Answered step by step

Verified Expert Solution

Question

1 Approved Answer

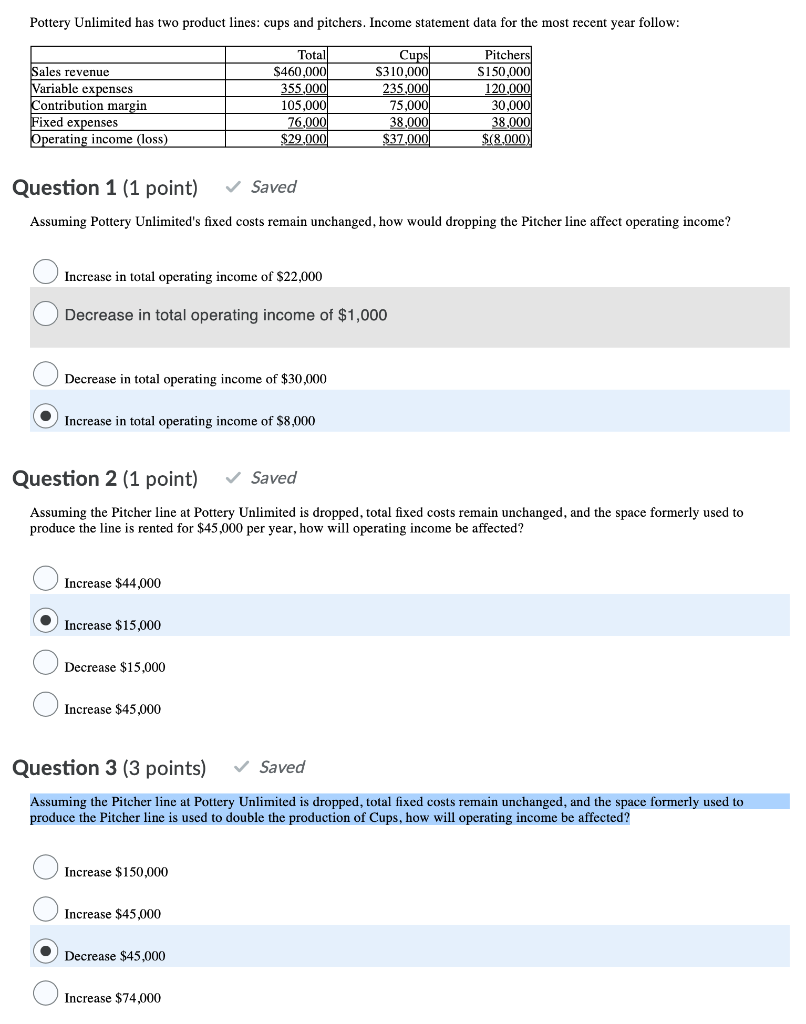

Pottery Unlimited has two product lines: cups and pitchers. Income statement data for the most recent year follow: Total Cups Pitchers $310,000 $150,000 $460,000

Pottery Unlimited has two product lines: cups and pitchers. Income statement data for the most recent year follow: Total Cups Pitchers $310,000 $150,000 $460,000 355,000 235,000 120,000 Sales revenue Variable expenses Contribution margin Fixed expenses Operating income (loss) 105,000 75,000 30,000 76,000 38,000 38,000 $29,000 $37,000 $(8,000) Question 1 (1 point) Saved Assuming Pottery Unlimited's fixed costs remain unchanged, how would dropping the Pitcher line affect operating income? Increase in total operating income of $22,000 Decrease in total operating income of $1,000 Decrease in total operating income of $30,000 Increase in total operating income of $8,000 Question 2 (1 point) Saved Assuming the Pitcher line at Pottery Unlimited is dropped, total fixed costs remain unchanged, and the space formerly used to produce the line is rented for $45,000 per year, how will operating income be affected? Increase $44,000 Increase $15,000 Decrease $15,000 Increase $45,000 Question 3 (3 points) Saved Assuming the Pitcher line at Pottery Unlimited is dropped, total fixed costs remain unchanged, and the space formerly used to produce the Pitcher line is used to double the production of Cups, how will operating income be affected? Increase $150,000 Increase $45,000 Decrease $45,000 Increase $74,000

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Q 1 Assuming Pottery Unlimiteds fixed costs remain unchanged how would dropping the Pitcher line affect operating income Solution If Pottery Unlimited ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started