Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Post the journal entries to Allowance for Doubtful Accounts and calculate the new balance after each entry. Accounts receivable transactions are provided below for J

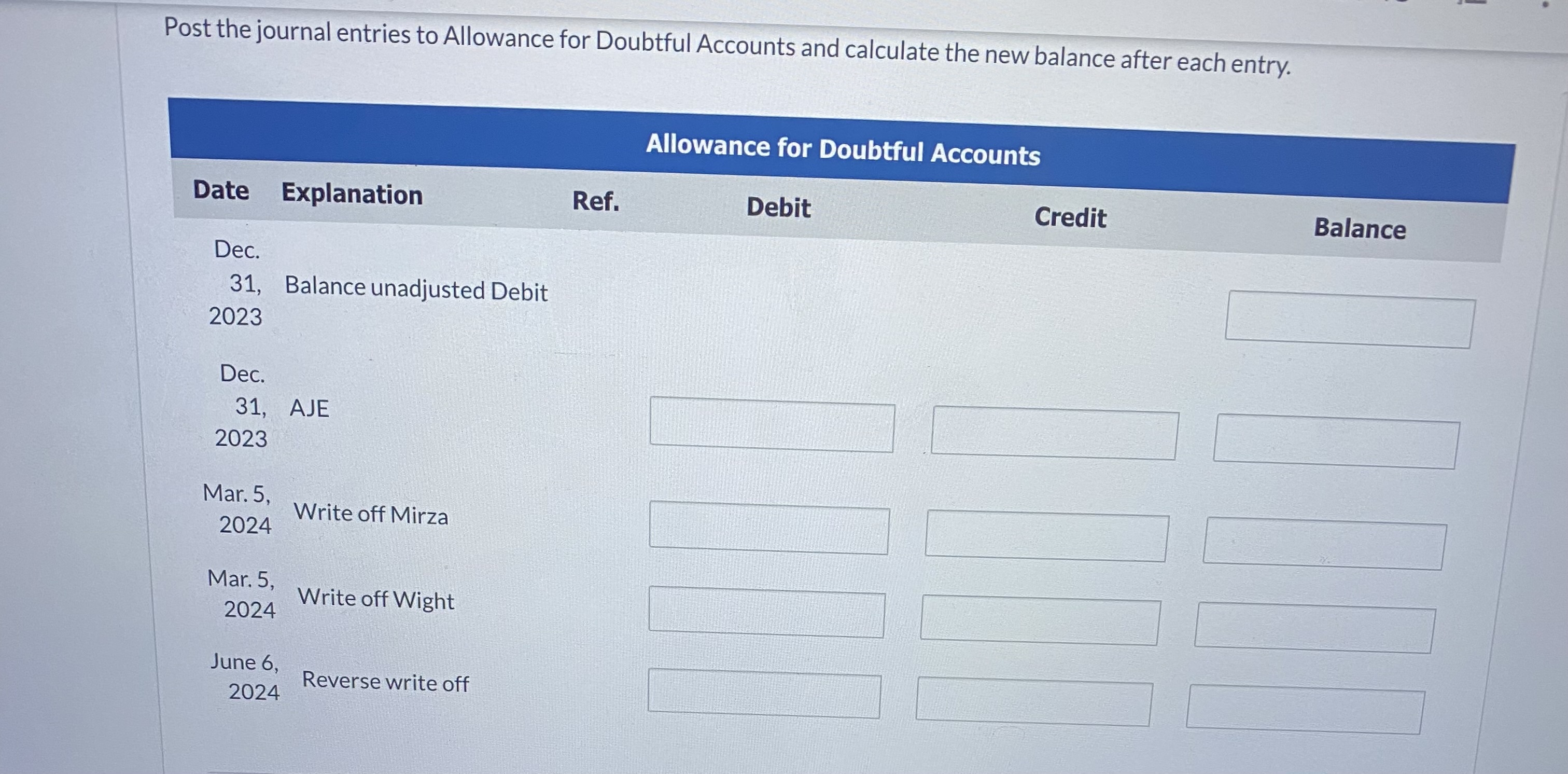

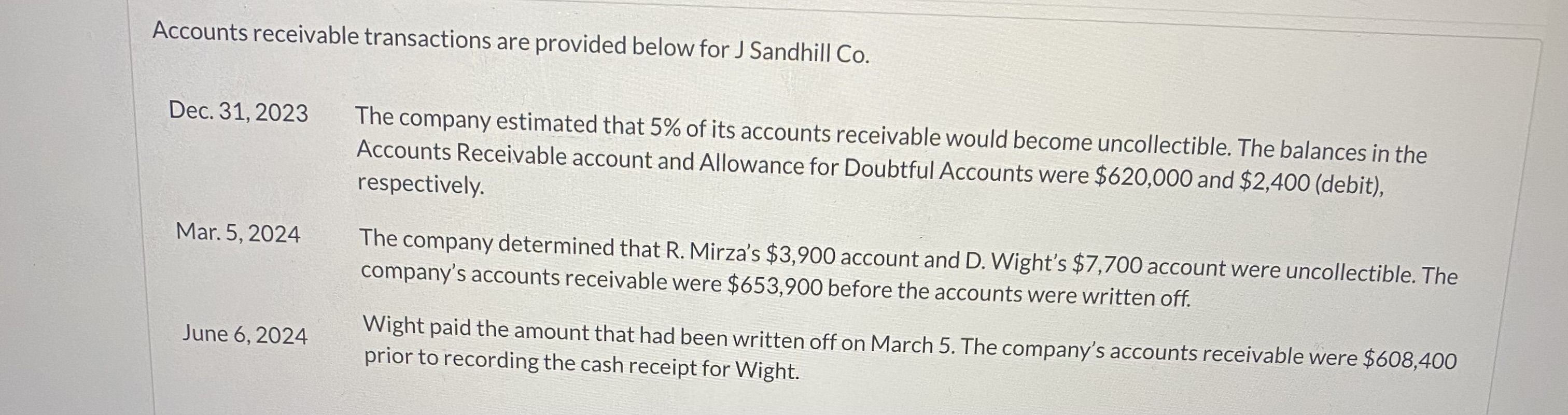

Post the journal entries to Allowance for Doubtful Accounts and calculate the new balance after each entry. Accounts receivable transactions are provided below for J Sandhill Co. Dec. 31, 2023 The company estimated that 5% of its accounts receivable would become uncollectible. The balances in the Accounts Receivable account and Allowance for Doubtful Accounts were $620,000 and $2,400 (debit), respectively. Mar. 5, 2024 The company determined that R. Mirza's $3,900 account and D. Wight's $7,700 account were uncollectible. The company's accounts receivable were $653,900 before the accounts were written off. June 6, 2024 Wight paid the amount that had been written off on March 5. The company's accounts receivable were $608,400 prior to recording the cash receipt for Wight

Post the journal entries to Allowance for Doubtful Accounts and calculate the new balance after each entry. Accounts receivable transactions are provided below for J Sandhill Co. Dec. 31, 2023 The company estimated that 5% of its accounts receivable would become uncollectible. The balances in the Accounts Receivable account and Allowance for Doubtful Accounts were $620,000 and $2,400 (debit), respectively. Mar. 5, 2024 The company determined that R. Mirza's $3,900 account and D. Wight's $7,700 account were uncollectible. The company's accounts receivable were $653,900 before the accounts were written off. June 6, 2024 Wight paid the amount that had been written off on March 5. The company's accounts receivable were $608,400 prior to recording the cash receipt for Wight Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started