Answered step by step

Verified Expert Solution

Question

1 Approved Answer

practice questions need help please 6. A factory machine was purchased for $375,000 on January 1, 2019. It was estimated that it would have a

practice questions need help please

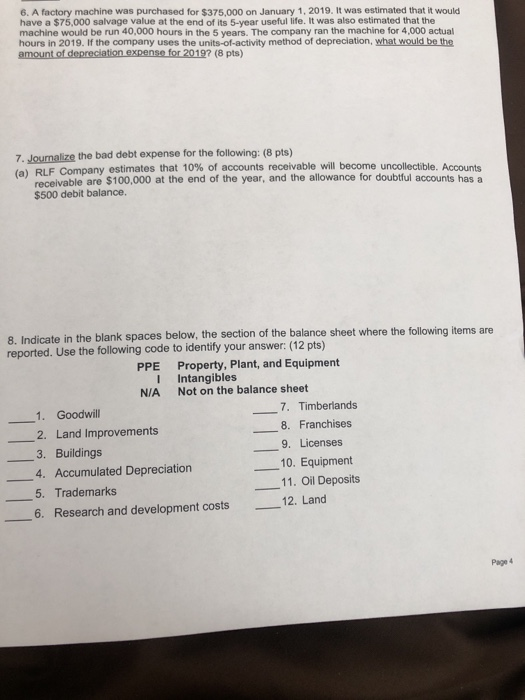

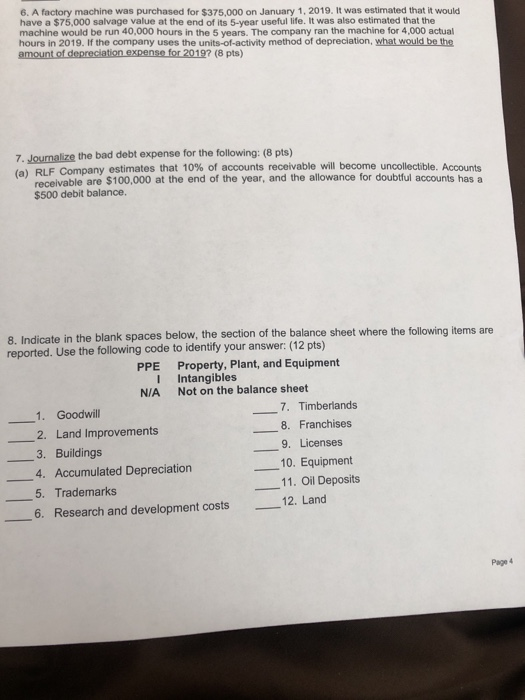

6. A factory machine was purchased for $375,000 on January 1, 2019. It was estimated that it would have a $75,000 salvage value at the end of its 5-year useful life. It was also estimated that the machine would be run 40,000 hours in the 5 years. The company ran the machine for 4,000 actual hours in 2019. If the company uses the units-of-activity method of depreciation, what would be the amount of depreciation expense for 2019? (8 pts) 7. Journalize the bad debt expense for the following: (8 pts) (a) RLF Company estimates that 10% of accounts receivable will become uncollectible. Accounts receivable are $100,000 at the end of the year, and the allowance for doubtful accounts has a $500 debit balance. 8. Indicate in the blank spaces below, the section of the balance sheet where the following items are reported. Use the following code to identify your answer: (12 pts) PPE Property, Plant, and Equipment Intangibles Not on the balance sheet 1. Goodwill 7. Timberlands 2. Land Improvements 8. Franchises 3. Buildings 9. Licenses 4. Accumulated Depreciation 10. Equipment 5. Trademarks 11. Oil Deposits 6. Research and development costs 12. Land Page 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started