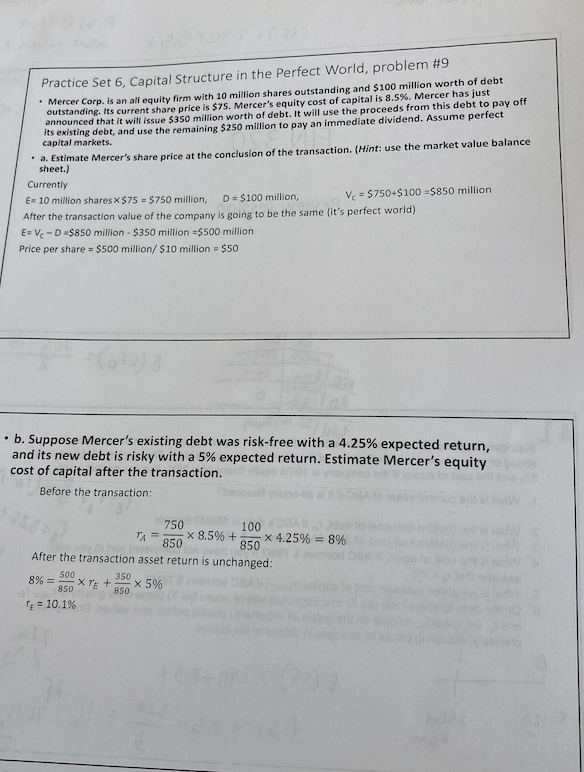

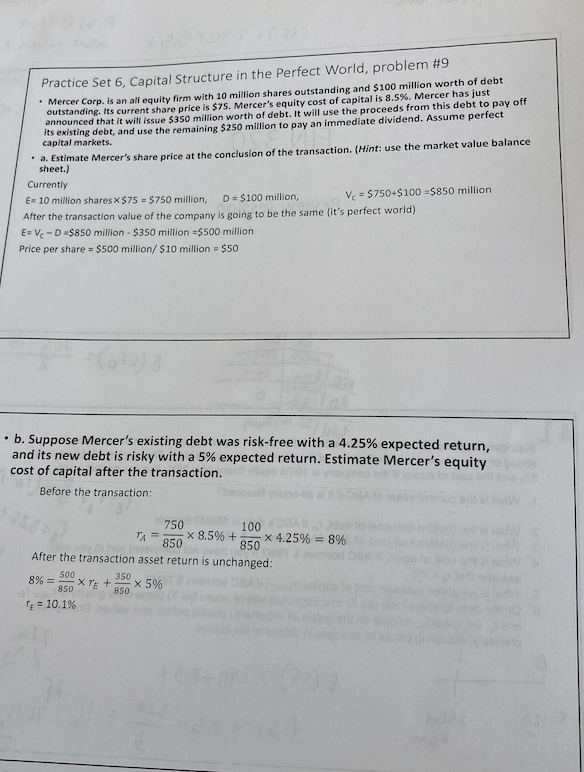

Practice Set 6, Capital Structure in the Perfect World, problem #9 Mercer Corp. is an all equity firm with 10 million shares outstanding and $100 million worth of debt outstanding. Its current share price is $75. Mercer's equity cost of capital is 8.5%. Mercer has just announced that it will issue $350 million worth of debt. It will use the proceeds from this debt to pay off its existing debt, and use the remaining $250 million to pay an immediate dividend. Assume perfect capital markets. . a. Estimate Mercer's share price at the conclusion of the transaction. (Hint: use the market value balance sheet.) Currently E= 10 million shares x $75 - $750 million, D = $100 million, Vc = $750+$100-$850 million After the transaction value of the company is going to be the same (it's perfect world) E=Vc-D=$850 million - $350 million $500 million Price per share= $500 million/ $10 million = $50 b. Suppose Mercer's existing debt was risk-free with a 4.25% expected return, and its new debt is risky with a 5% expected return. Estimate Mercer's equity cost of capital after the transaction. Before the transaction: 100 750 MOB TA = x 8.5% + 850 x 4.25% = 8% 850 After the transaction asset return is unchanged: ved 8% = 500 850 EXTE + 350 850 x 5% TE = 10.1% Practice Set 6, Capital Structure in the Perfect World, problem #9 Mercer Corp. is an all equity firm with 10 million shares outstanding and $100 million worth of debt outstanding. Its current share price is $75. Mercer's equity cost of capital is 8.5%. Mercer has just announced that it will issue $350 million worth of debt. It will use the proceeds from this debt to pay off its existing debt, and use the remaining $250 million to pay an immediate dividend. Assume perfect capital markets. . a. Estimate Mercer's share price at the conclusion of the transaction. (Hint: use the market value balance sheet.) Currently E= 10 million shares x $75 - $750 million, D = $100 million, Vc = $750+$100-$850 million After the transaction value of the company is going to be the same (it's perfect world) E=Vc-D=$850 million - $350 million $500 million Price per share= $500 million/ $10 million = $50 b. Suppose Mercer's existing debt was risk-free with a 4.25% expected return, and its new debt is risky with a 5% expected return. Estimate Mercer's equity cost of capital after the transaction. Before the transaction: 100 750 MOB TA = x 8.5% + 850 x 4.25% = 8% 850 After the transaction asset return is unchanged: ved 8% = 500 850 EXTE + 350 850 x 5% TE = 10.1%