Postef below is question and requirements. Help

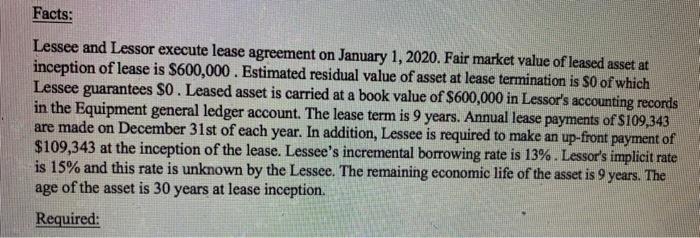

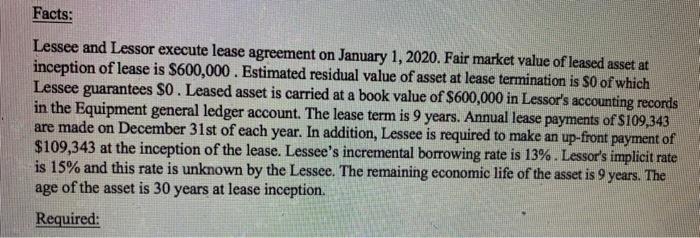

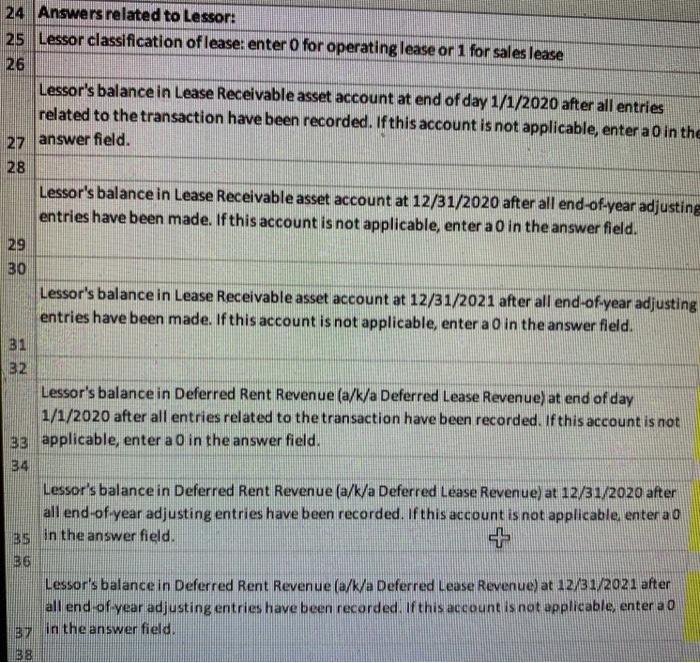

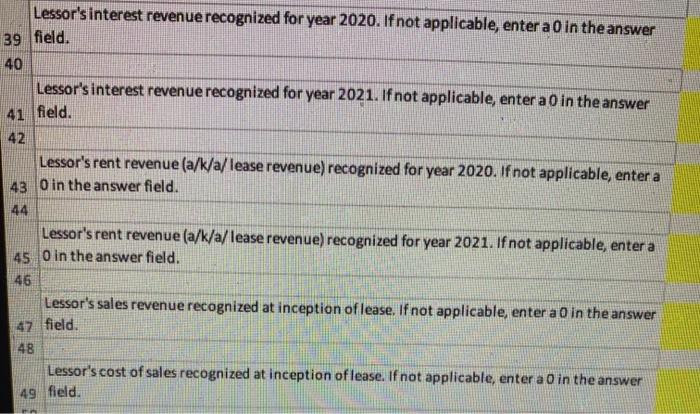

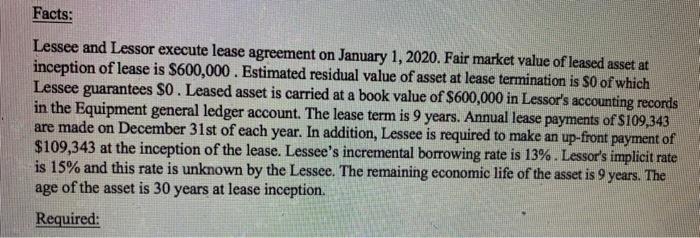

Facts: Lessee and Lessor execute lease agreement on January 1, 2020. Fair market value of leased asset at inception of lease is $600,000. Estimated residual value of asset at lease termination is $0 of which Lessee guarantees $0.Leased asset is carried at a book value of $600,000 in Lessor's accounting records in the Equipment general ledger account. The lease term is 9 years. Annual lease payments of S109,343 are made on December 31st of each year. In addition, Lessee is required to make an up-front payment of $109,343 at the inception of the lease. Lessee's incremental borrowing rate is 13%. Lessor's implicit rate is 15% and this rate is unknown by the Lessee. The remaining economic life of the asset is 9 years. The age of the asset is 30 years at lease inception. Required: 24 Answers related to Lessor: 25 Lessor classification of lease: enter for operating lease or 1 for sales lease 26 Lessor's balance in Lease Receivable asset account at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not applicable, enter a 0 in the 27 answer field. 28 Lessor's balance in Lease Receivable asset account at 12/31/2020 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a O in the answer field. 29 BO Lessor's balance in Lease Receivable asset account at 12/31/2021 after all end-of-year adjusting entries have been made. If this account is not applicable, enter a 0 in the answer field. 31 B2 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at end of day 1/1/2020 after all entries related to the transaction have been recorded. If this account is not 33 applicable, enter a o in the answer field. 34 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2020 after all end of year adjusting entries have been recorded. If this account is not applicable enter a 0 35 in the answer field. 36 Lessor's balance in Deferred Rent Revenue (a/k/a Deferred Lease Revenue) at 12/31/2021 after all end of year adjusting entries have been recorded. If this account is not applicable, enter a 0 137 in the answer field, B8 Lessor's interest revenue recognized for year 2020. If not applicable, enter a 0 in the answer 39 field. 40 Lessor's interest revenue recognized for year 2021. If not applicable, enter a 0 in the answer 41 field. 42 Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2020. If not applicable, enter a 43 O in the answer field. 44 Lessor's rent revenue (a/k/a/lease revenue) recognized for year 2021. If not applicable, enter a 45 O in the answer field. 46 Lessor's sales revenue recognized at inception of lease. If not applicable, enter a 0 in the answer 47 field. 48 Lessor's cost of sales recognized at inception of lease. If not applicable, enter a O in the answer 49 field