Question

Practice Scenario: A physician group, Rockpile, has decided NOT to invest in a mobile MRI route and instead want to upgrade their in-house MRI to

Practice Scenario:

A physician group, Rockpile, has decided NOT to invest in a mobile MRI route and instead want to upgrade their in-house MRI to a 3 Tesla magnet which gives sharper pictures and should reduce the time it takes to complete a procedure. You have gathered the following details on the potential investment:

- The cost to buy and install the new scanner is $1.3 million. The scanner is expected to last seven years and it should have a salvage value of $175,000 at the end of its useful life.

- The clinic operates 250 days per year and expects to provide 15 scans per day throughout the life of the scanner. Net revenue per scan in year one is expected to be $400 per scan and is expected to increase 4% per year.

- Salaries per scan are expected to be $130 per day and benefits will be 30% of salaries. Salaries are projected to increase 3% per year. Benefits as a percent of salaries will remain at 30% for each year.

- Supplies per scan will total $100 per scan in year 1 and increase 3% per year.

- Maintenance will be a fixed $120,000 per year in the first year and increase 3.5% per year.

- The MRI department will have $84,000 per year in overhead expenses for housekeeping, room maintenance, laundry, and utilities. Those costs will increase by 3% per year.

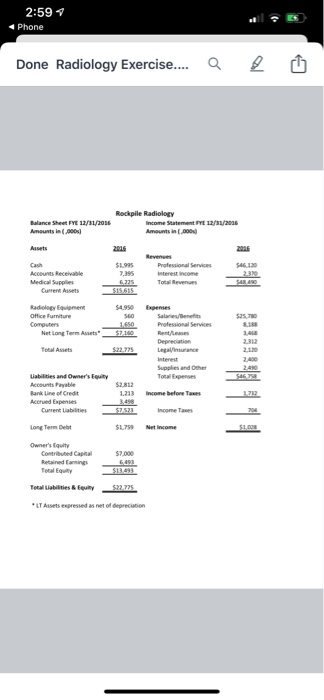

- Create a balance sheet to calculate the weighted average cost of capital ("WACC") for Rockpile. The estimated cost of debt is 4.5% and equity will cost 7%. State any assumptions you feel necessary to adjust the WACC up or down to reflect the relative risk of the project.

Present a capital investment analysis to the physician investors in Rockpile. What techniques will you use to provide an interpretation of your analytical calculations? Provide some rationale for a recommendation on making (or not making) the investment. State All assumptions you need to complete the assignment.

Prepare a spreadsheet with the analysis and recommendation.

1. State assumptions

2. Prepare a spreadsheet

3. What's the recommendation and why you are making this recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started