Question

PQRS Company is preparing for the first half of the next year. The following information was available: a. Sales - 15% of monthly sales are

PQRS Company is preparing for the first half of the next year. The following information was available:

a. Sales - 15% of monthly sales are in cash while the balance is sold on credit. Collections from receivables are 50% in the first month after sales, 30% in the second month and the balance in the third month after sales. b. Purchases are usually 55% of sales and paid in the month of purchase. c. Insurance company is expected to pay the sum of RM525,000 in the month of February based on the companys accidented vehicles. d. Salary deductions are paid on preceding month basis. e. Company income tax of RM475,550 will be paid in the month of March. f. Cash and Cash equivalent balance as at December is RM502,760.00.

g. Bank Charges is 1% of total payment for the month. h. Additional Information is as follows:

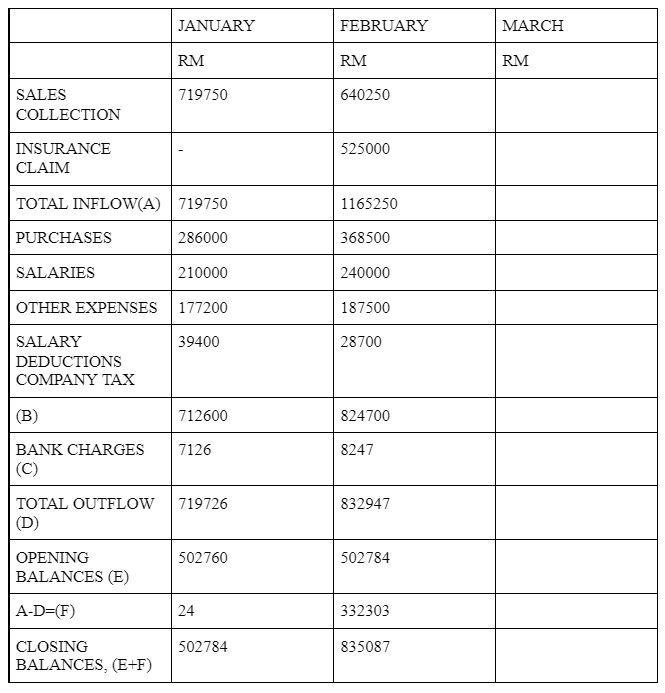

By using the information above, complete the table below,

October RM 750,000 230,000 November December January RM RM RM 600,000 850,000 520,000 200,000 250,000 210,000 February RM 670,000 240,000 March RM 800,000 270,000 Sales Net Salaries Other Expenses Salaries Deductions 200,000 187,500 197,500 177,200 187,500 192,700 29,400 28,400 39,400 28,700 32,750 27,650 JANUARY FEBRUARY MARCH RM RM RM 719750 640250 SALES COLLECTION 525000 INSURANCE CLAIM TOTAL INFLOW(A) 719750 1165250 PURCHASES 286000 368500 SALARIES 210000 240000 OTHER EXPENSES 177200 187500 39400 28700 SALARY DEDUCTIONS COMPANY TAX (B) 712600 824700 7126 8247 BANK CHARGES (C) 719726 832947 TOTAL OUTFLOW (D) 502760 502784 OPENING BALANCES (E) A-D=(F) 24 332303 502784 835087 CLOSING BALANCES, (E+F)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started