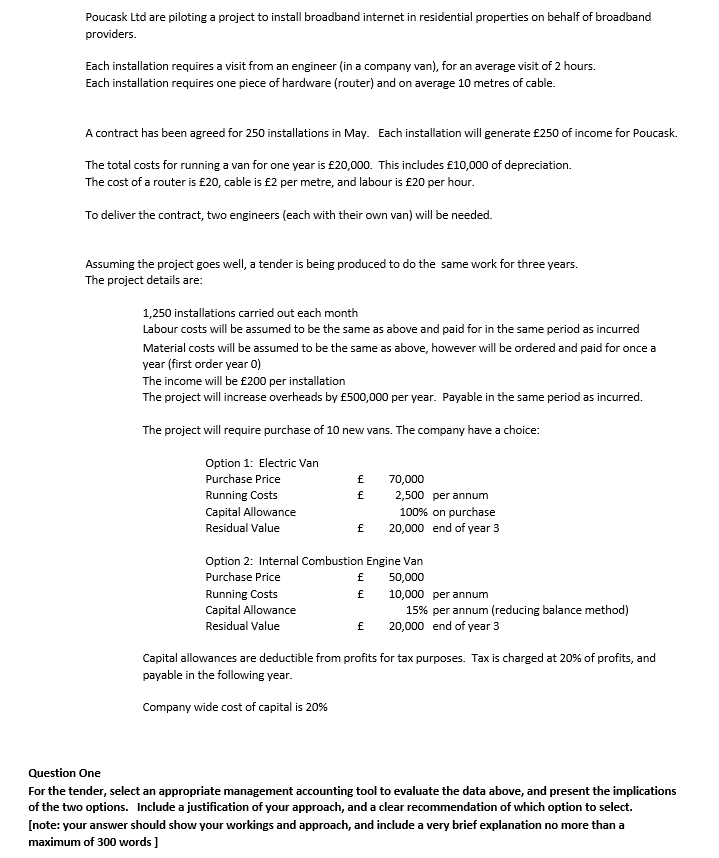

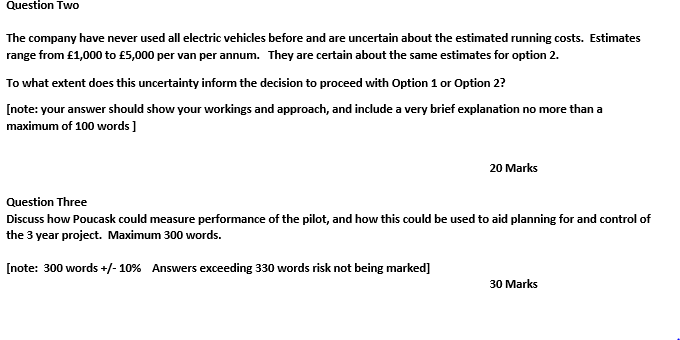

Poucask Ltd are piloting a project to install broadband internet in residential properties on behalf of broadband providers. Each installation requires a visit from an engineer (in a company van), for an average visit of 2 hours. Each installation requires one piece of hardware (router) and on average 10 metres of cable. A contract has been agreed for 250 installations in May. Each installation will generate 250 of income for Poucask. The total costs for running a van for one year is 20,000. This includes 10,000 of depreciation. The cost of a router is 20, cable is 2 per metre, and labour is 20 per hour. To deliver the contract, two engineers (each with their own van) will be needed. Assuming the project goes well, a tender is being produced to do the same work for three years. The project details are: 1,250 installations carried out each month Labour costs will be assumed to be the same as above and paid for in the same period as incurred Material costs will be assumed to be the same as above, however will be ordered and paid for once a year (first order year 0) The income will be 200 per installation The project will increase overheads by 500,000 per year. Payable in the same period as incurred. The project will require purchase of 10 new vans. The company have a choice: Option 1: Electric Van Purchase Price Running Costs Capital Allowance Residual Value 70,000 2,500 per annum 100% on purchase 20,000 end of year 3 Option 2: Internal Combustion Engine Van Purchase Price 50,000 Running Costs 10,000 per annum 15% per annum (reducing balance method) Residual Value 20,000 end of year 3 Capital allowances are deductible from profits for tax purposes. Tax is charged at 20% of profits, and payable in the following year. Company wide cost of capital is 20% Question One For the tender, select an appropriate management accounting tool to evaluate the data above, and present the implications of the two options. Include a justification of your approach, and a clear recommendation of which option to select. (note: your answer should show your workings and approach, and include a very brief explanation no more than a maximum of 300 words ] Question Two The company have never used all electric vehicles before and are uncertain about the estimated running costs. Estimates range from 1,000 to 5,000 per van per annum. They are certain about the same estimates for option 2. To what extent does this uncertainty inform the decision to proceed with Option 1 or Option 2? [note: your answer should show your workings and approach, and include a very brief explanation no more than a maximum of 100 words ] Question Three Discuss how Poucask could measure performance of the pilot, and how this could be used to aid planning for and control of the 3 year project. Maximum 300 words. [note: 300 words +/- 10% Answers exceeding 330 words risk not being marked) 30 Marks Poucask Ltd are piloting a project to install broadband internet in residential properties on behalf of broadband providers. Each installation requires a visit from an engineer (in a company van), for an average visit of 2 hours. Each installation requires one piece of hardware (router) and on average 10 metres of cable. A contract has been agreed for 250 installations in May. Each installation will generate 250 of income for Poucask. The total costs for running a van for one year is 20,000. This includes 10,000 of depreciation. The cost of a router is 20, cable is 2 per metre, and labour is 20 per hour. To deliver the contract, two engineers (each with their own van) will be needed. Assuming the project goes well, a tender is being produced to do the same work for three years. The project details are: 1,250 installations carried out each month Labour costs will be assumed to be the same as above and paid for in the same period as incurred Material costs will be assumed to be the same as above, however will be ordered and paid for once a year (first order year 0) The income will be 200 per installation The project will increase overheads by 500,000 per year. Payable in the same period as incurred. The project will require purchase of 10 new vans. The company have a choice: Option 1: Electric Van Purchase Price Running Costs Capital Allowance Residual Value 70,000 2,500 per annum 100% on purchase 20,000 end of year 3 Option 2: Internal Combustion Engine Van Purchase Price 50,000 Running Costs 10,000 per annum 15% per annum (reducing balance method) Residual Value 20,000 end of year 3 Capital allowances are deductible from profits for tax purposes. Tax is charged at 20% of profits, and payable in the following year. Company wide cost of capital is 20% Question One For the tender, select an appropriate management accounting tool to evaluate the data above, and present the implications of the two options. Include a justification of your approach, and a clear recommendation of which option to select. (note: your answer should show your workings and approach, and include a very brief explanation no more than a maximum of 300 words ] Question Two The company have never used all electric vehicles before and are uncertain about the estimated running costs. Estimates range from 1,000 to 5,000 per van per annum. They are certain about the same estimates for option 2. To what extent does this uncertainty inform the decision to proceed with Option 1 or Option 2? [note: your answer should show your workings and approach, and include a very brief explanation no more than a maximum of 100 words ] Question Three Discuss how Poucask could measure performance of the pilot, and how this could be used to aid planning for and control of the 3 year project. Maximum 300 words. [note: 300 words +/- 10% Answers exceeding 330 words risk not being marked) 30 Marks