Answered step by step

Verified Expert Solution

Question

1 Approved Answer

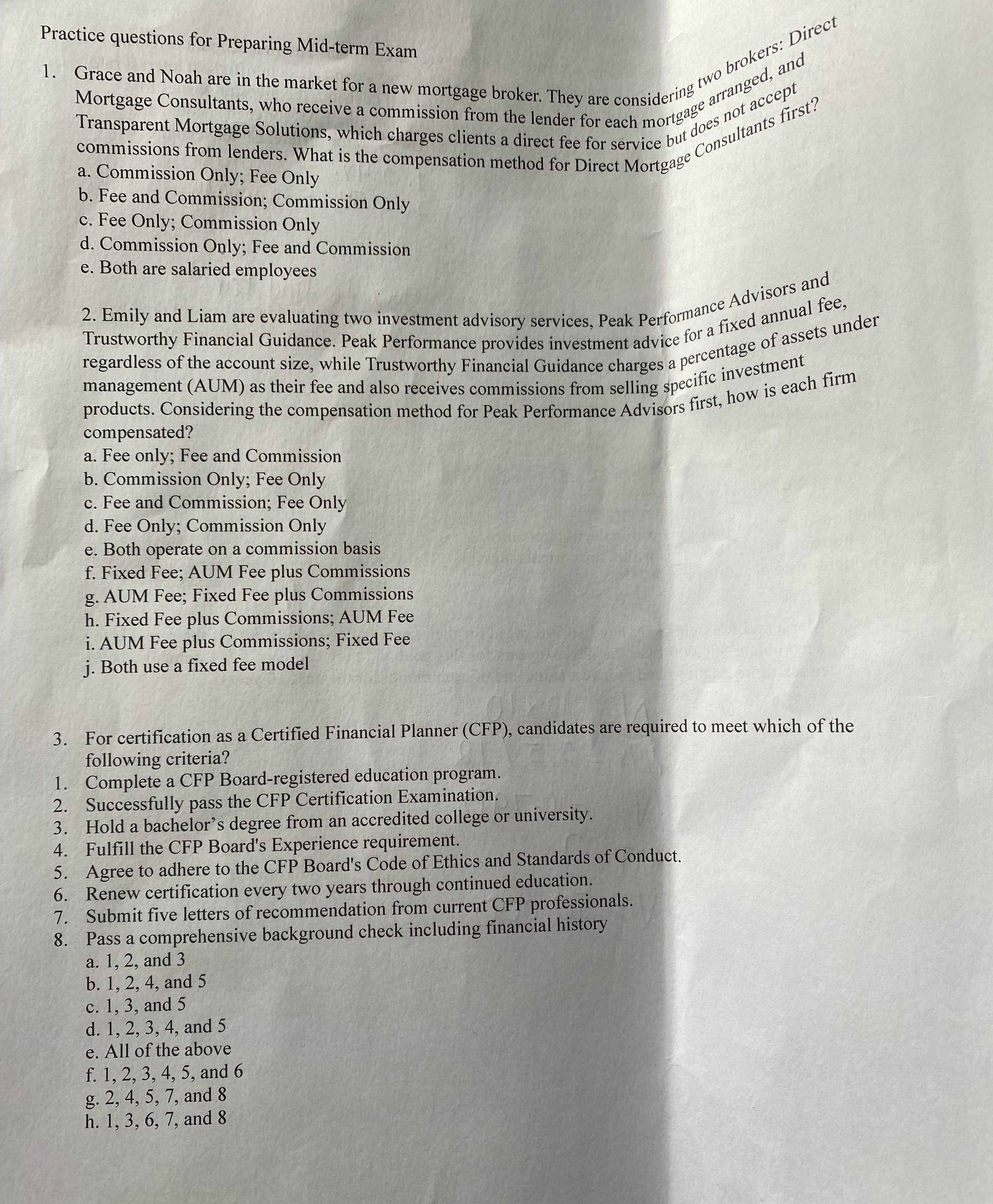

Practice questions for Preparing Mid - term Exam Grace and Noah are in the market for a new mortgage broker. They are considering two brokers:

Practice questions for Preparing Midterm Exam

Grace and Noah are in the market for a new mortgage broker. They are considering two brokers: Direct commissions from lenders. What is the compen a Commission Only; Fee Only b Fee and Commission; Commission Only

a Commission Only; Fee Only b Fee and Commission; Comm c Fee Only; Commission Only

d Commission Only; Fee and Commission

e Both are salaried employees

Emily and Liam are evaluating two investment advisory services, Peak Performance Advisors and Trustworthy Financial Guidance. Peak Performance provides investment advice for a fixed annual fee, regardless of the account size, while Trustworthy Financial Guidance charges a percentage of assets under management AUM as their fee and also receives commissions from selling specific investment products. Considering the compensation method for Peak Performance Advisors first, how is each firm compensated?

a Fee only; Fee and Commission

b Commission Only; Fee Only

c Fee and Commission; Fee Only

d Fee Only; Commission Only

e Both operate on a commission basis

f Fixed Fee; AUM Fee plus Commissions

g AUM Fee; Fixed Fee plus Commissions

h Fixed Fee plus Commissions; AUM Fee

i AUM Fee plus Commissions; Fixed Fee

j Both use a fixed fee model

For certification as a Certified Financial Planner CFP candidates are required to meet which of the following criteria?

Complete a CFP Boardregistered education program.

Successfully pass the CFP Certification Examination.

Hold a bachelor's degree from an accredited college or university.

Fulfill the CFP Board's Experience requirement.

Agree to adhere to the CFP Board's Code of Ethics and Standards of Conduct.

Renew certification every two years through continued education.

Submit five letters of recommendation from current CFP professionals.

Pass a comprehensive background check including financial history

a and

b and

c and

d and

e All of the above

f and

g and

h and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started