Answered step by step

Verified Expert Solution

Question

1 Approved Answer

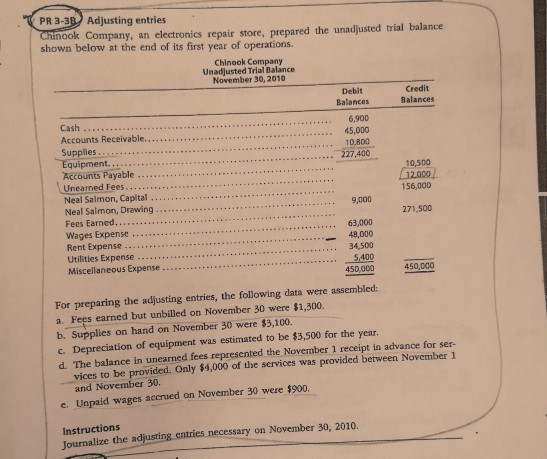

PR 3-3B Adjusting entries Chinook Company, an electronics repair store, prepared the unadjusted trial balance shown below at the end of its first year of

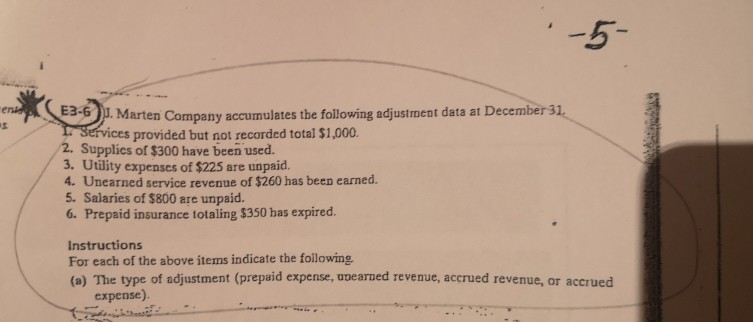

PR 3-3B Adjusting entries Chinook Company, an electronics repair store, prepared the unadjusted trial balance shown below at the end of its first year of operations. Chinook Company Unadjusted Trial Balance November 30, 2010 Debit Credit Balances Balances Cash ......... 6.900 Accounts Receivable.... 45.000 Supplies 10.800 Equipment.... 227,400 Accounts Payable 10,500 Unearned Fees 12.000 Neal Salmon, Capital 156,000 Neal Salmon, Drawing 9,000 Fees Earned.. 271,500 Wages Expense.... 63.000 48,000 Rent Expense.. Utilities Expense.. 34,500 Miscellaneous Expense... 5.400 450,000 450,000 For preparing the adjusting entries, the following data were assembled: a. Fees earned but unbilled on November 30 were $1,300. b. Supplies on hand on November 30 were $3,100. c. Depreciation of equipment was estimated to be $3,500 for the year. The balance in uneared fees represented the November 1 receipt in advance for ser vices to be provided. Only $1,000 of the services was provided between November 1 and November 30. e. Unpaid wages accrued on November 30 were $900. Instructions Journalize the adjusting entries necessary on November 30, 2010. P. Marten Company accumulates the following adjustment data at December 31 1. Services provided but not recorded total $1,000. 2. Supplies of $300 have been used. 3. Utility expenses of $225 are unpaid. 4. Unearned service revenue of $260 has been earned. 5. Salaries of $800 are unpaid. 6. Prepaid insurance totaling $350 has expired. Instructions For each of the above items indicate the following (a) The type of adjustment (prepaid expense, ugearned revenue, accrued revenue, or accrued expense)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started