Question

practice ch26 ***Project 1 requires an original investment of $51,900. The project will yield cash flows of $13,000 per year for five years. Project 2

practice ch26

***Project 1 requires an original investment of $51,900. The project will yield cash flows of $13,000 per year for five years. Project 2 has a calculated net present value of $9,100 over a three-year life. Project 1 could be sold at the end of three years for a price of $50,000.

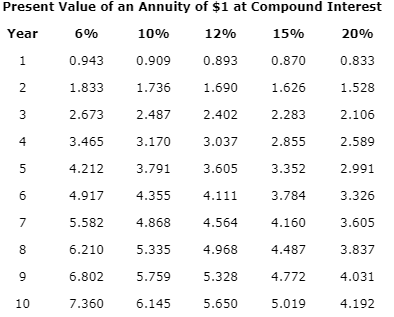

Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below.

a. Determine the net present value of Project 1 over a three-year life with residual value, assuming a minimum rate of return of 15%. If required, round to the nearest dollar $_____.

b. Which project provides the greatest net present value? project 1 or project 2?

Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 6.210 5.335 4.968 4.487 3.837 6.802 5.759 5.328 4.772 4.031 8 9 10 7.360 6.145 5.650 5.019 4.192Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started