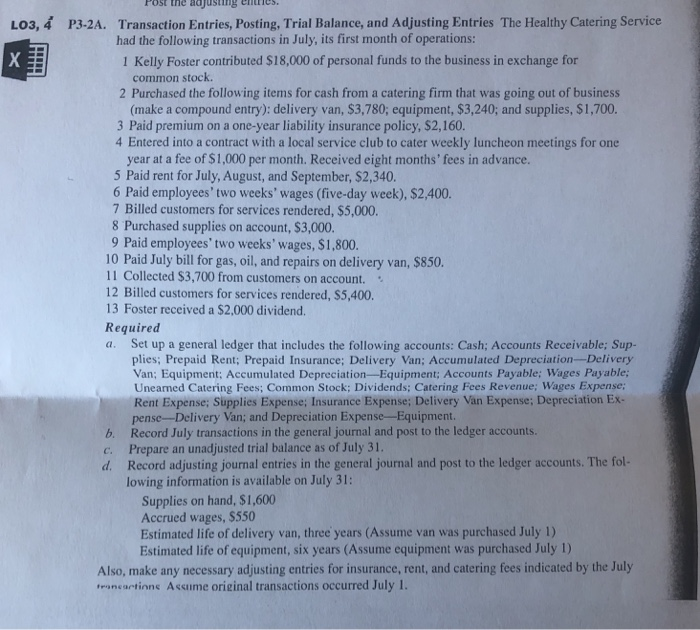

Post the ajusting entrie LO3, 4 P3-2A. Transaction Entries, Posting, Trial Balance, and Adjusting Entries The Healthy Catering Service had the following transactions in July, its first month of operations 1 Kelly Foster contributed $18,000 of personal funds to the business in exchange for common stock 2 Purchased the following items for cash from a catering firm that was going out of business (make a compound entry): delivery van, $3,780; equipment, $3,240; and supplies, $1,700. 3 Paid premium on a one-year liability insurance policy, $2,160. 4 Entered into a contract with a local service club to cater weekly luncheon meetings for one year at a fee of $1,000 per month. Received eight months' fees in advance. 5 Paid rent for July, August, and September, $2,340. 6 Paid employees' two weeks' wages (five-day week), $2,400. 7 Billed customers for services rendered, $5,000. 8 Purchased supplies on account, $3,000. 9 Paid employees' two weeks' wages, S1,800. 10 Paid July bill for gas, oil, and repairs on delivery van, $850. 11 Collected $3,700 from customers on account. 12 Billed customers for services rendered, S5,400 13 Foster received a $2,000 dividend. Required Set up a general ledger that includes the following accounts: Cash; Accounts Receivable; Sup plies; Prepaid Rent; Prepaid Insurance; Delivery Van; Accumulated Depreciation-Delivery Van; Equipment: Accumulated Depreciation-Equipment; Accounts Payable; Wages Payable Unearned Catering Fees; Common Stock; Dividends; Catering Fees Revenue; Wages Expense Rent Expense; Supplies Expense: Insurance Expense; Delivery Van Expense; Depreciation Ex pense-Delivery Van; and Depreciation Expense-Equipment Record July transactions in the general journal and post to the ledger accounts Prepare an unadjusted trial balance as o uly 31 Record adjusting journal entries in the general journal and post to the ledger accounts. The lowing information is available on July 31: a. b. c. d. Supplies on hand, $1,600 Accrued wages, $550 Estimated life of delivery van, three years (Assume van was purchased July 1) Estimated life of equipment, six years (Assume equipment was purchased July 1) Also, make any necessary adjusting entries for insurance, rent, and catering fees indicated by the July traneactinns Assume original transactions occurred July 1