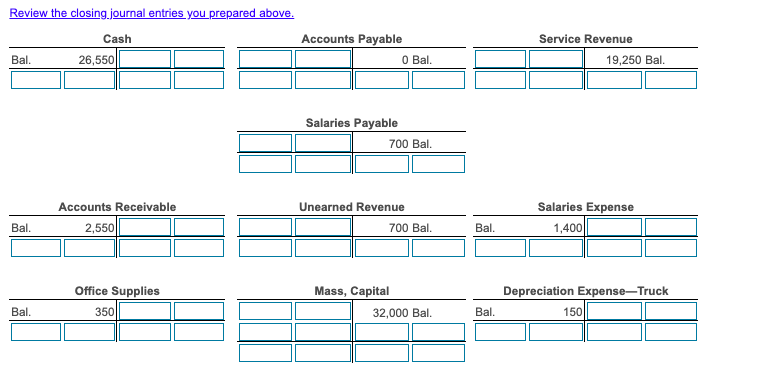

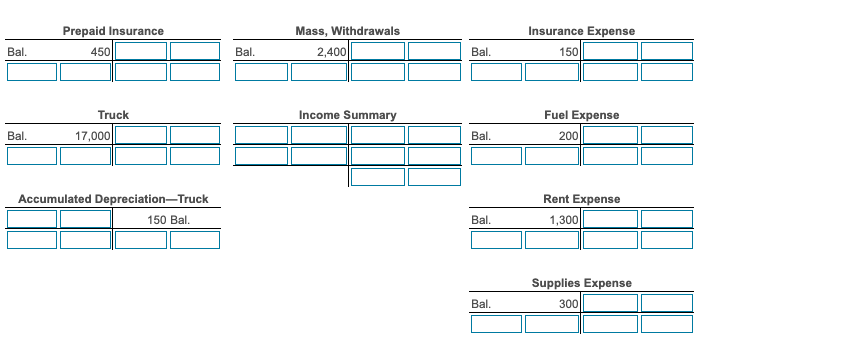

Post the closing entries to the T-accounts. Use Clos. and the corresponding number as shown in the journal entry as posting referenceslong dashClos.(1), Clos.(2), etc.

Post the closing entries to the T-accounts. Use "Clos." and the corresponding number as shown in the journal entry as posting

referenceslong dash"Clos.(1)",

"Clos.(2)", etc. The adjusted balance of each account has been entered for you. Post any closing entries to the accounts and then calculate the post-closing balance ("Bal.") of each account (including those that were not closed). For any accounts with a zero balance after closing, enter a "0" on the normal side of the account. For Income Summary, calculate and enter the balance ("Bal.") before posting the entry to close out the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing (the second line) and then show the post-closing balance ("Bal.") on the last (third) line of the account.

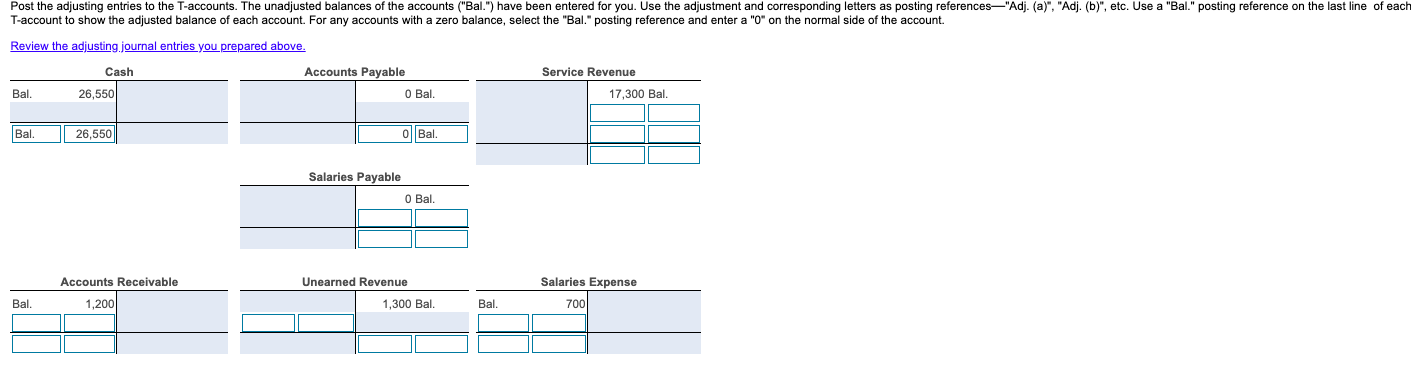

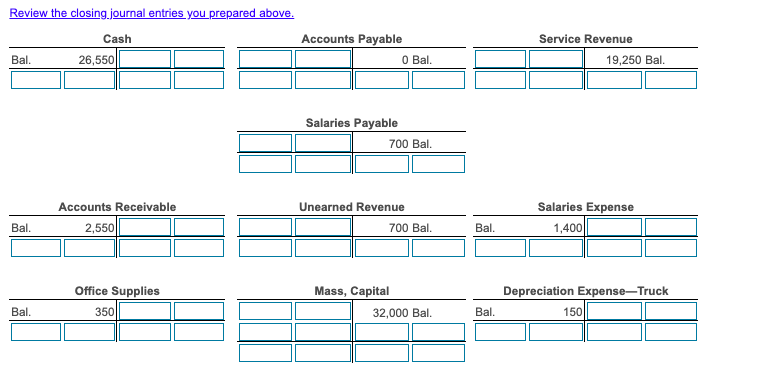

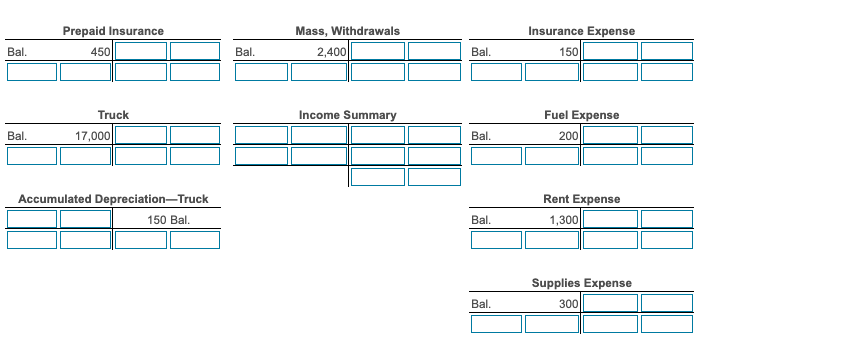

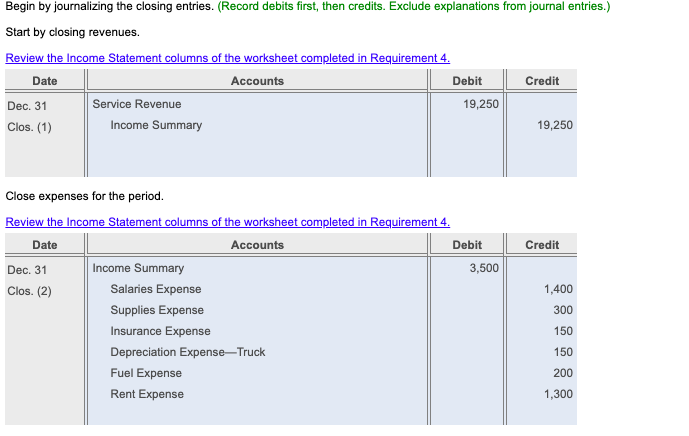

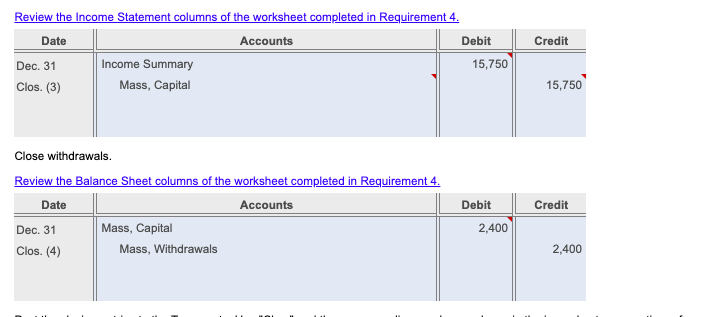

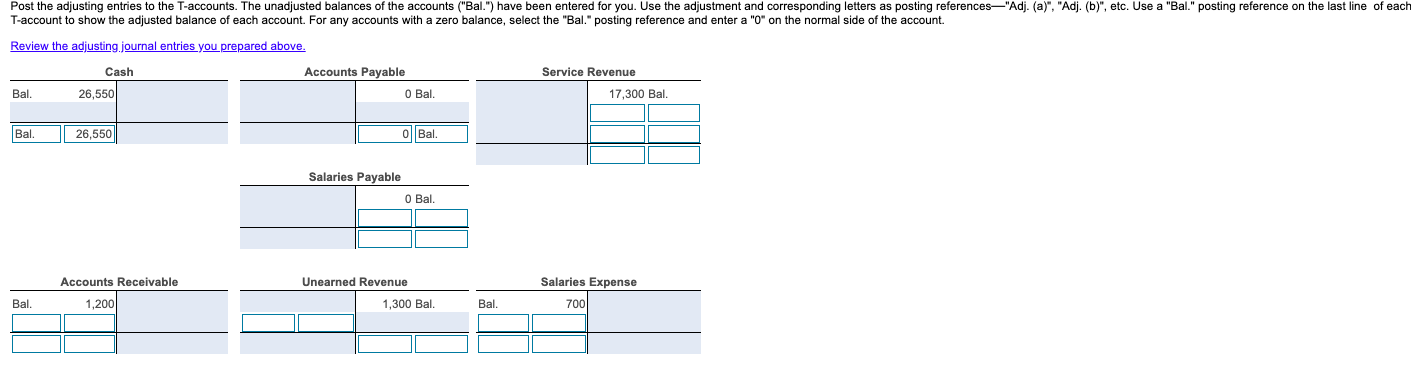

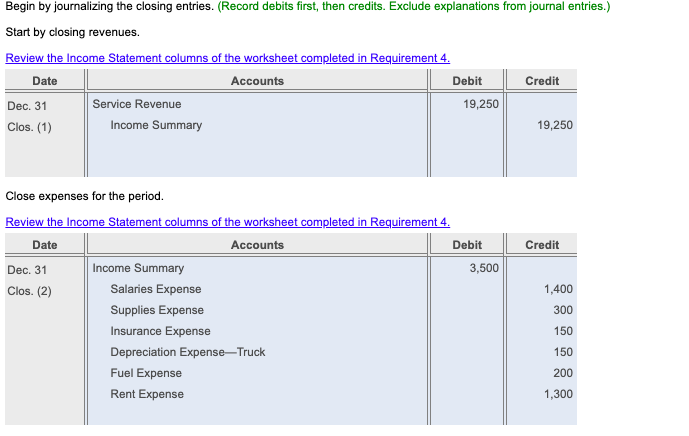

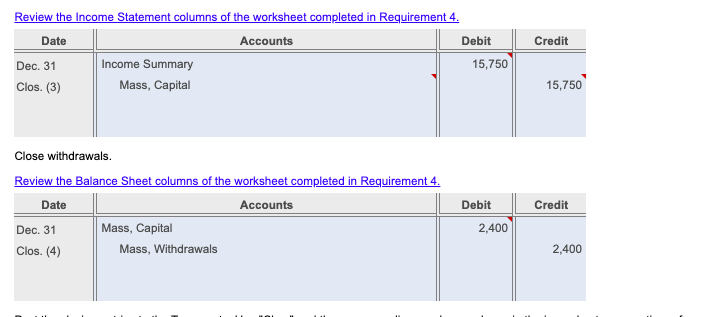

Post the adjusting entries to the T-accounts. The unadjusted balances of the accounts ("Bal.") have been entered for you. Use the adjustment and corresponding letters as posting references-"Adj. (a)", "Adj. (b)", etc. Use a "Bal." posting reference on the last line of each T-account to show the adjusted balance of each account. For any accounts with a zero balance, select the "Bal." posting reference and enter a "0" on the normal side of the account. Review the adjusting journal entries you prepared above. Service Revenue Cash 26,550 Accounts Payable O Bal. Bal. 17,300 Bal. Bal. 26,550 0 Bal. Salaries Payable O Bal. Accounts Receivable 1,200 Unearned Revenue 1,300 Bal. Salaries Expense 700 Bal. Bal. Review the closing.journal entries you prepared above, Cash Accounts Payable Bal. 26,550 O Bal. Service Revenue 19,250 Bal. Salaries Payable Accounts Receivable 2,550 Unearned Revenue 700 Bal. Bal. Salaries Expense 1,400 Bal. Office Supplies 350 Mass, Capital 32,000 Bal. Depreciation Expense-Truck Bal. 150 Bal. Prepaid Insurance 450 Mass, Withdrawals 2,400 Insurance Expense 150 Bal. Income Summary Truck 17,000 Fuel Expense 200 Bal. Accumulated Depreciation-Truck 150 Bal. Rent Expense 1,300 C Supplies Expense Bal. Begin by journalizing the closing entries. (Record debits first, then credits. Exclude explanations from journal entries.) Start by closing revenues. Review the Income Statement columns of the worksheet completed in Requirement 4. Date Accounts Debit Dec. 31 Service Revenue 19,250 Clos. (1) Income Summary Credit 19,250 Close expenses for the period. Credit Review the Income Statement columns of the worksheet completed in Requirement 4. Date Accounts Debit Dec. 31 Income Summary 3,500 Clos. (2) Salaries Expense Supplies Expense Insurance Expense Depreciation Expense--Truck Fuel Expense Rent Expense 1,400 300 150 150 200 1,300 Credit Review the Income Statement columns of the worksheet completed in Requirement 4. Date Accounts Debit Dec. 31 Income Summary 15,750 Clos. (3) Mass, Capital 15,750 Close withdrawals. Credit Review the Balance Sheet columns of the worksheet completed in Requirement 4. Date Accounts Dec. 31 Mass, Capital Clos. (4) Mass, Withdrawals Debit 2,400 2,400