practic question: second page is correct answers.

Can someone please write out the calculations on how to solve each question. thank you!

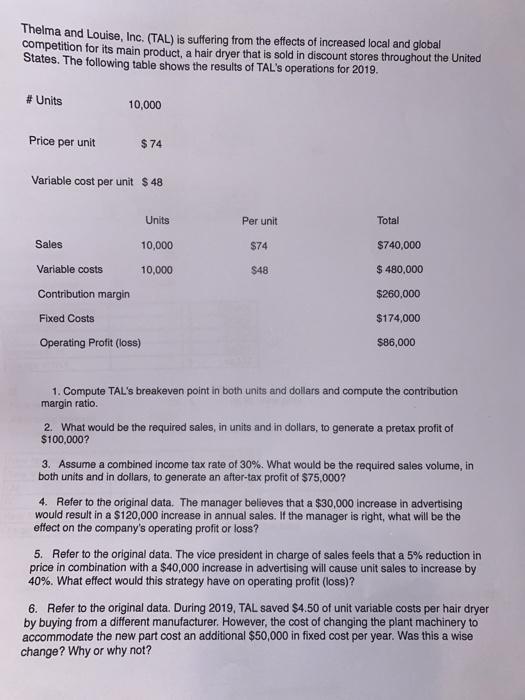

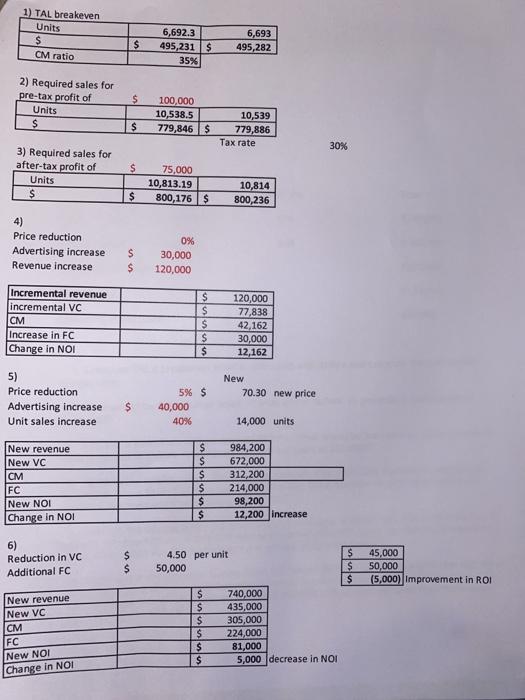

Thelma and Louise, Inc. (TAL) is suffering from the effects of increased local and global competition for its main product, a hair dryer that is sold in discount stores throughout the United States. The following table shows the results of TAL's operations for 2019. # Units 10,000 Price per unit $ 74 Variable cost per unit $ 48 Units Per unit Total Sales 10,000 $74 $740,000 $48 $ 480,000 $260,000 Variable costs 10,000 Contribution margin Fixed Costs Operating Profit (loss) $174,000 $86,000 1. Compute TAL's breakeven point in both units and dollars and compute the contribution margin ratio. 2. What would be the required sales, in units and in dollars, to generate a pretax profit of $100,000? 3. Assume a combined income tax rate of 30%. What would be the required sales volume, in both units and in dollars, to generate an after-tax profit of $75,000? 4. Refer to the original data. The manager believes that a $30,000 increase in advertising would result in a $120,000 increase in annual sales. If the manager is right, what will be the effect on the company's operating profit or loss? 5. Refer to the original data. The vice president in charge of sales feels that a 5% reduction in price in combination with a $40,000 increase in advertising will cause unit sales to increase by 40%. What effect would this strategy have on operating profit (loss)? 6. Refer to the original data. During 2019, TAL saved $4.50 of unit variable costs per hair dryer by buying from a different manufacturer. However, the cost of changing the plant machinery to accommodate the new part cost an additional $50,000 in fixed cost per year. Was this a wise change? Why or why not? 1) TAL breakeven Units $ CM ratio 6,692.3 495,231 $ $ 6,693 495,282 35% 2) Required sales for pre-tax profit of Units $ $ 100,000 10,538.5 779,846 $ $ 10,539 779,886 Tax rate 30% 3) Required sales for after-tax profit of Units $ $ 75,000 10,813.19 800,176 $ $ 10,814 800,236 4) Price reduction Advertising increase Revenue increase is 0% 30,000 120,000 $ Incremental revenue incremental VC CM Increase in FC Change in NOI $ $ $ $ $ 120,000 77,838 42,162 30,000 12,162 5) Price reduction Advertising increase Unit sales increase New 70.30 new price $ 5% $ 40,000 40% 14,000 units New revenue New VC CM $ $ S $ $ $ 984,200 672,000 312,200 214,000 98,200 12,200 increase FC New NOI Change in NOI $ 6) Reduction in VC Additional FC $ $ 4.50 per unit 50,000 $ $ $ 45,000 50,000 (5,000) improvement in ROI $ $ $ New revenue New VC CM FC New NOI Change in NOI 740,000 435,000 305,000 224,000 81,000 5,000 decrease in NOI lulus