Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Practice Exam # 1 A firm has a total debt ratio of 0 . 4 7 . This means the firm has $ 0 .

Practice Exam #

A firm has a total debt ratio of This means the firm has $ in debt for every

A $ in equity

B $ in equity

C $ in equity

D $ in equity

E $ in equity

Song Partners Test Prep Services generated its first annual cashflow yesterday, of

$ Analysts expect its cashflows to grow at forever. If the appropriate

discount rate for Song is per year, what is the present value of its future cashflows?

A $

B $

C $

D $

E $

Which one of these is an intangible asset?

A Building

B Machinery

C Vehicle

D Loan

E Trademark

Which one of the following is a capital budgeting decision?

A Deciding whether or not to open a new store

B Determining how much inventory to keep on hand

C Determining how much debt should be borrowed from a particular lender

D Deciding if stock shares should be repurchased

E Determining how much cash to keep on hand

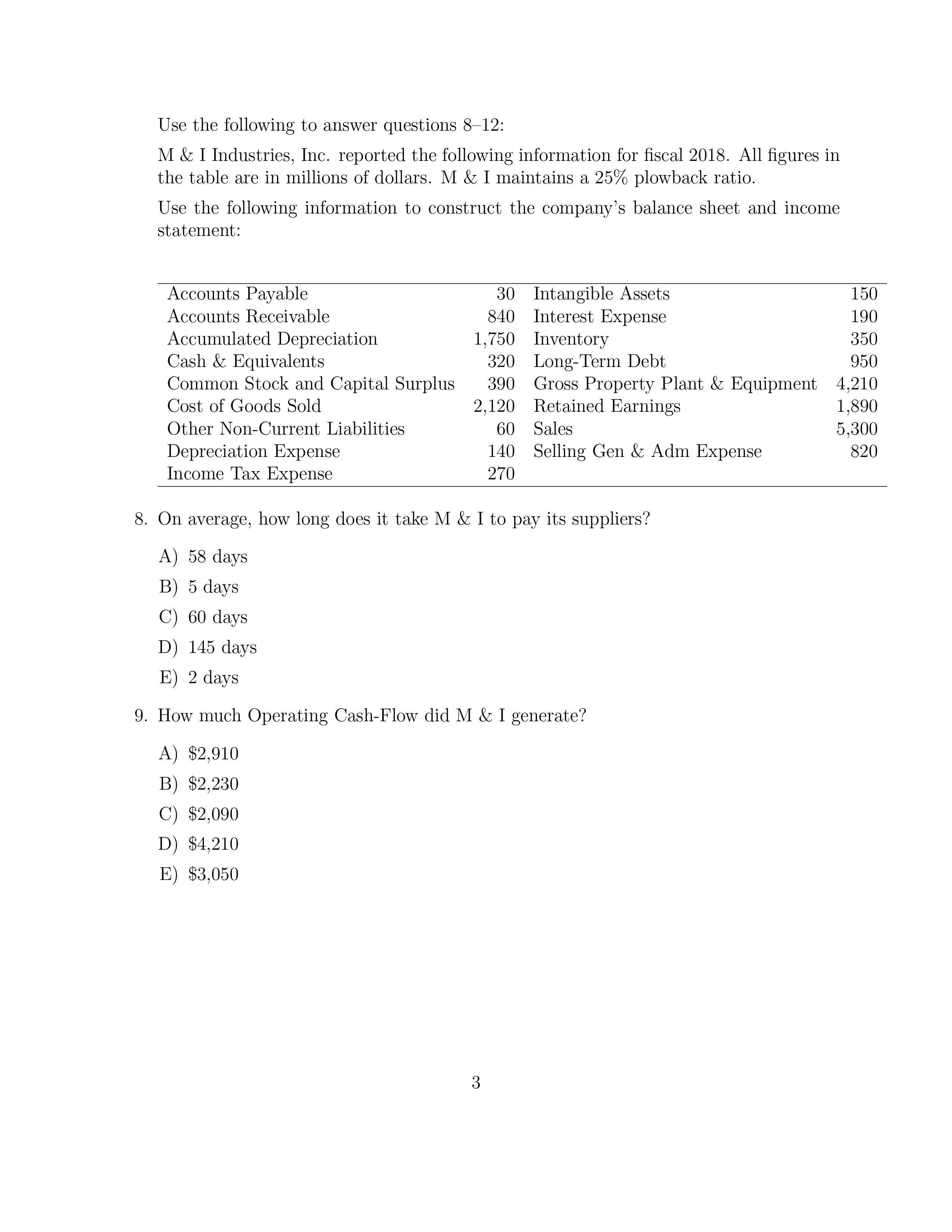

Use the following to answer questions :

M & I Industries, Inc. reported the following information for fiscal All figures in

the table are in millions of dollars. M & I maintains a plowback ratio.

Use the following information to construct the company's balance sheet and income

statement:

On average, how long does it take M & I to pay its suppliers?

A days

B days

C days

D days

E days

How much Operating CashFlow did M & I generate?

A $

B $

C $

D $

E $

How much did M & I pay in dividends?

A $ B $ C $ D $ E $

At what rate can M & I increase their sales revenue without raising any external funds?

A B C D E

M & I is forecasting sales for of $ billion. Using the percentage of sales approach, what should the company forecast for Cost of Goods Sold?

A $ B $ C $ D $ E $

years from now, you want to be a millionaire. Suppose your savings earn per year, compounded monthly. How much do you need to save each month, starting next month?

A $

B $

C $

D $

E $

What if you start saving right now, instead?

A $ B $ C $ D $ E $

IMan Athletics Co just borrowed $ at compounded semiannually. The loan is fully amortized and has a year term. How much interest will IMan pay in the second year?

A $ B $ C $ D $ E $

When the debt ratio rises,

A the debttoequity ratio falls and the equity multiplier increases B the debttoequity ratio falls and the equity multiplier falls

C the debttoequity ratio rises and the equity multiplier falls

D the debttoequity ratio rises and the equity multiplier rises

E the debttoequity ratio falls and the equity multiplier stays constant The goal of the corporation is to

A Minimize income tax expense

B Maximize the market value of the firms existing equity shares. C Avoid financial distress and bankruptcy

D Maintain steady earnings growth

E Have a higher stock price than the firms competitors.

A client agreed to pay your firm $ in four years, plus an additional $ in six years. If your discount rate is what is the present value of these payments?

A $

B $

C $ D $ E $

Which ratio calculates the amount of sales generated by each $ of debt and equity invested in the firm?

A Total Asset Turnover B Return on Assets

C Equity Multiplier

D Return on Equity

E DuPont Identity

Yesterday, ImYong Pharmaceuticals stock sold for $ a share. Today, the overall market fell, and ImYong stock is now selling for $ a share. Which of these ratios will be affected by this market reaction? Assume all else is held constant.

A Enterprise value multiple and priceearnings ratio B Earnings per share and priceearnings ratio

C Return on equity and return on assets

D Return on book equity and markettobook ratio E Priceearnings ratio and return on book equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started