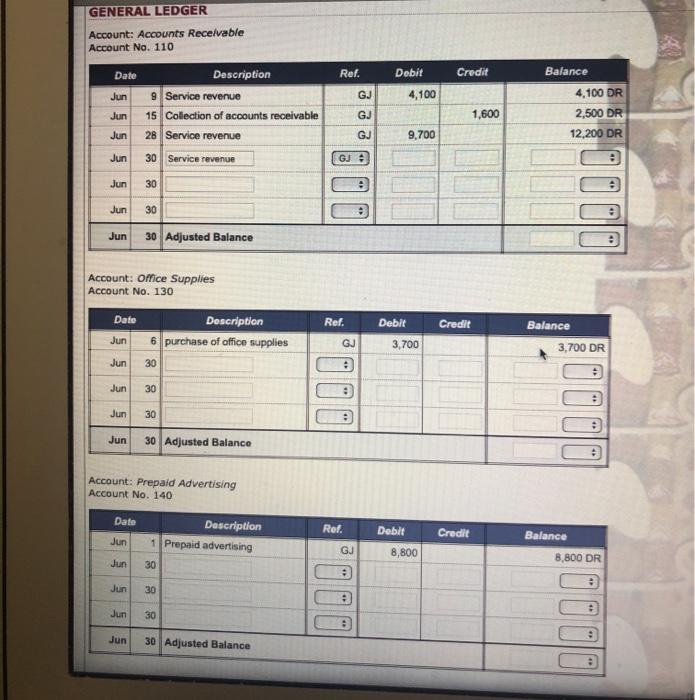

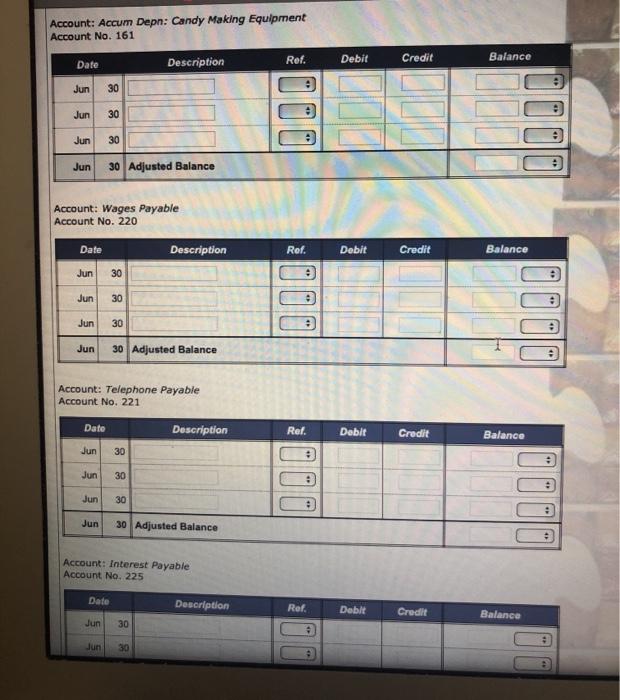

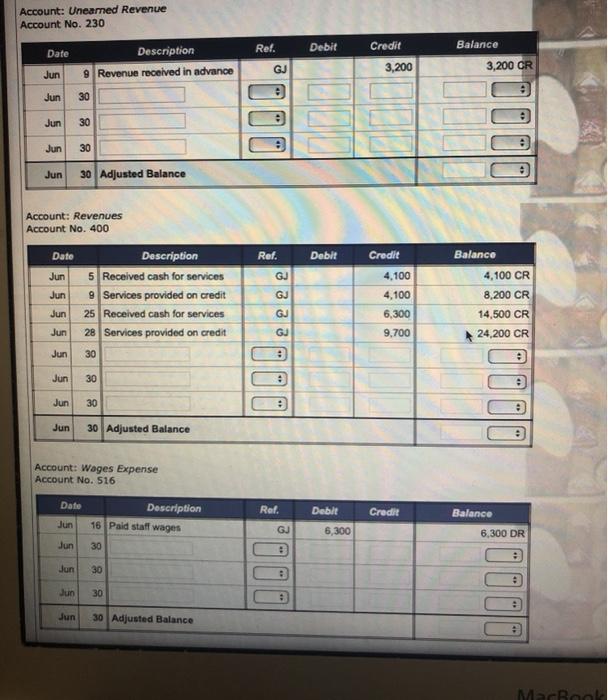

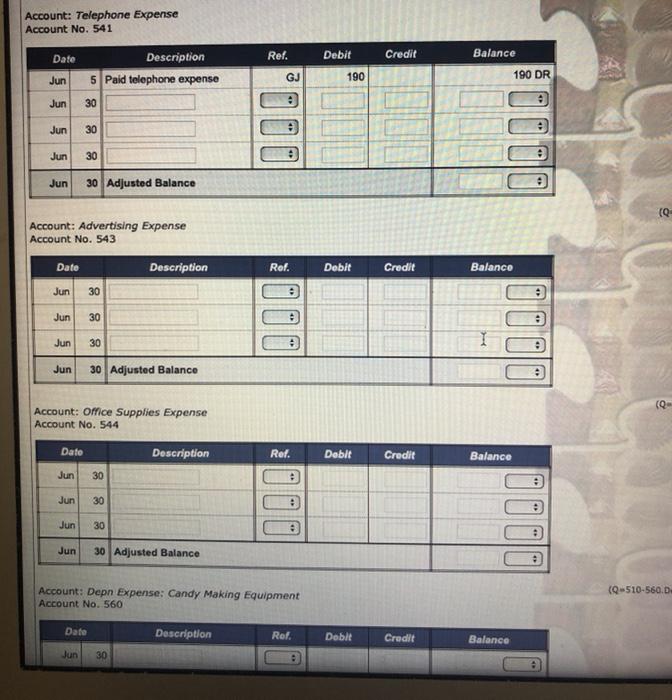

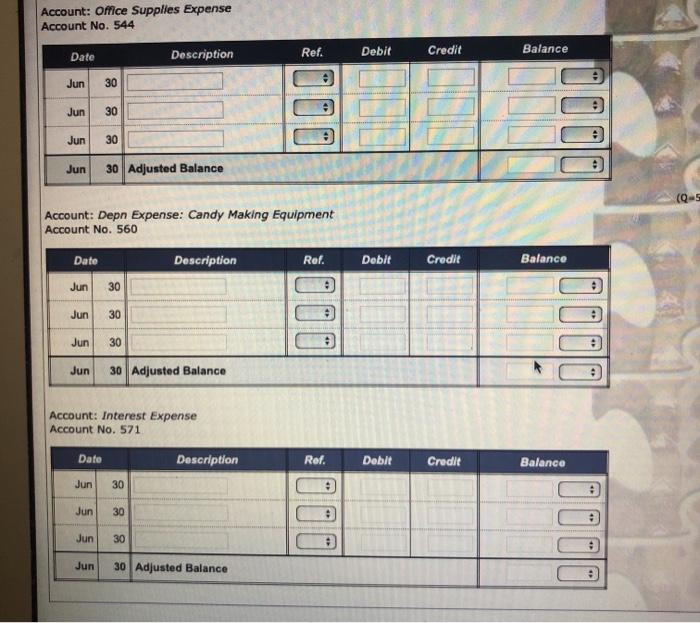

Post Ref. Debit Credit Account and Explanation Date Kselect) Jun 30 select) select) Jun 30 Jun 30 (select Telech Jun 30 select) select select Jun 30 select select Jun 30 Jun 30 Thalect select Jun 30 select GENERAL LEDGER Account: Accounts Receivable Account No. 110 Date Ref. Debit Credit Balance Jun 4,100 Description 9 Service revenue 15 Collection of accounts receivable 28 Service revenue Jun 2 2 2 1,600 4,100 DR 2,500 DR 12,200 DR Jun 9,700 Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Account No. 130 Date Ref. Debit Credit Balance Description 6 purchase of office supplies Jun GJ 3,700 3,700 DR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Prepaid Advertising Account No. 140 Date Ref. Credit Balance Description 1 Prepaid advertising Jun Debit 8,800 GJ 8.800 DR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Accum Depn: Candy Making Equipment Account No. 161 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Telephone Payable Account No. 221 Date Description Ref. Debit Credit Balance Jun 30 2 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 DO Account: Uneamed Revenue Account No. 230 Date Ref. Debit Credit Balance Description 9 Revenue received in advance Jun GJ 3.200 3.200 GR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Ref. Debit Credit Balance Account: Revenues Account No. 400 Date Description Jun 5 Received cash for services Jun 9 Services provided on credit Jun 25 Received cash for services Jun 28 Services provided on credit Jun 30 4,100 4,100 2 2 2 2 4,100 CR 8,200 CR 14,500 CR 24,200 CR 6,300 9,700 . Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Expense Account No. 516 Dato Description Rel. Debit Credit Balance Balance Jun 16 Paid staff wages GJ 6,300 6,300 DR Jun 30 Jun 30 . Jun 30 . Jun 30 Adjusted Balance Account: Telephone Expense Account No. 541 Date Ref. Debit Credit Balance Description 5 Paid telephone expense Jun GJ 190 190 DR Jun 30 Jun 30 " Jun 30 Jun 30 Adjusted Balance Account: Advertising Expense Account No. 543 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Expense Account No. 544 Defe Description Ref. Debit Credit Balance Jun 30 . Jun 30 Jun 30 Jun 30 Adjusted Balance . Account: Depn Expense: Candy Making Equipment Account No. 560 Dato Description Rel. Debit Credit Balance 30 MacBoo Account: Office Supplies Expense Account No. 544 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 0000 Jun 30 Jun 30 Adjusted Balance Account: Interest Expense Account No. 571 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 . Jun 30 Adjusted Balance Account: Accounts Receivable Account No. 110 Ref. Credit Date Debit 4,100 Jun Description 9 Service revenue 15 Collection of accounts receivable 28 Service revenue 2 2 2 Balance 4,100 DR 2,500 DR 12,200 DR 1,600 Jun 9,700 Jun Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Account No. 130 Ref. Date Debit Credit Balance Description 6 purchase of office supplies Jun GJ 3,700 3,700 DR Jun 30 Jun 30 42 Jun 30 Jun 30 Adjusted Balance Account: Prepaid Advertising Account No. 140 Date Description Jun 1 Prepaid advertising Jun 30 Ref. Debit Credit Balance GJ 8,800 8,800 DR Jun 30 OOO . Jun 30 Jun 30 Adjusted Balance Account: Accum Depn: Candy Making Equipment Account No. 161 Date Description Ref. Debit Credit Balance Jun 30 : Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance Account: Telephone Payable Account No. 221 Date Description Ref. Debit Credit Balance Jun 30 . Jun 30 e O O OO Jun 30 Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Unearned Revenue Account No. 230 Date Ref. Debit Credit Balance Description 9 Revenue received in advance Jun GJ 3,200 3,200 CR Jun 30 I Jun 30 . Jun 30 Jun 30 Adjusted Balance Account: Revenues Account No. 400 Date Ref. Dobit Credit Balance Jun GJ 4,100 Jun 4,100 Description 5 Received cash for services 9 Services provided on credit 25 Received cash for services 28 Services provided on credit 30 GJ GJ 4,100 CR 8,200 CR 14,500 CR 24,200 CR Jun 6,300 9,700 Jun GJ Jun Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Expense Account No. 516 Date Description Ref. Debit Credit Balance Jun GJ 6,300 DR 16 Paid staff wages 6,300 Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Telephone Expense Account No. 541 Date Ref. Debit Credit Balance Description 5 Paid telephone expense Jun GJ 190 190 DR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Advertising Expense Account No. 543 Date Description Rof. Dobit Credit Balance Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Expense Account No. 544 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Interest Expense Account No. 571 Dato Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance I Candy Unadjusted Trial Balance June 30, 2021 Credit Account No. Name Debit ($) 224,430 12,200 3,700 8,800 54,000 2,220 100 Cash 110 Accounts Receivable 130 Office Supplies 140 Prepaid Advertising 160 Candy Making Equipment 161 Accum Depn: Candy Making Equipment 210 Accounts Payable 220 Wages Payable 221 Telephone Payable 225 Interest Payable 230 Unearned Revenue 250 Bank Loan Payable 300 Capital 310 Income Summary 350 Withdrawals 400 Revenues 516 Wages Expense 541 Telephone Expense 543 Advertising Expense 544 Office Supplies Expense 560 Depr Expense: Candy Making Equipment 571 Interest Expense Total 3,200 162,000 119,000 1.000 24,200 6,300 190 310,620 310,620 ICandy Unadjusted Trial Balance June 30, 2021 Account No. Name Credit ($) Debit ($) 224,430 12,200 3,700 8,800 54,000 2,220 100 Cash 110 Accounts Receivable 130 Office Supplies 140 Prepaid Advertising 160 Candy Making Equipment 161 Accum Depn: Candy Making Equipment 210 Accounts Payable 220 Wages Payable 221 Telephone Payable 225 Interest Payable 230 Uneamed Revenue 250 Bank Loan Payable 300 Capital 310 Income Summary 350 Withdrawals 400 Revenues 516 Wages Expense 541 Telephone Expense 543 Advertising Expense 544 Office Supplies Expense 560 Depn Expense: Candy Making Equipment 571 Interest Expense 3,200 162,000 119,000 1,000 24,200 6,300 190 Total 310,620 310,620 Adjusting entries Your p INTROC ADJU TRE MALA FINAN Now that you have completed the unadjusted trial balance, you are ready to record the end of month adjustments for June. The purpose of adjusting entries is to ensure that the general ledger account balances reflect the revenues eamed and expenses incurred during the accounting period. Remember that the details of the end of month adjustments for June are as follows: Candy Making Equipment owned by the business: original purchase price was $54,000, estimated useful life was 7 years, and estimated residual value was $8,200 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. A number of candy making lessons totalling $2,900 were provided during the month of June for Sugar-hi but not yet invoiced. The estimated telephone bill payable as at the end of June is $110. . Instructors work every single day during the week including weekends and are paid on a periodic basis. Wages were last paid up to and including June 15. Wages incurred after that day (from June 16 to June 30 inclusive) are estimated to have been $620 per day. Interest expense incurred during the month of June but not yet paid to MRMC Bank for the bank loan is $810. Provided $1,280 worth of candy making lessons during the month of June in relation to the cash received in advance from Candy Man on June 9. Office supplies totaling $1,332 are still on hand at June 30. $4,400 worth of prepaid advertising was consumed in June. Instructions for adjusting entries 1) Record the end of month adjusting entries in the general journal. 2) Post the adjusting entries from the general journal to the general ledger accounts. 3) Record the final adjusted balance of each ledger account in the Adjusted Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Adjusted Balance row must still be filled out in order to receive full points. Back-On-Track functionality page or in a popup information page) have been reset, if necessary, to the correct answers. Your ( particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. You are also required to apply the journal and ledger instructions provided in previous stages of the practice set. Com This Roma The time fra take you mc Your gra Yourg Points Points Points Total Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. GENERAL JOURNAL .C Jo GE Ur Date Post Ref. Account and Explanation Debit Credit . Jun 30 select) select) Jun 30 select select) Jun 30 select) (select) Jun 30 select) select) Jun 30 select (select Jun 30 (select) telect Jun 30 (select) select Jun 30 GENERAL LEDGER Account: Accounts Receivable Account No. 110 Date Ref. Credit Balance Debit 4,100 Jun GJ Description 9 Service revenue 15 Collection of accounts receivable 28 Service revenue GJ 1,600 Jun Jun 4,100 DR 2,500 DR 12,200 DR GJ 9,700 Jun 30 Service revenue GJ Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Account No. 130 Date Ref. Debit Credit Credit Description 6 purchase of office supplies Balance Jun GJ 3,700 3,700 DR Jun 30 Jun 30 C Jun 30 Jun 30 Adjusted Balance 0 0 Account: Prepaid Advertising Account No. 140 Date Ref. Debit Credit Balance Jun Description 1 Prepaid advertising 30 GJ 8,800 Jun 8,800 DR Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Accum Depn: Candy Making Equipment Account No. 161 Description Ref. Debit Credit Date Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Credit Balance Jun 30 O Jun 30 Jun 30 . Jun 30 Adjusted Balance Account: Telephone Payable Account No. 221 Date Description Ref. Debit Credit Balance Jun 30 2. Jun 30 . Jun 30 3 Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 . Jun 30 OD Account: Uneamed Revenue Account No. 230 Date Ref. Credit Description Debit Balance GJ 3,200 3,200 GR Jun 9 Revenue received in advance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Revenues Account No. 400 Date Ref. Debit Credit Balance Jun 4,100 Jun Description 5 Received cash for services 9 Services provided on credit 25 Received cash for services 28 Services provided on credit 30 2 2 2 2 4,100 CR 8,200 CR 14,500 CR 24,200 CR 4,100 6,300 9,700 Jun Jun Jun : e Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Expense Account No. 516 Date Description 16 Paid staff wages Ref. Debit Credit Balance Jun GJ 6,300 6,300 DR Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance OD Macron Account: Telephone Expense Account No. 541 Date Ref. Debit Balance Credit Description 5 Paid telephone expense Jun GJ 190 190 DR Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance (Q Account: Advertising Expense Account No. 543 Date Description Ref. Debit Credit Credit Balance Jun 30 . Jun 30 0 0 Jun 30 Jun 30 Adjusted Balance (Q- Account: Office Supplies Expense Account No. 544 Date Description Ref. Dobit Credit Balance Jun 30 + . Jun 30 Jun 30 Jun 30 Adjusted Balance (Q-510-560.0 Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Deble Credit Balance Jun 30 Account: Office Supplies Expense Account No. 544 Description Date Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Dobit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Interest Expense Account No. 571 Date Description Ref. Debit Credit Credit Balance Jun 30 . Jun 30 : Jun 30 Jun 30 Adjusted Balance Post Ref. Debit Credit Account and Explanation Date Kselect) Jun 30 select) select) Jun 30 Jun 30 (select Telech Jun 30 select) select select Jun 30 select select Jun 30 Jun 30 Thalect select Jun 30 select GENERAL LEDGER Account: Accounts Receivable Account No. 110 Date Ref. Debit Credit Balance Jun 4,100 Description 9 Service revenue 15 Collection of accounts receivable 28 Service revenue Jun 2 2 2 1,600 4,100 DR 2,500 DR 12,200 DR Jun 9,700 Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Account No. 130 Date Ref. Debit Credit Balance Description 6 purchase of office supplies Jun GJ 3,700 3,700 DR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Prepaid Advertising Account No. 140 Date Ref. Credit Balance Description 1 Prepaid advertising Jun Debit 8,800 GJ 8.800 DR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Accum Depn: Candy Making Equipment Account No. 161 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Telephone Payable Account No. 221 Date Description Ref. Debit Credit Balance Jun 30 2 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 DO Account: Uneamed Revenue Account No. 230 Date Ref. Debit Credit Balance Description 9 Revenue received in advance Jun GJ 3.200 3.200 GR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Ref. Debit Credit Balance Account: Revenues Account No. 400 Date Description Jun 5 Received cash for services Jun 9 Services provided on credit Jun 25 Received cash for services Jun 28 Services provided on credit Jun 30 4,100 4,100 2 2 2 2 4,100 CR 8,200 CR 14,500 CR 24,200 CR 6,300 9,700 . Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Expense Account No. 516 Dato Description Rel. Debit Credit Balance Balance Jun 16 Paid staff wages GJ 6,300 6,300 DR Jun 30 Jun 30 . Jun 30 . Jun 30 Adjusted Balance Account: Telephone Expense Account No. 541 Date Ref. Debit Credit Balance Description 5 Paid telephone expense Jun GJ 190 190 DR Jun 30 Jun 30 " Jun 30 Jun 30 Adjusted Balance Account: Advertising Expense Account No. 543 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Expense Account No. 544 Defe Description Ref. Debit Credit Balance Jun 30 . Jun 30 Jun 30 Jun 30 Adjusted Balance . Account: Depn Expense: Candy Making Equipment Account No. 560 Dato Description Rel. Debit Credit Balance 30 MacBoo Account: Office Supplies Expense Account No. 544 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 0000 Jun 30 Jun 30 Adjusted Balance Account: Interest Expense Account No. 571 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 . Jun 30 Adjusted Balance Account: Accounts Receivable Account No. 110 Ref. Credit Date Debit 4,100 Jun Description 9 Service revenue 15 Collection of accounts receivable 28 Service revenue 2 2 2 Balance 4,100 DR 2,500 DR 12,200 DR 1,600 Jun 9,700 Jun Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Account No. 130 Ref. Date Debit Credit Balance Description 6 purchase of office supplies Jun GJ 3,700 3,700 DR Jun 30 Jun 30 42 Jun 30 Jun 30 Adjusted Balance Account: Prepaid Advertising Account No. 140 Date Description Jun 1 Prepaid advertising Jun 30 Ref. Debit Credit Balance GJ 8,800 8,800 DR Jun 30 OOO . Jun 30 Jun 30 Adjusted Balance Account: Accum Depn: Candy Making Equipment Account No. 161 Date Description Ref. Debit Credit Balance Jun 30 : Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance Account: Telephone Payable Account No. 221 Date Description Ref. Debit Credit Balance Jun 30 . Jun 30 e O O OO Jun 30 Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Unearned Revenue Account No. 230 Date Ref. Debit Credit Balance Description 9 Revenue received in advance Jun GJ 3,200 3,200 CR Jun 30 I Jun 30 . Jun 30 Jun 30 Adjusted Balance Account: Revenues Account No. 400 Date Ref. Dobit Credit Balance Jun GJ 4,100 Jun 4,100 Description 5 Received cash for services 9 Services provided on credit 25 Received cash for services 28 Services provided on credit 30 GJ GJ 4,100 CR 8,200 CR 14,500 CR 24,200 CR Jun 6,300 9,700 Jun GJ Jun Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Expense Account No. 516 Date Description Ref. Debit Credit Balance Jun GJ 6,300 DR 16 Paid staff wages 6,300 Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Telephone Expense Account No. 541 Date Ref. Debit Credit Balance Description 5 Paid telephone expense Jun GJ 190 190 DR Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Advertising Expense Account No. 543 Date Description Rof. Dobit Credit Balance Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Expense Account No. 544 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Interest Expense Account No. 571 Dato Description Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance I Candy Unadjusted Trial Balance June 30, 2021 Credit Account No. Name Debit ($) 224,430 12,200 3,700 8,800 54,000 2,220 100 Cash 110 Accounts Receivable 130 Office Supplies 140 Prepaid Advertising 160 Candy Making Equipment 161 Accum Depn: Candy Making Equipment 210 Accounts Payable 220 Wages Payable 221 Telephone Payable 225 Interest Payable 230 Unearned Revenue 250 Bank Loan Payable 300 Capital 310 Income Summary 350 Withdrawals 400 Revenues 516 Wages Expense 541 Telephone Expense 543 Advertising Expense 544 Office Supplies Expense 560 Depr Expense: Candy Making Equipment 571 Interest Expense Total 3,200 162,000 119,000 1.000 24,200 6,300 190 310,620 310,620 ICandy Unadjusted Trial Balance June 30, 2021 Account No. Name Credit ($) Debit ($) 224,430 12,200 3,700 8,800 54,000 2,220 100 Cash 110 Accounts Receivable 130 Office Supplies 140 Prepaid Advertising 160 Candy Making Equipment 161 Accum Depn: Candy Making Equipment 210 Accounts Payable 220 Wages Payable 221 Telephone Payable 225 Interest Payable 230 Uneamed Revenue 250 Bank Loan Payable 300 Capital 310 Income Summary 350 Withdrawals 400 Revenues 516 Wages Expense 541 Telephone Expense 543 Advertising Expense 544 Office Supplies Expense 560 Depn Expense: Candy Making Equipment 571 Interest Expense 3,200 162,000 119,000 1,000 24,200 6,300 190 Total 310,620 310,620 Adjusting entries Your p INTROC ADJU TRE MALA FINAN Now that you have completed the unadjusted trial balance, you are ready to record the end of month adjustments for June. The purpose of adjusting entries is to ensure that the general ledger account balances reflect the revenues eamed and expenses incurred during the accounting period. Remember that the details of the end of month adjustments for June are as follows: Candy Making Equipment owned by the business: original purchase price was $54,000, estimated useful life was 7 years, and estimated residual value was $8,200 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. A number of candy making lessons totalling $2,900 were provided during the month of June for Sugar-hi but not yet invoiced. The estimated telephone bill payable as at the end of June is $110. . Instructors work every single day during the week including weekends and are paid on a periodic basis. Wages were last paid up to and including June 15. Wages incurred after that day (from June 16 to June 30 inclusive) are estimated to have been $620 per day. Interest expense incurred during the month of June but not yet paid to MRMC Bank for the bank loan is $810. Provided $1,280 worth of candy making lessons during the month of June in relation to the cash received in advance from Candy Man on June 9. Office supplies totaling $1,332 are still on hand at June 30. $4,400 worth of prepaid advertising was consumed in June. Instructions for adjusting entries 1) Record the end of month adjusting entries in the general journal. 2) Post the adjusting entries from the general journal to the general ledger accounts. 3) Record the final adjusted balance of each ledger account in the Adjusted Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Adjusted Balance row must still be filled out in order to receive full points. Back-On-Track functionality page or in a popup information page) have been reset, if necessary, to the correct answers. Your ( particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. You are also required to apply the journal and ledger instructions provided in previous stages of the practice set. Com This Roma The time fra take you mc Your gra Yourg Points Points Points Total Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. GENERAL JOURNAL .C Jo GE Ur Date Post Ref. Account and Explanation Debit Credit . Jun 30 select) select) Jun 30 select select) Jun 30 select) (select) Jun 30 select) select) Jun 30 select (select Jun 30 (select) telect Jun 30 (select) select Jun 30 GENERAL LEDGER Account: Accounts Receivable Account No. 110 Date Ref. Credit Balance Debit 4,100 Jun GJ Description 9 Service revenue 15 Collection of accounts receivable 28 Service revenue GJ 1,600 Jun Jun 4,100 DR 2,500 DR 12,200 DR GJ 9,700 Jun 30 Service revenue GJ Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Office Supplies Account No. 130 Date Ref. Debit Credit Credit Description 6 purchase of office supplies Balance Jun GJ 3,700 3,700 DR Jun 30 Jun 30 C Jun 30 Jun 30 Adjusted Balance 0 0 Account: Prepaid Advertising Account No. 140 Date Ref. Debit Credit Balance Jun Description 1 Prepaid advertising 30 GJ 8,800 Jun 8,800 DR Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Accum Depn: Candy Making Equipment Account No. 161 Description Ref. Debit Credit Date Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Credit Balance Jun 30 O Jun 30 Jun 30 . Jun 30 Adjusted Balance Account: Telephone Payable Account No. 221 Date Description Ref. Debit Credit Balance Jun 30 2. Jun 30 . Jun 30 3 Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date Description Ref. Debit Credit Balance Jun 30 . Jun 30 OD Account: Uneamed Revenue Account No. 230 Date Ref. Credit Description Debit Balance GJ 3,200 3,200 GR Jun 9 Revenue received in advance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Revenues Account No. 400 Date Ref. Debit Credit Balance Jun 4,100 Jun Description 5 Received cash for services 9 Services provided on credit 25 Received cash for services 28 Services provided on credit 30 2 2 2 2 4,100 CR 8,200 CR 14,500 CR 24,200 CR 4,100 6,300 9,700 Jun Jun Jun : e Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Wages Expense Account No. 516 Date Description 16 Paid staff wages Ref. Debit Credit Balance Jun GJ 6,300 6,300 DR Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance OD Macron Account: Telephone Expense Account No. 541 Date Ref. Debit Balance Credit Description 5 Paid telephone expense Jun GJ 190 190 DR Jun 30 Jun 30 . Jun 30 Jun 30 Adjusted Balance (Q Account: Advertising Expense Account No. 543 Date Description Ref. Debit Credit Credit Balance Jun 30 . Jun 30 0 0 Jun 30 Jun 30 Adjusted Balance (Q- Account: Office Supplies Expense Account No. 544 Date Description Ref. Dobit Credit Balance Jun 30 + . Jun 30 Jun 30 Jun 30 Adjusted Balance (Q-510-560.0 Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Deble Credit Balance Jun 30 Account: Office Supplies Expense Account No. 544 Description Date Ref. Debit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Depn Expense: Candy Making Equipment Account No. 560 Date Description Ref. Dobit Credit Balance Jun 30 Jun 30 Jun 30 Jun 30 Adjusted Balance Account: Interest Expense Account No. 571 Date Description Ref. Debit Credit Credit Balance Jun 30 . Jun 30 : Jun 30 Jun 30 Adjusted Balance