Answered step by step

Verified Expert Solution

Question

1 Approved Answer

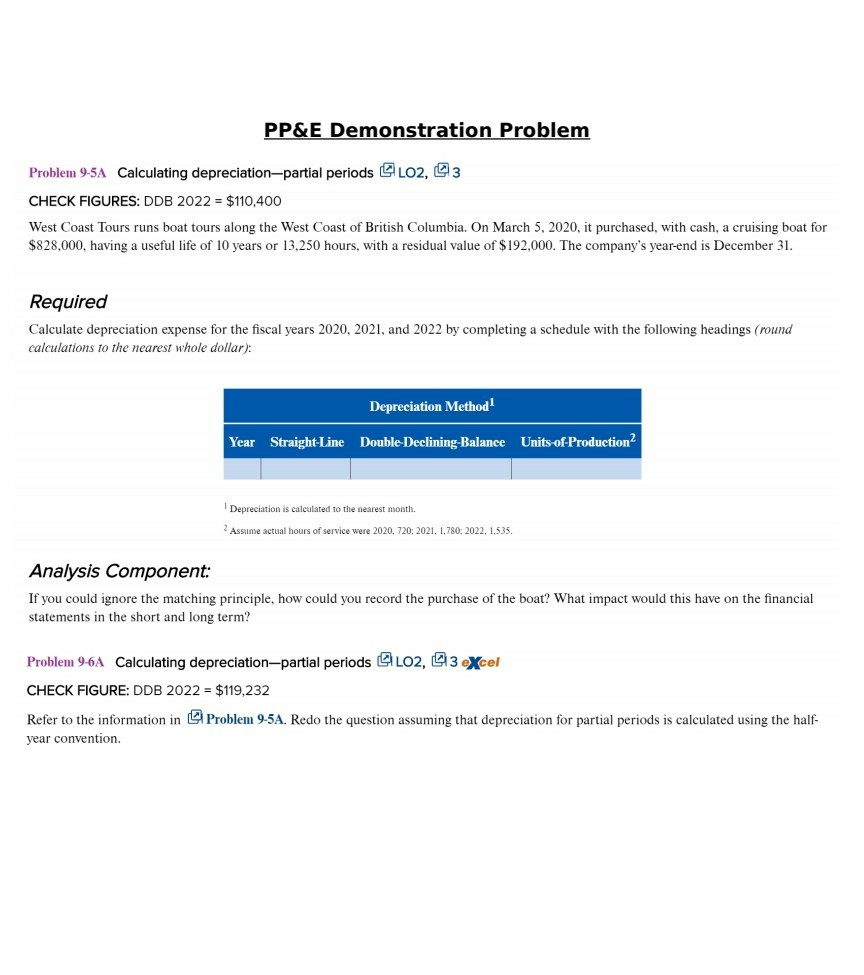

PP&E Demonstration Problem Problem 9-5A Calculating depreciation-partial periods Glo2, 3 CHECK FIGURES: DDB 2022 = $110,400 West Coast Tours runs boat tours along the West

PP&E Demonstration Problem Problem 9-5A Calculating depreciation-partial periods Glo2, 3 CHECK FIGURES: DDB 2022 = $110,400 West Coast Tours runs boat tours along the West Coast of British Columbia. On March 5, 2020, it purchased, with cash, a cruising boat for $828,000, having a useful life of 10 years or 13,250 hours, with a residual value of $ 192,000. The company's year-end is December 31. Required Calculate depreciation expense for the fiscal years 2020, 2021, and 2022 by completing a schedule with the following headings (round calculations to the nearest whole dollar): Depreciation Method Year Straight-Line Double-Declining-Balance Units-of-Production? Depreciation is calculated to the nearest month. 2 Assume actual hours of service were 2020, 720; 2021, 1.780: 2022, 1.535. Analysis Component: If you could ignore the matching principle, how could you record the purchase of the boat? What impact would this have on the financial statements in the short and long term? Problem 9-6A Calculating depreciation-partial periods Lo2, 3 excel CHECK FIGURE: DDB 2022 = $119,232 Refer to the information in Problem 9-5A. Redo the question assuming that depreciation for partial periods is calculated using the half- year convention

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started