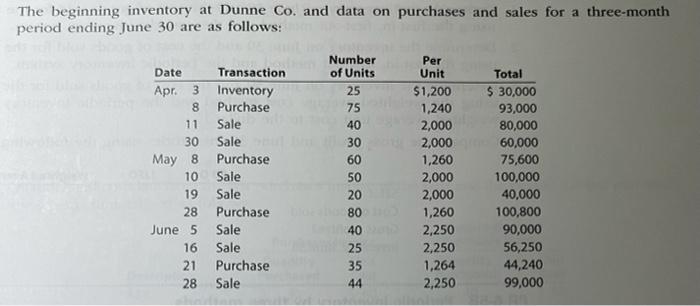

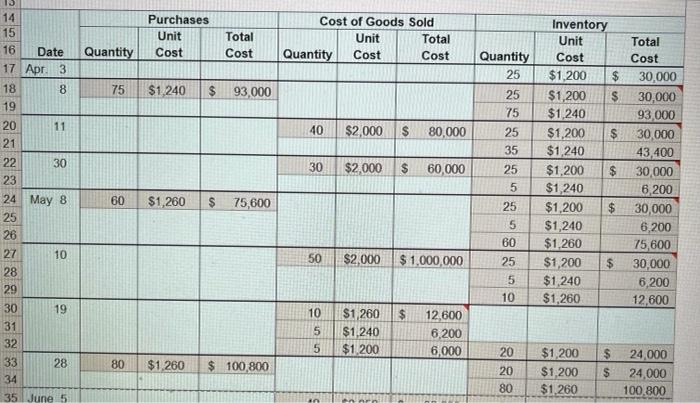

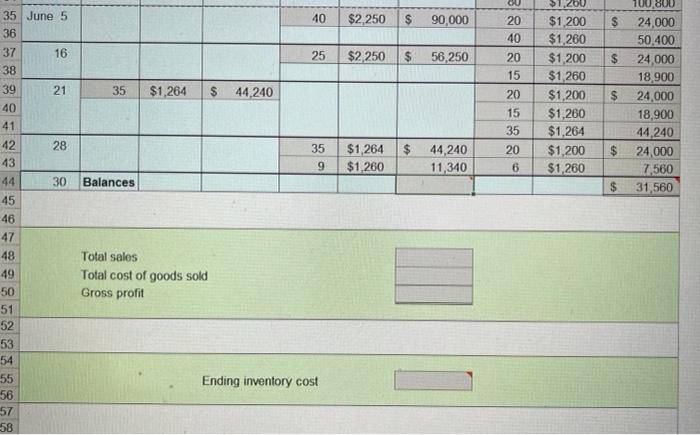

PR 6-2B LIFO perpetual inventory Obj. 2, 3 The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 6-1B. Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. 2. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period. 3. Determine the ending inventory cost on June 30. The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Date Apr. 3 8 11 30 May 8 10 19 28 June 5 16 21 28 Transaction Inventory Purchase Sale Sale Purchase Sale Sale Purchase Sale Sale Purchase Sale Number of Units 25 75 40 30 60 50 20 80 40 25 35 44 Per Unit $1,200 1,240 2,000 2,000 1,260 2,000 2,000 1,260 2,250 2,250 1,264 2,250 Total $ 30,000 93,000 80,000 60,000 75,600 100,000 40,000 100,800 90,000 56,250 44,240 99,000 15 14 15 Purchases Unit Cost Cost of Goods Sold Unit Total Quantity Cost Cost Total Cost Quantity 16 Date 17 Apr. 3 8 19 Quantity 25 18 75 $1,240 $ 93,000 11 20 21 25 75 25 35 40 $2,000 $ 80,000 22 30 30 $2,000 $ 60,000 Inventory Unit Cost $1.200 $ $1,200 $ $1,240 $1,200 $ $1,240 $1,200 $ $1,240 $1,200 $ $1,240 $1,260 $1,200 $ $1,240 $1,260 25 Total Cost 30,000 30,000 93000 30.000 43,400 30,000 6.200 30,000 6,200 75,600 30,000 6,200 12,600 23 5 60 $1,260 $ 75,600 24 May 8 25 26 27 10 28 29 25 5 60 50 $2,000 $ 1.000.000 25 5 10 30 19 $ 31 32 33 10 5 5 $1,260 $1.240 $1 200 12,600 6,200 6,000 28 80 $1,260 $ 100,800 20 20 80 $1,200 $1,200 $1,260 24,000 24.000 100.800 34 $ 35 June 5 40 $2,250 90,000 $ 20 40 25 $2250 $ 56,250 $ 20 15 35 35 June 5 36 37 16 38 39 21 40 41 42 28 43 44 30 $1,264 S 44,240 91,200 $1,200 $1,260 $1,200 $1,260 $1,200 $1,260 $1,264 $1,200 $1,260 $ 20 15 35 100.800 24,000 50,400 24,000 18,900 24,000 18,900 44,240 24,000 7,560 31,560 35 9 $ $ $1,264 $1,260 44,240 11,340 20 6 Balances $ Total sales Total cost of goods sold Gross profit 45 46 47 48 49 50 51 52 53 54 55 56 57 -58 Ending inventory cost