Answered step by step

Verified Expert Solution

Question

1 Approved Answer

post the general hournal closing entries and general ledger income summary. On April 1, John Thompson opened Pelican Company. The company provides services to a

post the general hournal closing entries and general ledger income summary.

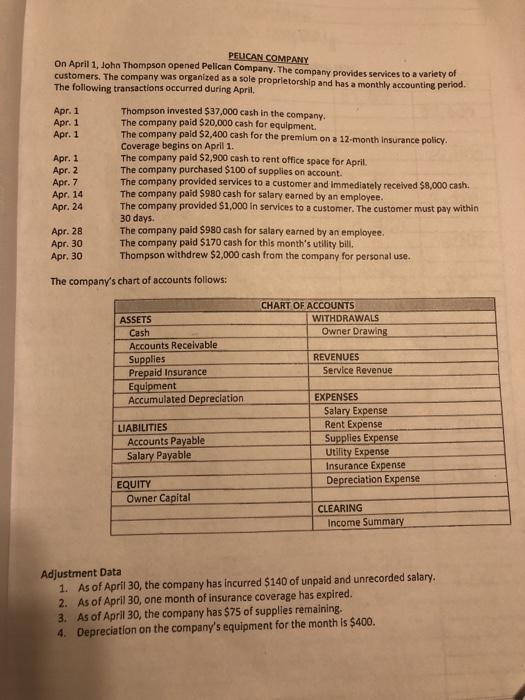

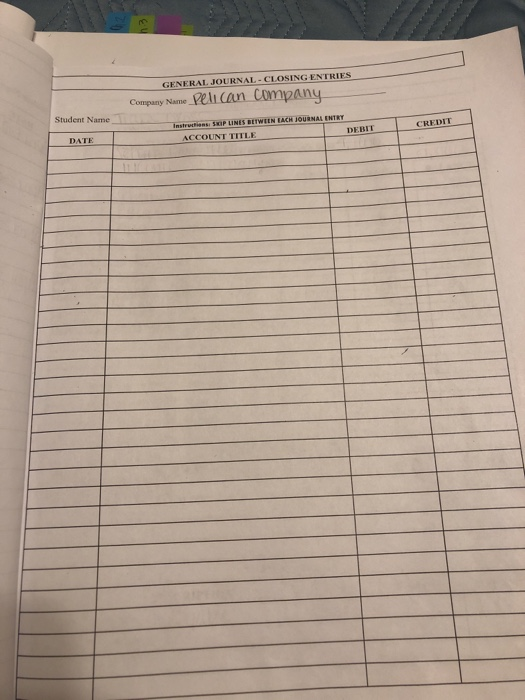

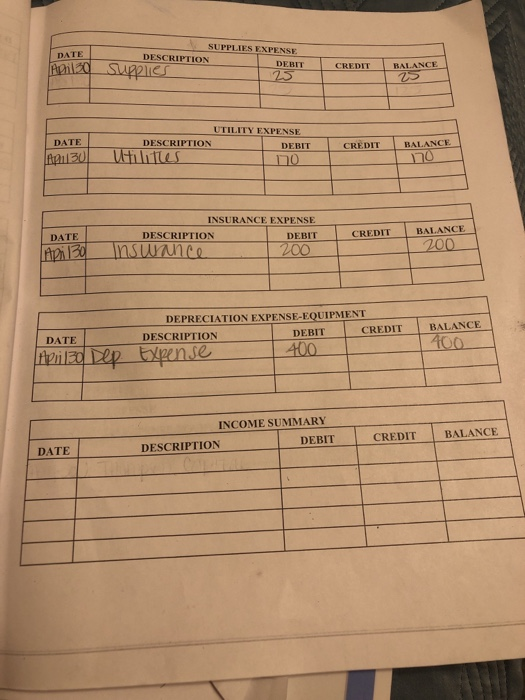

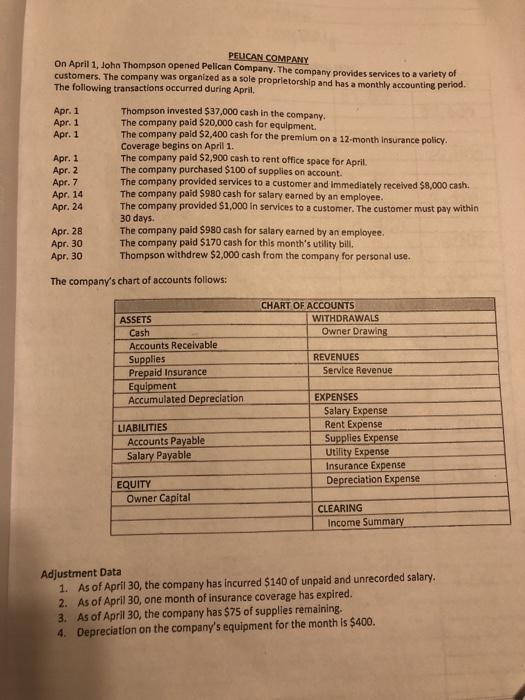

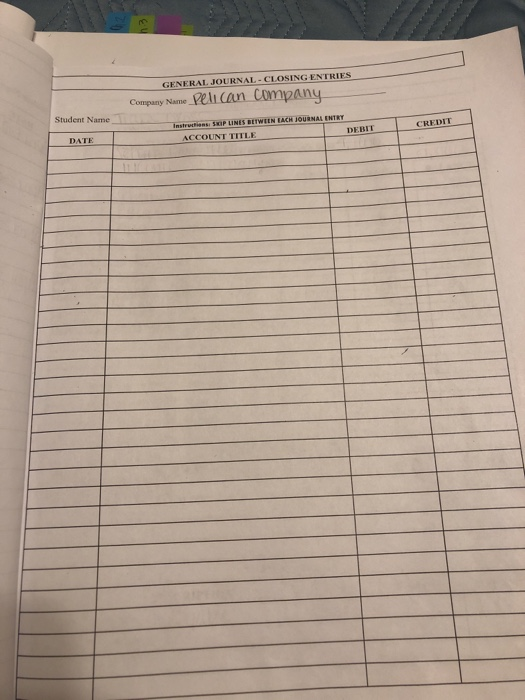

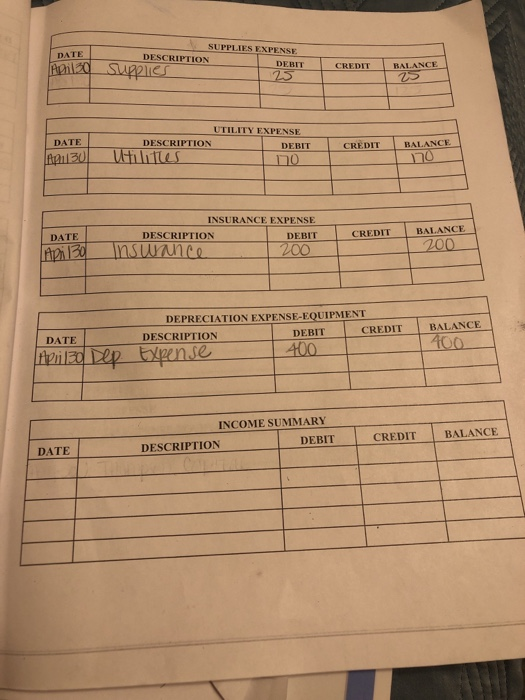

On April 1, John Thompson opened Pelican Company. The company provides services to a variety of customers. The company was organized as a sole proprietorship and has a monthly accounting period The following transactions occurred during April. Thompson invested $37,000 cash in the company The company paid $20,000 cash for equipment. The company paid $2,400 cash for the premium on a 12-month insurance policy Coverage begins on April 1 The company paid $2,900 cash to rent office The company purchased $100 of supplies on account. The company provided services to a customer and immediately received $8,000 cash. The company paid $980 cash for salary earned by an employee. The company provided $1,000 in services to a customer. The customer must pay within 30 days. The company paid $980 cash for salary earned by an employee. The company paid $170 cash for this month's utility bill. Thompson withdrew $2,000 cash from the company for personal use. Apr. 1 Apr. 1 space for April. Apr. 2 Apr. 14 Apr. 24 Apr. 28 Apr. 30 Apr. 30 The company's chart of accounts follows: CHART OF ACCOUNTS WITHDRAWALS ASSETS Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Owner Drawing REVENUES Service Revenue EXPENSES Salary Expense Rent Expense LIABILITIES Accounts Payable Salary Payable Utility Expense Insurance Expense Depreciation Expense EQUITY Owner Capital CLEARING Income Summary Adjustment Data 1. As of April 30, the company has incurred $140 of unpaid and unrecorded salary. 2. As of April 30, one month of insurance coverage has expired. 3. As of April 30, the company has $75 of supplies remaining. 4. Depreciation on the company's equipment for the month is $400. GENERAL JOURNAL-CLOSING ENTRIES Company Name PeltCan Company Student Name Instructions SKIP LINES BETWEEN EACH JOURNAL ENTRY DATE ACCOUNT TITLE CREDIT DEBIT SUPPLIES EXPENSE DATE DESCRIPTION DEBIT BALANCE UTILITY EXPENSE DATE DESCRIPTION DEBIT CREDITBALANCE INSURANCE EXPENSE DESCRIPTION DATE DEBIT | yon t-CREDIT BALANCE 200 200 DEPRECIATION EXPENSE-EQUIPMENT BALANCE CREDIT DESCRIPTION DEBIT DATE INCOME SUMMARY CREDIT BALANCE DEBIT DESCRIPTION DATE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started